- United States

- /

- Semiconductors

- /

- NasdaqGS:DIOD

Evaluating Diodes (DIOD) Valuation Following Launch of Automotive-Grade DisplayPort and USB 3.2 Retimer

Reviewed by Simply Wall St

Diodes (DIOD) just unveiled the PI2DPT1021Q, a high-speed bit-level retimer built for automotive applications. This new device is designed to address growing needs in infotainment, smart cockpits, and other in-vehicle systems.

See our latest analysis for Diodes.

Diodes’ recent rollout of advanced automotive chips is happening against a backdrop of mixed momentum. The share price is currently $53.36, with a 1-day share price return of 0.87%. However, the total shareholder return over the past year is down 11.35%. This quarter shows some signs of stabilization with an 8.4% gain over 90 days. In contrast, long-term investors have seen a 26.8% three-year total return decline, so sentiment remains cautious despite the company’s push into growth markets.

If you’re keeping an eye on evolving trends in the auto tech space, this could be the ideal time to see what’s next and explore See the full list for free.

With shares trading below analyst targets but showing only modest recovery from longer-term declines, investors are left wondering if Diodes is trading at a discount that reflects real value or if the market has already factored in its growth prospects.

Most Popular Narrative: 9% Undervalued

With the most recent analyst consensus setting Diodes’ fair value at $58.67, a notable premium to the last close at $53.36, expectations for long-term growth are rising. The market is eyeing significant expansion, but what are the foundational factors driving this optimism?

“Rising demand for Diodes' solutions in AI-related computing and the broader ecosystem of connected devices (including data centers, servers, industrial automation, and IoT) is boosting revenue momentum and contributing to consistent market share gains, improving longer-term top-line growth visibility. Rapid electrification in automotive, particularly EVs in China, is leading to growing content per vehicle and an expanding set of design wins for Diodes' automotive-qualified products (such as protection devices, LED controllers, and power management ICs), supporting higher average selling prices and future margin expansion.”

Curious what’s fueling this bullish outlook? The narrative hinges on aggressive profit forecasts and margin shifts that could catch Wall Street off guard. Ready to discover which financial trend stands behind the price target? Don’t miss the deep-dive that unpacks the assumptions powering this market view.

Result: Fair Value of $58.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high inventory levels and a heavy reliance on cyclical consumer markets could challenge Diodes’ ability to deliver on these bullish forecasts.

Find out about the key risks to this Diodes narrative.

Another View: What Do Valuation Ratios Suggest?

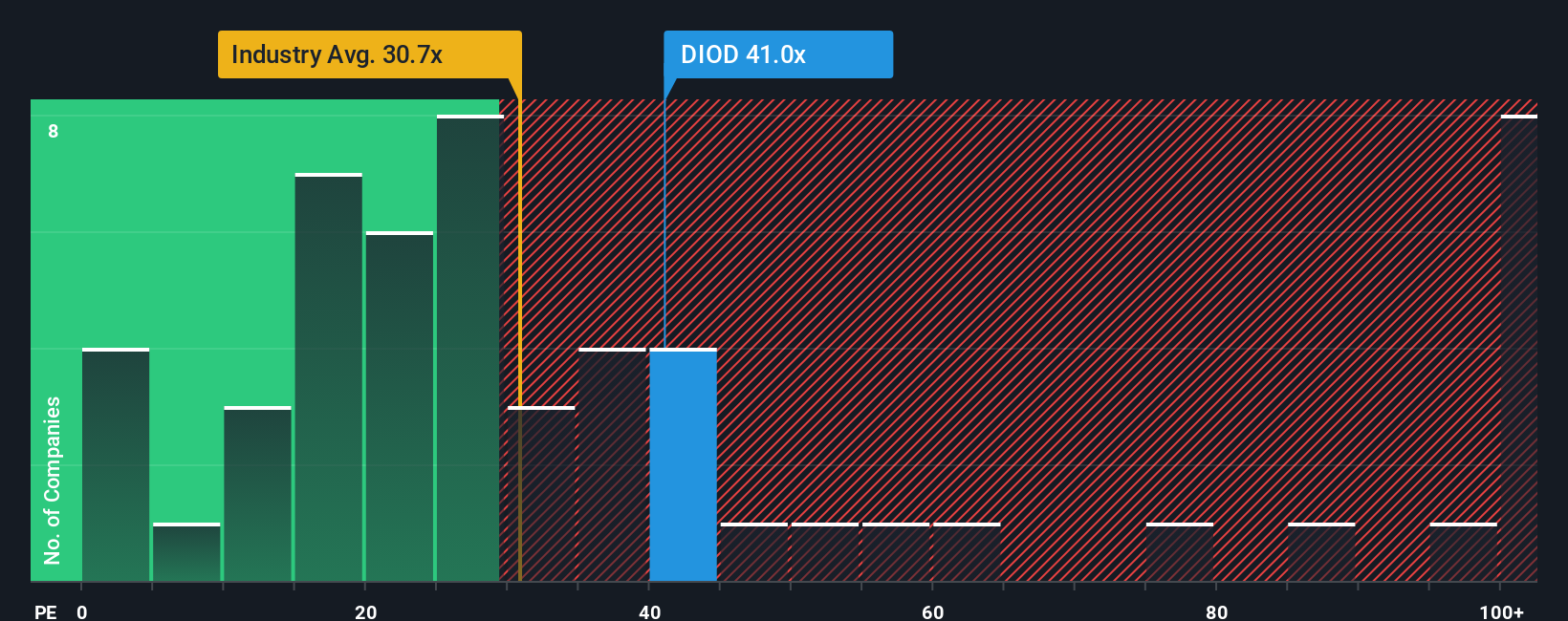

Looking through a different lens, Diodes is trading at a price-to-earnings ratio of 38.9x, which is above both the industry average of 36.1x and its fair ratio of 34.7x. While it appears cheaper than the peer average of 50.7x, the premium over the industry and fair ratio could mean investors are paying up for uncertain growth. Does this tilt the risk-to-reward equation further?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Diodes Narrative

If you see the story unfolding differently, or want to dive deeper into the numbers yourself, you can put your own perspective together in just a couple of minutes. Do it your way

A great starting point for your Diodes research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Compelling Investment Ideas?

Smart investors constantly scan for tomorrow’s outperformers. If you want to stay ahead of the crowd, act now by targeting sectors and opportunities most people miss.

- Tap into reliable cash flows by searching for strong-performing companies offering yields above 3% using these 20 dividend stocks with yields > 3%.

- Capture opportunities in artificial intelligence by reviewing these 27 AI penny stocks, which are leading powerful advancements in automation, analytics, and next-generation digital platforms.

- Uncover promising value buys hiding in plain sight with the help of these 845 undervalued stocks based on cash flows to filter for stocks that could be primed for a price catch-up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DIOD

Diodes

Manufactures and supplies application-specific standard products in the broad discrete, logic, analog, and mixed-signal semiconductor markets in Asia, Europe, and the Americas.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives