- United States

- /

- Semiconductors

- /

- NasdaqGS:DIOD

Could Diodes' (DIOD) New EV-Focused Chip Reveal a Shift in Its Automotive Ambitions?

Reviewed by Sasha Jovanovic

- Earlier this month, Diodes Incorporated unveiled the PI7C9X762Q, a high-performance automotive-compliant I2C/SPI-bus-to-dual-channel UART bridge featuring low power consumption and enhanced compatibility for electric vehicle and ADAS applications.

- This device offers protocol flexibility, streamlined migration for automotive manufacturers, and packaging that supports complex vehicle architectures such as smart cockpits and zonal gateways.

- We’ll examine how the focus on EV and ADAS applications in this recent product launch could impact Diodes’ investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

Diodes Investment Narrative Recap

Shareholders in Diodes need to see upside from the company’s transition towards higher-value automotive and industrial applications, rather than relying on the more cyclical consumer segment. While the PI7C9X762Q launch deepens Diodes’ automotive presence and addresses long-term demand for EV and ADAS solutions, it does not immediately address the most critical short-term catalyst: improving profit margins and balancing high inventory levels, which remain key sources of risk if demand falters.

Among recent announcements, the introduction of the AL58818Q and AL58812Q automotive LED drivers (September 2025) is particularly aligned with Diodes’ focus on expanding automotive offerings, providing another answer to the push for better product mix and margin expansion. This dovetails with efforts like the PI7C9X762Q yet does not directly resolve concerns around inventory or profit volatility.

By contrast, investors should also be aware of the risks linked to Diodes’ continued high inventory levels and what happens...

Read the full narrative on Diodes (it's free!)

Diodes' narrative projects $1.8 billion revenue and $124.0 million earnings by 2028. This requires 8.7% yearly revenue growth and a $60.4 million earnings increase from $63.6 million today.

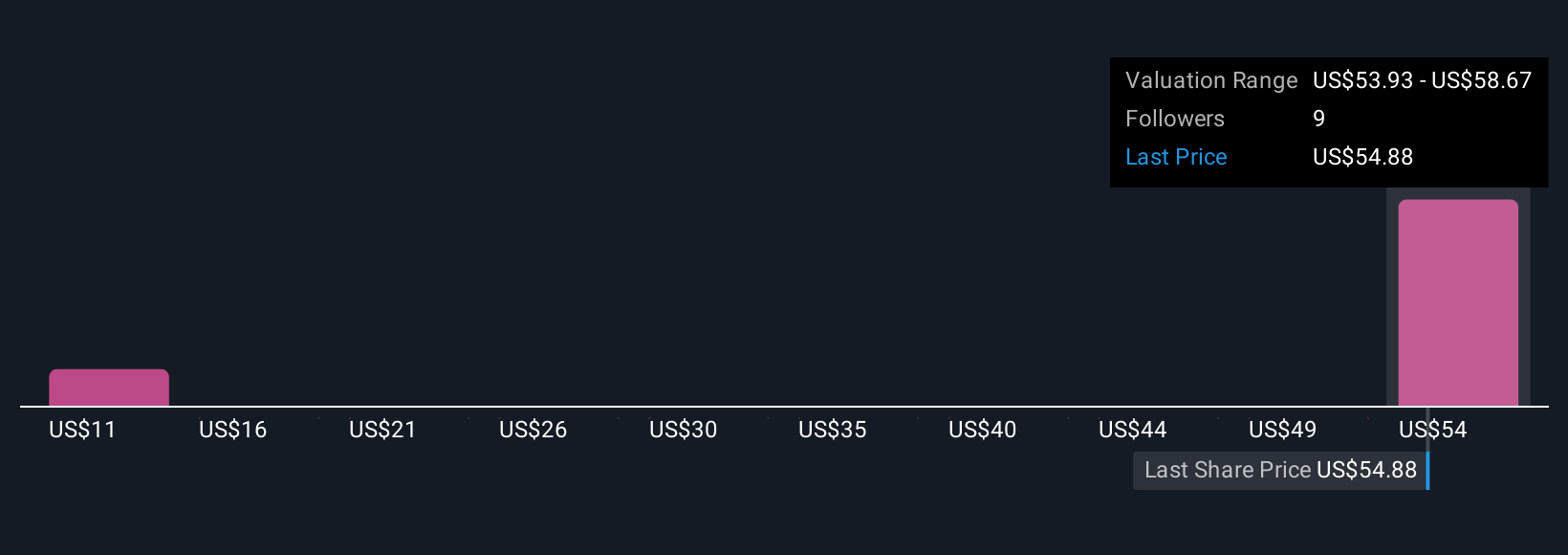

Uncover how Diodes' forecasts yield a $58.67 fair value, a 9% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community submitted two fair value estimates for Diodes ranging from US$11.19 to US$58.67 per share. With such diverse outlooks, consider how dependance on the cyclical consumer segment could influence future financial performance.

Explore 2 other fair value estimates on Diodes - why the stock might be worth as much as 9% more than the current price!

Build Your Own Diodes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Diodes research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Diodes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Diodes' overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DIOD

Diodes

Manufactures and supplies application-specific standard products in the broad discrete, logic, analog, and mixed-signal semiconductor markets in Asia, Europe, and the Americas.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives