- United States

- /

- Semiconductors

- /

- NasdaqGS:ENTG

Entegris (ENTG): Exploring Current Valuation After Recent 21% Share Price Rebound

Reviewed by Simply Wall St

See our latest analysis for Entegris.

After a bumpy start to the year, Entegris has begun to regain its footing. The company posted a strong 21% share price return over the last 90 days, which stands in contrast to a 1-year total shareholder return of -14%. This recent momentum suggests shifting sentiment around its growth prospects and risk profile.

If you’re looking for more opportunities in high-potential markets, consider broadening your search and discover fast growing stocks with high insider ownership

With shares rallying off recent lows, the key question is whether Entegris remains undervalued, or if this renewed optimism means the market has already priced in its future growth and upside potential.

Most Popular Narrative: 9.4% Undervalued

Entegris is currently trading below what the most-followed narrative considers fair value, with a last close of $91.57 compared to an estimated value of $101.08. This perspective hinges on several forward-looking assumptions and industry shifts that could re-shape the company's financial profile in the coming years.

Investments and leadership in advanced materials for next-generation nodes, including CMP slurries, selective etch, and deposition materials, position Entegris to capitalize on upcoming node transitions (for example, advanced logic, 3D NAND, and HBM) and increasing semiconductor complexity. This is seen as supporting higher average selling prices and improved gross margins.

Want to know what powers this optimism? This valuation leans on bold forecasts for both profit margins and emerging tech cycles. Ready to uncover the volume-driving assumptions that set up this price gap?

Result: Fair Value of $101.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent global trade tensions or lingering inefficiencies in new facilities could quickly undermine this optimistic outlook for Entegris.

Find out about the key risks to this Entegris narrative.

Another View: What Do Market Valuations Say?

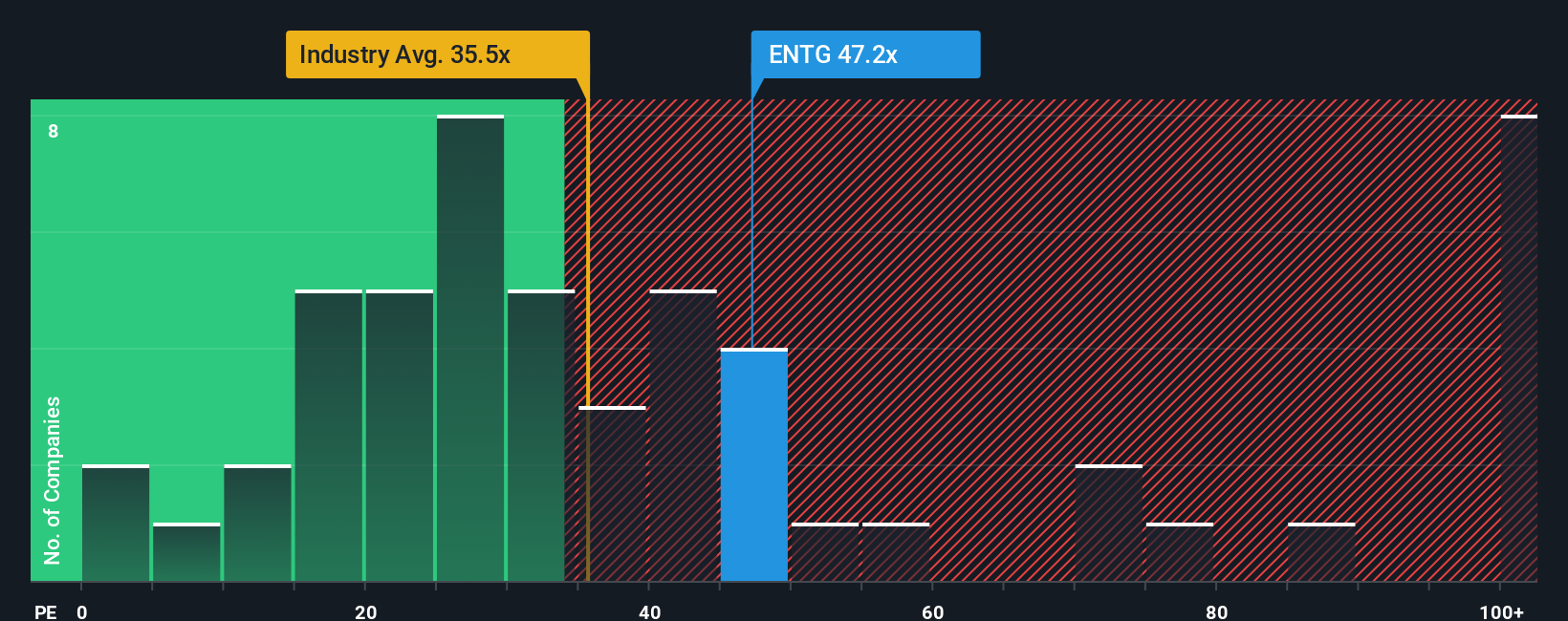

Looking at how Entegris is priced by one key market metric, the shares trade at a 48.1x earnings ratio, which is noticeably higher than both the US Semiconductor industry average of 37.7x and its peer group at 42.7x. That is also well above a fair ratio target of 33.5x. This kind of gap raises real questions about whether today's optimism is already fully baked into the price, or if investors are overlooking the risks.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Entegris Narrative

If your perspective differs or you want to dig deeper into the numbers, it's easy to piece together your own view in just a few minutes. Do it your way.

A great starting point for your Entegris research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Expand your portfolio horizons now and take control of tomorrow’s gains. Smart investors know opportunities rarely wait, so don’t get left behind.

- Boost your passive income potential by checking out these 22 dividend stocks with yields > 3%, which offers attractive yields above 3% from cash-rich companies.

- Tap into the momentum of artificial intelligence with these 26 AI penny stocks, where trailblazers are transforming everything from automation to data analytics.

- Uncover hidden gems trading below their intrinsic value with these 832 undervalued stocks based on cash flows, targeting stocks that show the strongest financial foundations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Entegris might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ENTG

Entegris

Provides advanced materials and process solutions for the semiconductor and other high-technology industries in North America, Taiwan, South Korea, Japan, China, Europe, and Southeast Asia.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives