- United States

- /

- Semiconductors

- /

- NasdaqGS:ASML

Is ASML’s 51% Rally in 2025 a Fair Reflection of Its True Value?

Reviewed by Bailey Pemberton

- Wondering if ASML Holding is still a good value? You are not alone, especially as semiconductor giants keep making headlines and valuations seem to shift by the week.

- ASML's stock has moved up 2.5% in the last week and is now boasting a remarkable 51.2% gain year-to-date, with a 58.3% return over the past twelve months. This has attracted the attention of growth-minded investors.

- Recent news highlights surging global demand for advanced chipmaking equipment and ongoing optimism in the AI sector, both of which directly impact ASML's prospects. Headlines have also focused on government policies tightening around chip exports, creating fresh conversations about future growth and risk.

- Currently, ASML earns a 1 out of 6 on our valuation checks, prompting some investors to look more closely for hidden value or risks. Here is a breakdown of what those valuation methods indicate, along with guidance on smarter ways to determine if ASML is priced suitably for your investment strategy.

ASML Holding scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: ASML Holding Discounted Cash Flow (DCF) Analysis

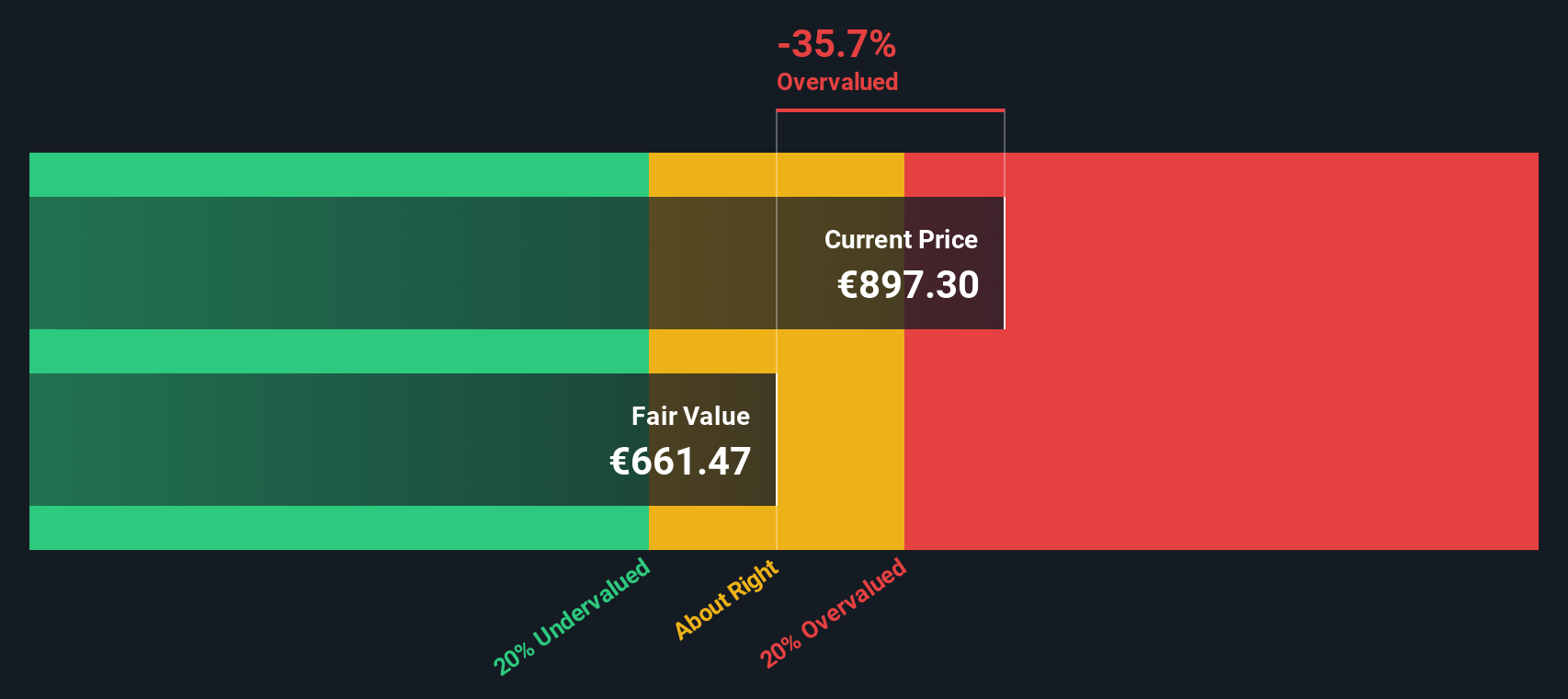

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and discounting them back to today. This process offers a snapshot of what the business could be worth now based on those projections.

ASML Holding currently generates €8.56 Billion in free cash flow, with analyst forecasts expecting steady growth over the next decade. By 2029, projected free cash flow is anticipated to reach €14.71 Billion, reflecting both analyst estimates for the near term and gradually decreasing growth rates extrapolated for the years beyond. While forecasts from analysts cover the next 5 years in detail, further projections are modeled using Simply Wall St’s in-house methodology.

After discounting all these future cash flows, the DCF model arrives at an estimated intrinsic value of $697 per share. However, this estimate suggests that ASML’s shares are about 52% above what this model would consider fair value in today’s terms.

The takeaway for investors is that ASML’s strong growth prospects may already be priced in, so caution should be exercised if seeking out undervalued opportunities.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ASML Holding may be overvalued by 52.0%. Discover 832 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: ASML Holding Price vs Earnings

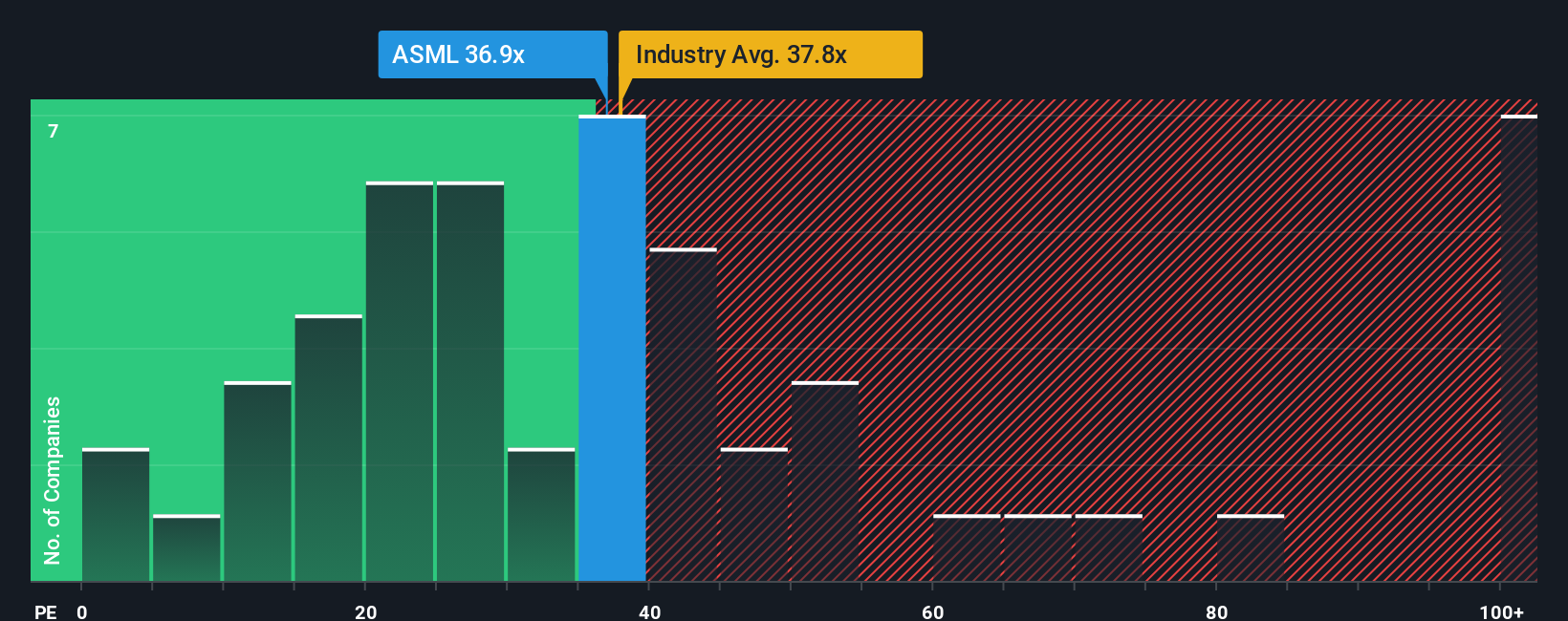

The Price-to-Earnings (PE) ratio is a go-to valuation metric for profitable companies like ASML Holding because it directly compares a company’s market value to its bottom-line profits. For mature, consistently profitable firms, PE offers a clear snapshot of what investors are willing to pay for each dollar of earnings.

When analyzing what a “normal” or “fair” PE ratio should be, it is important to factor in expectations for future growth and the risks unique to a business. Companies with higher projected growth rates or lower risk profiles typically warrant higher PE ratios, while those facing more uncertainty or slower growth generally trade at lower multiples.

ASML Holding’s current PE ratio is 37.57x. This is right in step with the semiconductor industry average PE of 37.57x and compares reasonably to key peers, which average 41.01x. Simply Wall St’s proprietary Fair Ratio for ASML stands at 35.38x, which weights growth outlook, profitability, size and risk specifically for ASML, rather than relying on broad industry benchmarks or peer groups alone.

The Fair Ratio is more insightful than a simple peer or industry comparison because it is customized to ASML’s exact circumstances, including its potential for earnings growth, its profit margins, current size and risks. This makes it a truer gauge of what would be a reasonable valuation multiple for the company today.

Since ASML’s current PE of 37.57x is very close to its Fair Ratio of 35.38x, the stock appears priced about right at current levels.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ASML Holding Narrative

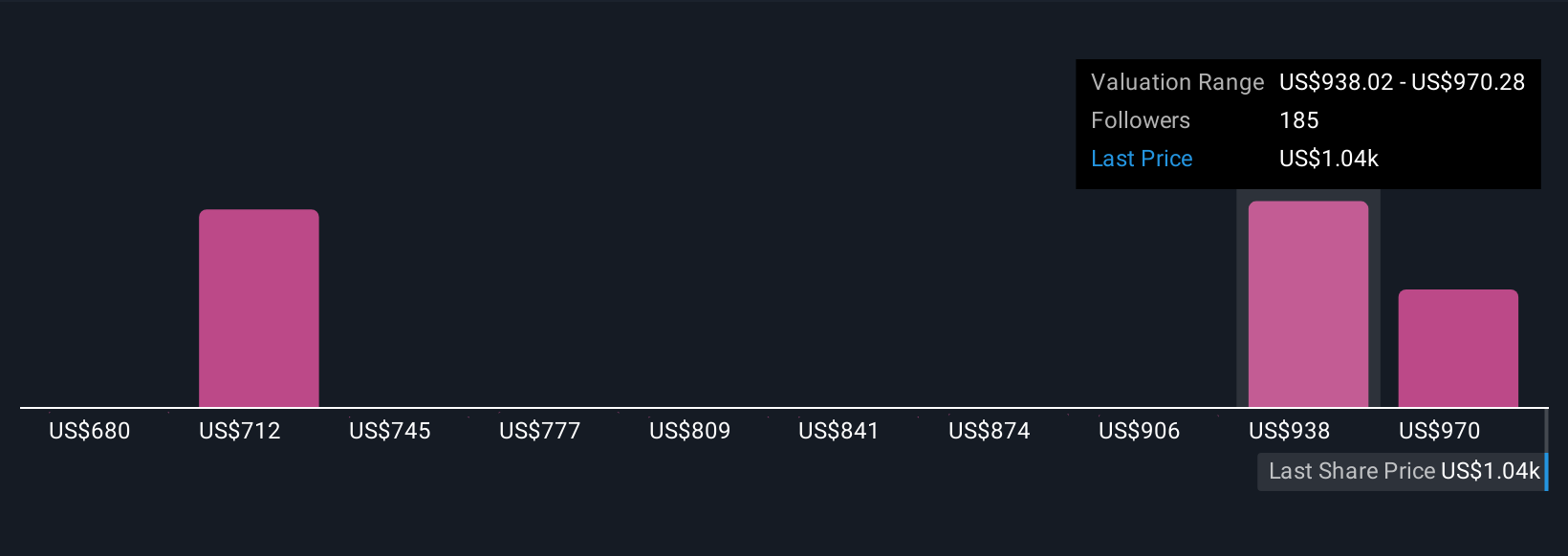

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your personal story about a company’s future, combining what you believe about its prospects with your assumptions for things like revenue, profit margins, and what the company should be worth.

Narratives connect the dots between what is happening at a company, your view of its financial future, and the resulting fair value. This approach lets you move beyond fixed models or broad averages. They are accessible and intuitive. On Simply Wall St’s Community page, millions of investors are already using Narratives to share what they think ASML Holding is really worth, whether they are bullish or cautious.

By setting up a Narrative, you'll see what a fair value could be under your assumptions and compare it directly to today’s price, making buy and sell decisions more informed and personal. Whenever new results or news emerge, Narratives update automatically and keep your perspective current amid changing events.

For example, some investors expect ASML Holding’s fair value as high as $1,002 per share, while others see it closer to $697. Narratives make space for every perspective and help you invest with confidence in your own story.

Do you think there's more to the story for ASML Holding? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASML

ASML Holding

Provides lithography solutions for the development, production, marketing, sales, upgrading, and servicing of advanced semiconductor equipment systems.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives