- United States

- /

- Semiconductors

- /

- NasdaqGS:ASML

A Fresh Look at ASML Holding's (NasdaqGS:ASML) Valuation After the Recent Share Price Dip

Reviewed by Simply Wall St

See our latest analysis for ASML Holding.

Following a stellar run earlier this year, ASML Holding has seen its share price cool off slightly this week, but that has hardly dulled its momentum. While the 1-day share price return is down 5.61% and the 7-day return is off 3.81%, strong gains over the past quarter and a robust 47.14% total shareholder return over the last 12 months show that long-term believers in ASML have been well rewarded, even as near-term volatility shapes sentiment.

If the latest market swings have you considering other opportunities in the tech sector, it’s a great moment to check out the full list of innovative companies via our See the full list for free.

With the latest dip set against impressive long-term growth, the key question now is whether ASML Holding shares are undervalued or if investors have already priced in all the company’s future potential. Could there still be a buying opportunity?

Most Popular Narrative: 2.1% Undervalued

ASML Holding's narrative fair value estimate stands at $1,002.53, modestly above its last close price of $981.04. This invites a closer look at the drivers behind this valuation and what could shape future moves.

ASML is the only company in the world producing EUV lithography tools. These machines are essential for making the world’s most powerful semiconductors. This gives ASML a near monopoly in a fast-growing market driven by AI, 5G, and high-performance computing.

Curious what financial assumptions led to this edge in valuation? The narrative hinges on an unrivaled market position and powerful technology, supported by forward-looking profit margins and industry dominance. What specific earnings projections put ASML at the top? Discover the pivotal numbers and unique industry insights that drive this narrative’s fair value.

Result: Fair Value of $1,002.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing geopolitical tensions and export restrictions to China could present challenges to ASML’s upbeat outlook and affect future growth momentum.

Find out about the key risks to this ASML Holding narrative.

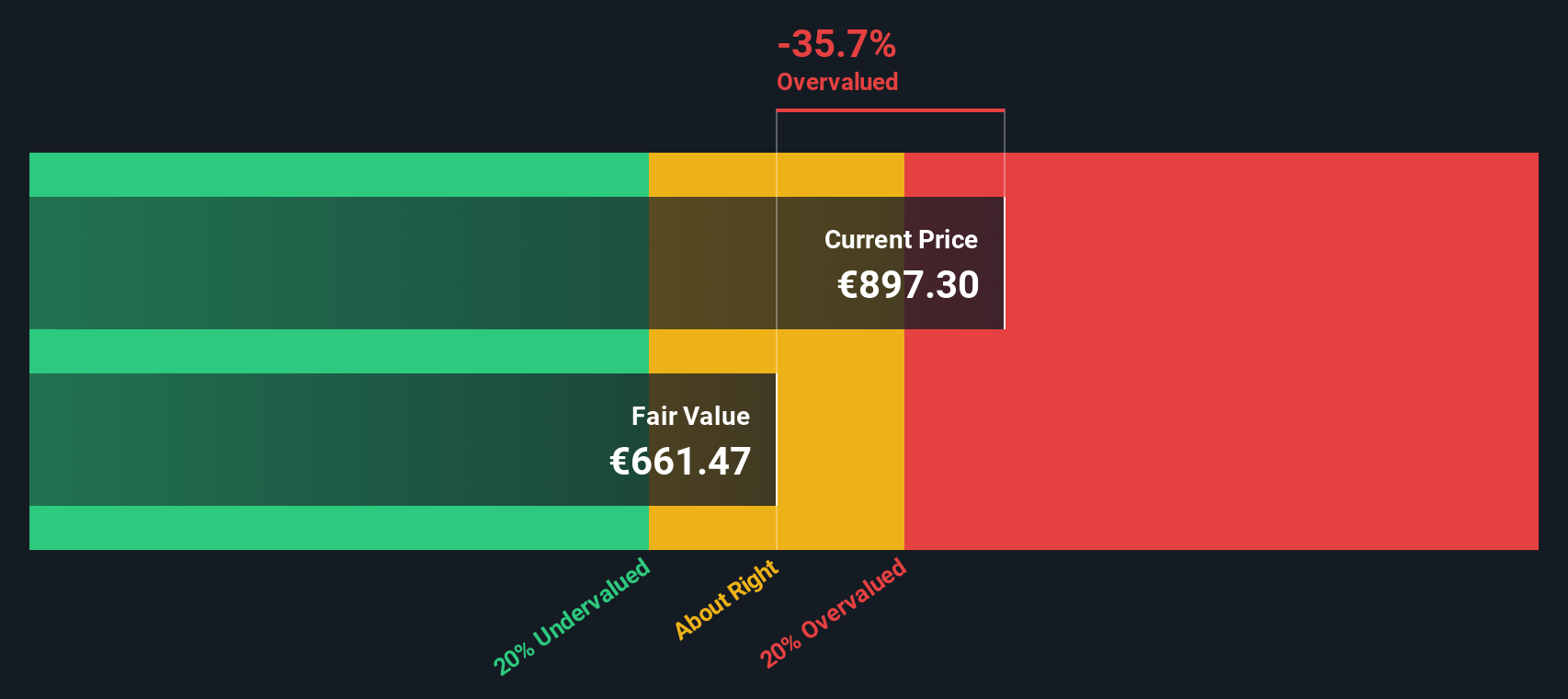

Another View: DCF Model Suggests Caution

While the narrative-led approach puts ASML’s fair value just above its recent share price, our DCF model tells a different story. The SWS DCF model calculates a fair value of $756.45, which is significantly below where shares are trading today. Does this mean the market sees something the models do not?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ASML Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 910 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ASML Holding Narrative

If you want to dig deeper, interpret the numbers differently, or just back your own insights, you can craft your own perspective in minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding ASML Holding.

Looking for More Winning Investment Ideas?

Uncover new opportunities and stay ahead by checking out these handpicked investment themes you do not want to overlook as markets move.

- Accelerate your growth strategy by targeting companies with rapid advancements in artificial intelligence. Use these 26 AI penny stocks to spot transformative industry leaders.

- Maximize your income potential by exploring these 15 dividend stocks with yields > 3%, featuring businesses offering attractive yields for consistent cash flow.

- Capitalize on breakthrough technologies by tapping into these 26 quantum computing stocks for exposure to the next wave of computing innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASML

ASML Holding

Provides lithography solutions for the development, production, marketing, sales, upgrading, and servicing of advanced semiconductor equipment systems.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives