- United States

- /

- Semiconductors

- /

- NasdaqCM:DVLT

Datavault AI (DVLT): Assessing Valuation After Recent Share Price Surge

Reviewed by Simply Wall St

Datavault AI (DVLT) has recently gotten investors' attention as its stock price continues to make modest moves in recent weeks. Many are now taking a closer look at where things stand for the company following these changes.

See our latest analysis for Datavault AI.

Datavault AI's recent share price surge has quickly become the talk of the market, with a 1-day share price return of 46.55% and a 7-day gain of 39.34% indicating accelerating momentum. Despite these impressive short-term gains, the 1-year total shareholder return stands at 47.83%. However, longer-term returns have been deeply negative, showing that the stock’s comeback story is still unfolding and not without risks.

If Datavault AI’s momentum has you scanning for what’s next, now’s the perfect time to branch out and discover fast growing stocks with high insider ownership

With Datavault AI’s stock rebounding sharply, yet longer-term losses still weighing on sentiment, investors now face a key question: is this an overlooked opportunity, or has the market already reflected the company’s growth prospects in its price?

Most Popular Narrative: 15% Undervalued

With Datavault AI's fair value pegged at $3.00 and the last close at $2.55, the most followed narrative positions the stock below its projected worth, setting up high expectations that recent partnership strategies could reshape the outlook.

The company's deepened alliance with IBM, including Platinum Partner status and integration of Watsonx.ai, provides Datavault with scalable AI capabilities and best-in-class cybersecurity. This supports enterprise-grade adoption and efficient scaling, which could drive higher net margins by improving operational leverage and reducing per-unit delivery costs.

Want to know why analysts see so much upside? This narrative leans on massive revenue acceleration and a high future profit margin. The fair value hinges on forward assumptions that could surprise even seasoned investors. Find out the numbers behind this ambitious growth story.

Result: Fair Value of $3.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Datavault AI's future depends on successful revenue recognition and seamless integration of acquisitions. Either factor could change the outlook if execution falters.

Find out about the key risks to this Datavault AI narrative.

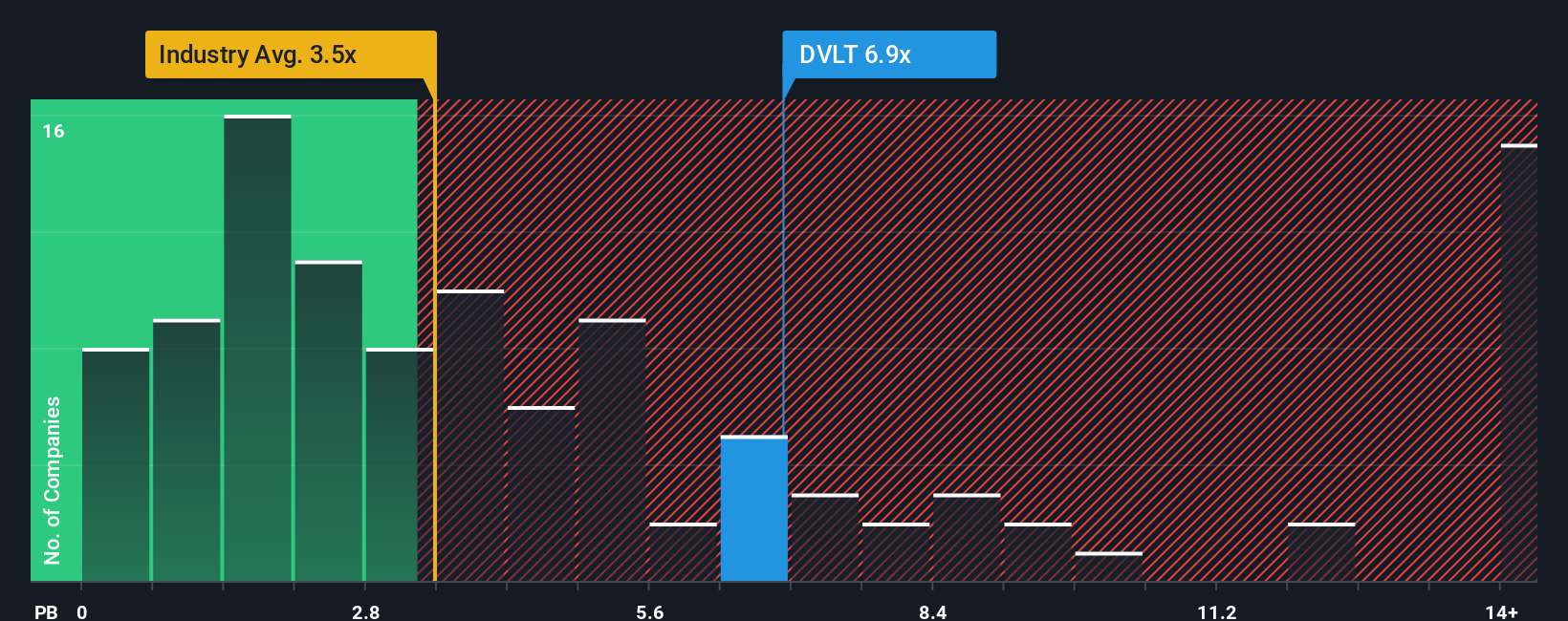

Another View: A Look at Market Comparisons

While analysts see Datavault AI as undervalued based on future earnings, a look at its price-to-book ratio tells a different story. Datavault trades at 7.4 times book value, much higher than the US Semiconductor industry average of 3.3 times, though slightly below the peer average of 7.9 times. This elevated ratio could mean the market is already pricing in significant growth, or that there is valuation risk if expectations fall short. Could this premium indicate untapped potential, or is it a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Datavault AI Narrative

If this take on Datavault AI's story doesn't fit your view, you can dive into the numbers and craft your own perspective in just a few minutes. Do it your way.

A great starting point for your Datavault AI research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Stay ahead of the market by checking out winning stocks from other promising themes. Don’t leave gains on the table when new strategies are just a click away.

- Capitalize on game-changing companies poised for exponential growth in artificial intelligence by scrutinizing these 25 AI penny stocks for the next tech breakthrough.

- Tap into the strong potential of digital currencies and blockchain adoption with these 81 cryptocurrency and blockchain stocks, pinpointing innovative businesses steering the financial revolution.

- Boost your search for value by targeting opportunities overlooked by the crowd with these 921 undervalued stocks based on cash flows, surfacing stocks priced below their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:DVLT

Datavault AI

A data sciences technology company, owns and operates data management platforms by supercomputing capabilities in the North America, Asia Pacific, Europe, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives