- United States

- /

- Semiconductors

- /

- NasdaqGS:DIOD

Diodes (DIOD) Is Up 8.6% After Strong Q2 Results and AI Automotive Growth Momentum

Reviewed by Simply Wall St

- In early August 2025, Diodes Incorporated reported strong second quarter results, with US$366.21 million in sales and US$46.1 million in net income, as well as optimistic guidance for continued revenue growth into the third quarter driven by AI computing and electric vehicle demand.

- One unique insight is that Diodes marked its fourth consecutive quarter of year-over-year revenue growth, highlighting signs of market recovery and increasing demand in Asia, particularly from the AI and automotive sectors.

- We'll explore how sustained growth in AI and electric vehicles impacts Diodes’ investment narrative and outlook for margin improvement.

Find companies with promising cash flow potential yet trading below their fair value.

Diodes Investment Narrative Recap

To be a shareholder in Diodes, you need to believe in the company's ability to capture sustained growth in AI computing and electric vehicles, particularly in the Asian market. The recent report of strong second quarter sales and net income reaffirms these growth drivers and supports short-term optimism, but the biggest risk continues to be softening demand in North American and European end markets; the latest news does not materially change that risk.

Among the recent developments, Diodes' launch of new HDMI ReDrivers designed for high-bandwidth AI and automotive applications stands out. This product introduction fits neatly into the company's growth narrative, as it aims to expand its content per unit in automotive and computing segments, reinforcing its position amid rising demand from these sectors.

Yet, in contrast to the upbeat guidance, investors should be aware that profit margins remain below previous years and could limit earnings recovery if...

Read the full narrative on Diodes (it's free!)

Diodes' outlook projects $1.6 billion in revenue and $160.0 million in earnings by 2028. Achieving these results would require 7.0% revenue growth per year and an earnings increase of $134.5 million from the current $25.5 million.

Uncover how Diodes' forecasts yield a $58.67 fair value, a 10% upside to its current price.

Exploring Other Perspectives

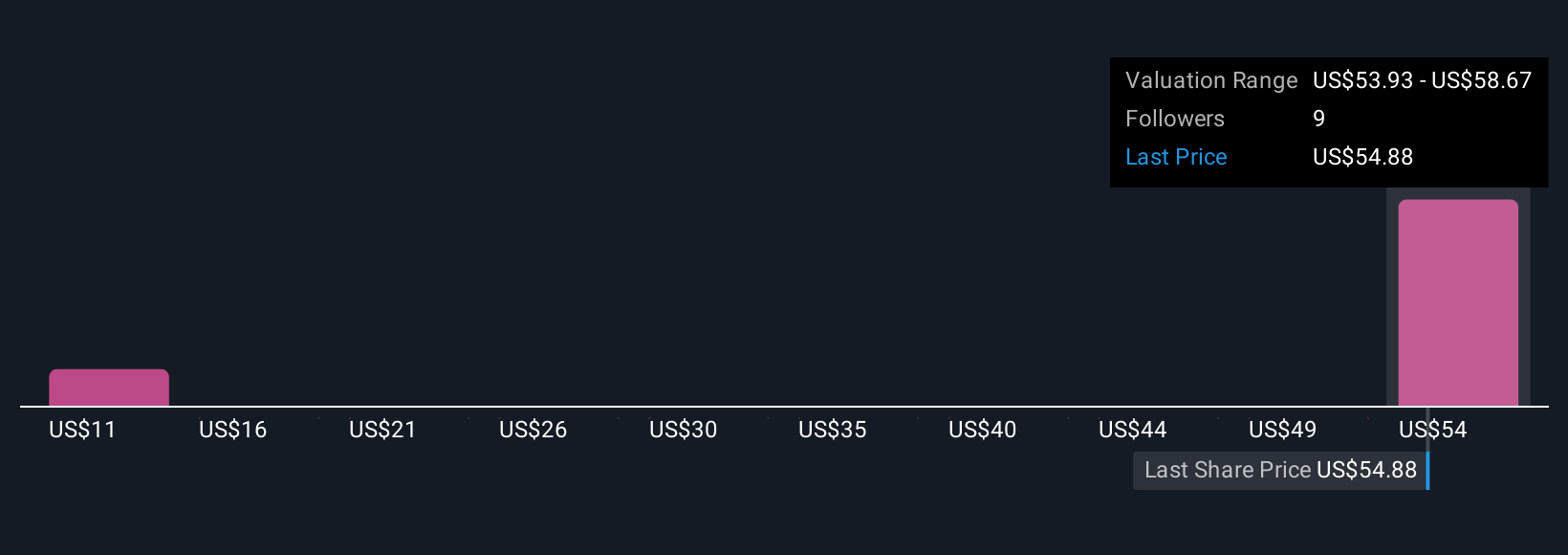

Two fair value estimates from the Simply Wall St Community put Diodes anywhere between US$11.13 and US$58.67 per share. While these perspectives vary widely, many are watching whether margin improvement can keep pace with revenue gains, which could have significant implications for future profitability.

Explore 2 other fair value estimates on Diodes - why the stock might be worth less than half the current price!

Build Your Own Diodes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Diodes research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Diodes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Diodes' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DIOD

Diodes

Manufactures and supplies application-specific standard products in the broad discrete, logic, analog, and mixed-signal semiconductor markets in Asia, Europe, and the Americas.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives