- United States

- /

- Semiconductors

- /

- NasdaqGS:CSIQ

How the 142% Surge in Canadian Solar Shares Impacts Its 2025 Valuation

Reviewed by Bailey Pemberton

- Wondering if Canadian Solar is a bargain or overpriced? You are not alone, especially with the spotlight shining bright on solar stocks these days.

- Canadian Solar has surged by 42.3% in the past week and an impressive 142.2% over the last month. This has sparked plenty of questions around its growth story and shifting risk profile.

- Recently, news around industry-wide policy changes and advancements in renewable energy tech has added fuel to the fire. Investors are weighing up the long-term potential as governments double down on clean energy incentives, putting Canadian Solar at the intersection of opportunity and scrutiny.

- If you are curious how it stacks up on traditional metrics, Canadian Solar currently scores a 5 out of 6 on our valuation checks. We will break down the numbers with classic methods next, but hang on for an even more insightful perspective on valuation at the end of the article.

Approach 1: Canadian Solar Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today. This provides investors with a sense of what the business is really worth, independent of current market sentiment.

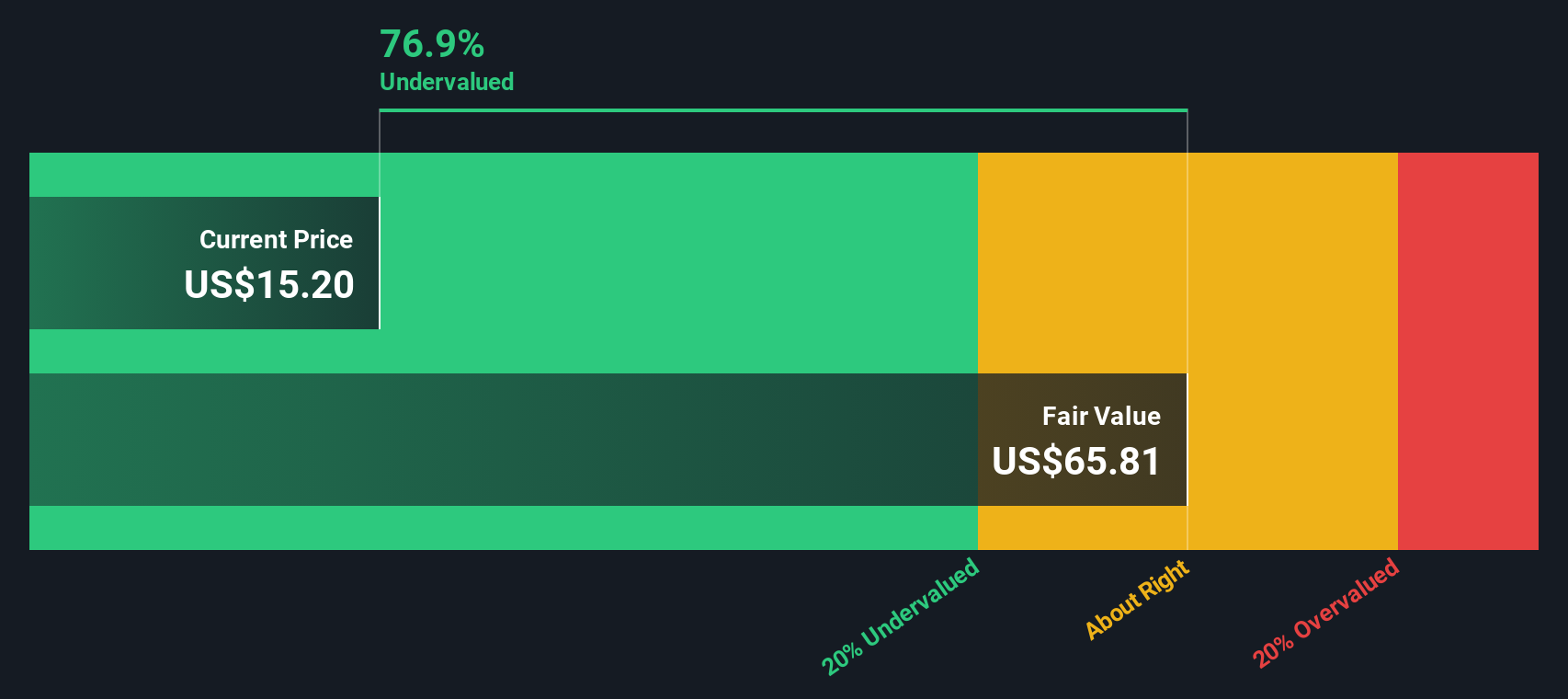

For Canadian Solar, analysts start their projections using the latest figures, showing free cash flow at -$1.56 billion in the last twelve months. While the company is currently burning cash, forecasts suggest a turnaround. Analysts expect free cash flow to climb to $242 million by 2029. Looking further ahead, extrapolated estimates indicate this could grow to over $740 million by 2035, according to Simply Wall St's model. The first five years rely on analyst forecasts, while later figures are calculated using historical and expected growth trends in the solar industry.

Based on these modelled cash flows, Canadian Solar’s estimated intrinsic value is $65.75 per share. With the DCF analysis indicating the stock trades at a 50.7% discount to this value, Canadian Solar appears significantly undervalued at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Canadian Solar is undervalued by 50.7%. Track this in your watchlist or portfolio, or discover 864 more undervalued stocks based on cash flows.

Approach 2: Canadian Solar Price vs Sales

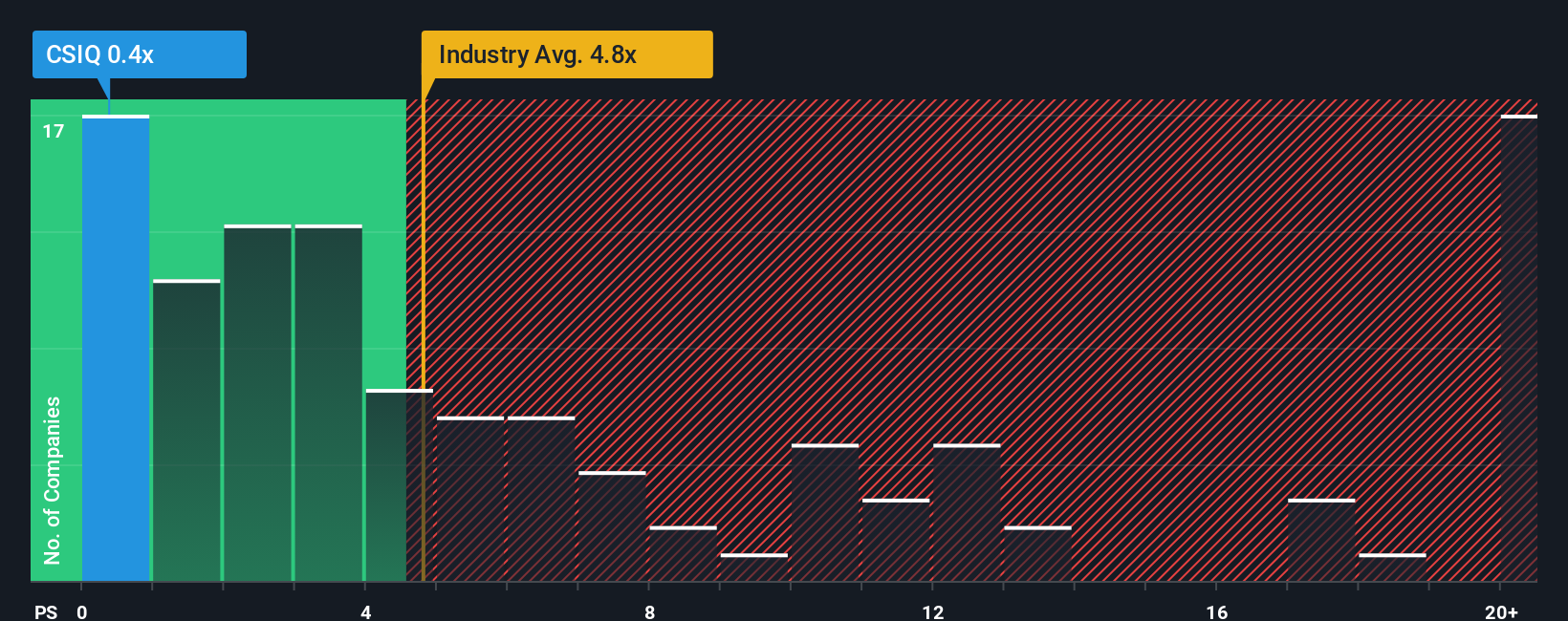

The Price-to-Sales (P/S) ratio is the preferred metric here because it is especially relevant for companies like Canadian Solar that may be reinvesting heavily or have volatile earnings, but are still generating substantial revenue. When profits are inconsistent, looking at sales can provide a more stable foundation for valuation, particularly in cyclical or growth industries like solar energy.

What constitutes a “normal” P/S ratio varies with the company’s growth outlook and risk profile. Businesses with higher expected growth or lower perceived risk typically command higher multiples. Slower-growing or riskier companies usually trade at a lower value.

Canadian Solar is currently priced at just 0.37x sales, a fraction of both the semiconductor industry average of 4.51x and its listed peer average of 2.10x. These comparisons suggest the stock is trading at a deep discount relative to many of its competitors.

Simply Wall St’s proprietary “Fair Ratio” goes beyond basic averages. This calculated benchmark weighs Canadian Solar’s own outlook, combining growth prospects, margins, industry position, market cap, and risk into a customized multiple. For Canadian Solar, the fair P/S ratio is 2.28x.

By comparing the actual P/S of 0.37x to the fair ratio of 2.28x, it is clear the stock is trading well below what would be justified by its fundamentals and outlook. This suggests a significant undervaluation, even when accounting for risks and industry trends.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1402 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Canadian Solar Narrative

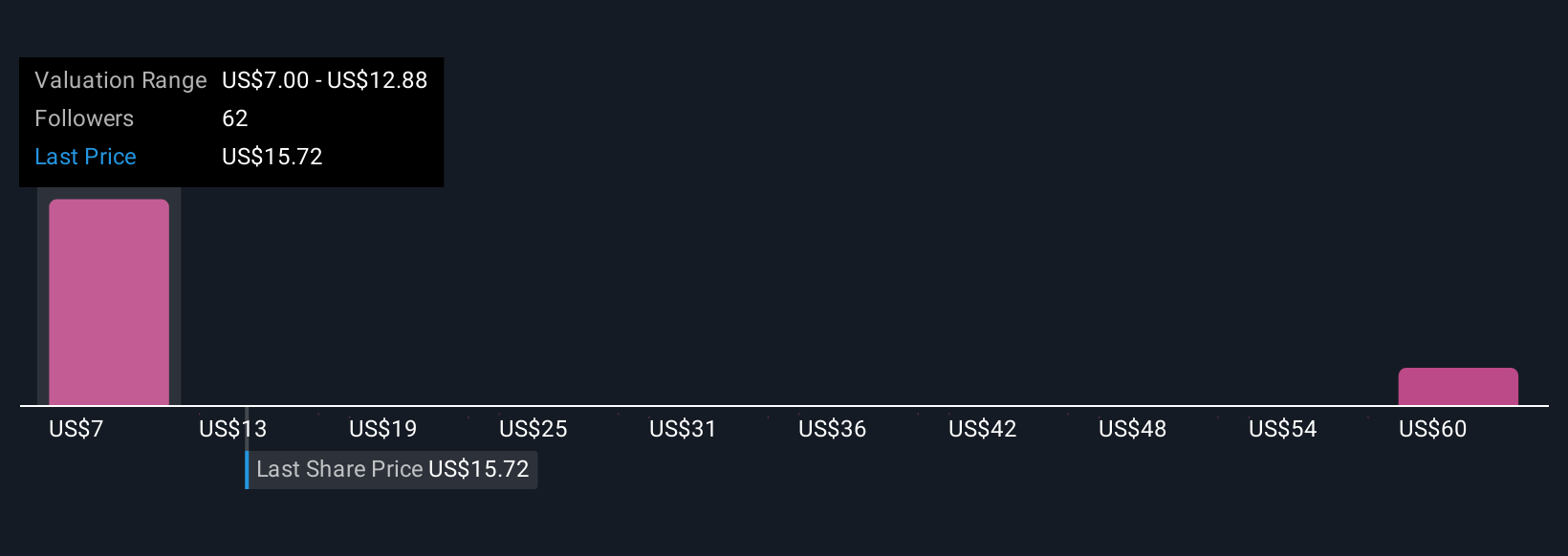

Earlier, we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your own story about Canadian Solar; it is how you connect your personal view of the company's future with the numbers behind fair value, using your assumptions about future revenue, earnings, and margins.

Narratives make valuation accessible by transforming dry data into a living, flexible story linked to your outlook. On Simply Wall St’s Community page, millions of investors use Narratives to create, update, and share their perspectives in minutes, combining a company’s story with a dynamic financial forecast and a fair value estimate.

As news or earnings releases drop, Narratives automatically update so your analysis always reflects the latest information. Investors use this tool to quickly compare Fair Value to the current share price, making smart decisions about when to buy or sell, all within a friendly and interactive setting.

For Canadian Solar, one investor’s Narrative might highlight aggressive global growth and innovation, supporting a high fair value and confidence in the stock, while another might point to policy risks and margin pressure, leading to a more conservative forecast. Narratives help you see every perspective and choose the one that matches your conviction.

Do you think there's more to the story for Canadian Solar? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSIQ

Canadian Solar

Provides solar energy and battery energy storage products and solutions in Asia, the Americas, Europe, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives