- United States

- /

- Semiconductors

- /

- NasdaqGS:CSIQ

Canadian Solar (NasdaqGS:CSIQ): Evaluating Valuation After Stock Momentum Rises on AI-Driven Energy Demand

Reviewed by Simply Wall St

Canadian Solar (NasdaqGS:CSIQ) is attracting fresh attention after its stock momentum picked up sharply, coinciding with heightened global energy demand related to the expansion of AI data center infrastructure. Investors are watching its role in sustainable energy closely.

See our latest analysis for Canadian Solar.

The latest AI-powered surge has put Canadian Solar’s 1-month share price return at a staggering 112.8%, pushing its year-to-date gain to 136.5%. Momentum is clearly building. This follows a stretch where the 1-year total shareholder return has soared even after a rocky multi-year patch, signalling a fresh wave of optimism around the stock’s outlook.

If this pace of change has you curious about other tech and energy disruptors, take the next step and check out See the full list for free.

After such dramatic recent gains, the big question for investors is whether Canadian Solar’s shares are still trading below their true value or if the market has already factored in all the potential upside from future growth.

Most Popular Narrative: 115% Overvalued

According to the most followed narrative, Canadian Solar’s recent price surge now sits far above its latest fair value estimate. This situation sets up a fierce debate over what truly justifies the stock’s premium position.

Global efforts to decrease the cost of renewable energy and deployments, through continued LCOE decline, and favorable policy environments such as safe harboring under U.S. tax credits and EU incentives, are set to support structurally high volumes and stable revenue streams over the next several years.

Wondering what aggressive growth and margin assumptions power this sky-high valuation? The narrative is built on bold projections and ambitious financial targets that only a handful of solar companies could contemplate. Unlock the story behind these optimistic numbers and see what is driving the valuation debate.

Result: Fair Value of $13.26 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent U.S. policy uncertainty and rising supply chain costs could quickly shift sentiment. These factors pose real risks to Canadian Solar’s current growth projections.

Find out about the key risks to this Canadian Solar narrative.

Another View: Is the Market Missing Value?

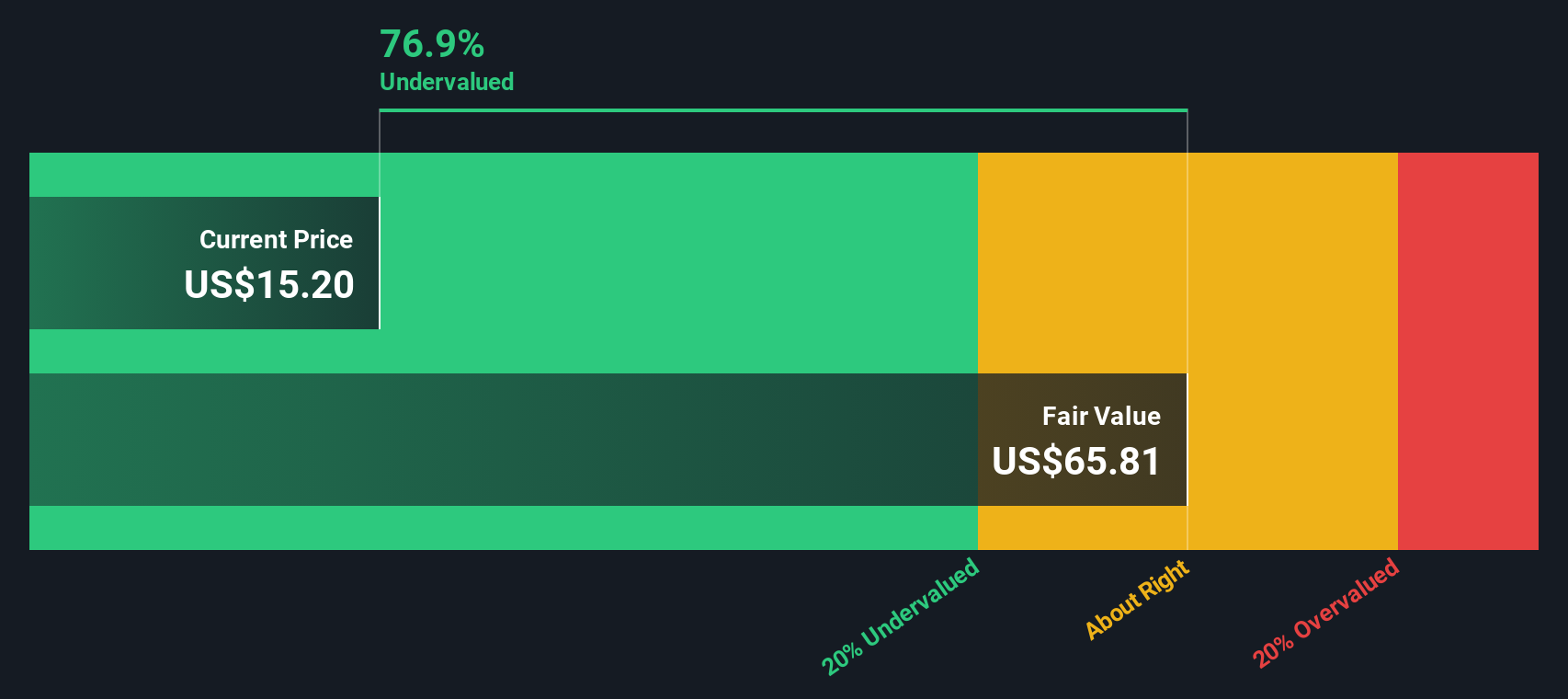

While the most followed narrative frames Canadian Solar as overvalued relative to fair value estimates, our DCF model tells a different story. The SWS DCF calculation points to a fair value of $65.75, which actually makes the current price look deeply undervalued. This stark gap highlights how different valuation methods can fuel debate. Could market pessimism be overstated, or does the DCF assume too rosy a future?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Canadian Solar Narrative

If these perspectives do not align with your take or you prefer hands-on research, consider diving in and putting together your own narrative in just a few minutes. Do it your way

A great starting point for your Canadian Solar research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Expand your horizon and tap into promising trends before the rest of the market catches up.

- Spot undervalued potential by checking out these 875 undervalued stocks based on cash flows, which may be poised for a turnaround based on strong cash flow fundamentals.

- Capitalize on breakthrough technology by following these 28 quantum computing stocks, featuring companies pushing boundaries in quantum computing innovation.

- Generate reliable income streams with these 16 dividend stocks with yields > 3%, offering robust yields and long-term dividend consistency for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSIQ

Canadian Solar

Provides solar energy and battery energy storage products and solutions in Asia, the Americas, Europe, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives