- United States

- /

- Semiconductors

- /

- NasdaqGS:ARM

Revisiting Arm Holdings (NasdaqGS:ARM) Valuation After Recent Share Price Rally

Reviewed by Simply Wall St

See our latest analysis for Arm Holdings.

This latest surge follows a wave of renewed optimism around semiconductors, with Arm Holdings’ 1-month share price return climbing over 10%. Even when accounting for some short-term volatility, momentum appears to be firmly on Arm’s side because of its strong year-to-date gains and 1-year total shareholder return of 22.65%.

Curious about other standout tech movers? Now is a smart moment to extend your search and discover See the full list for free.

But with Arm’s stock now trading above analyst price targets and a string of potent gains behind it, the question becomes clear: is there still value left for newcomers, or has the market already factored in the company’s future growth?

Most Popular Narrative: 141% Overvalued

According to jaikhom, the market price for Arm Holdings stands far above the fair value estimate. With shares recently closing at $168.68, the narrative sets a risk-adjusted fair value at only $70, casting Arm's current valuation as steep and exuberant.

ARM Holdings continues to benefit from its irreplaceable role in the global semiconductor ecosystem, powering everything from smartphones to AI edge devices. Based on a forward earnings framework anchored to the 10-year U.S. Treasury yield, the stock’s intrinsic fair value is estimated at $70 per share. Applying a prudent 20% discount to reflect interest rate risk and macro uncertainty yields a conservative, risk-adjusted target of $56.

What is the unseen logic driving such a bold undercut of the current market price? The narrative’s fair value rests on a unique connection between forward-looking earnings and the risk-free rate. This hints at contrarian assumptions about Arm’s long-term margin potential and the macroeconomic backdrop. Hungry to understand which hidden factors pull the target down? Uncover the critical levers shaping this provocative assessment.

Result: Fair Value of $70 (OVERVALUE)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if Arm delivers unexpectedly strong earnings or announces a major AI breakthrough, these catalysts could quickly shift sentiment and challenge the bearish view.

Find out about the key risks to this Arm Holdings narrative.

Another View: Comparing Market Ratios

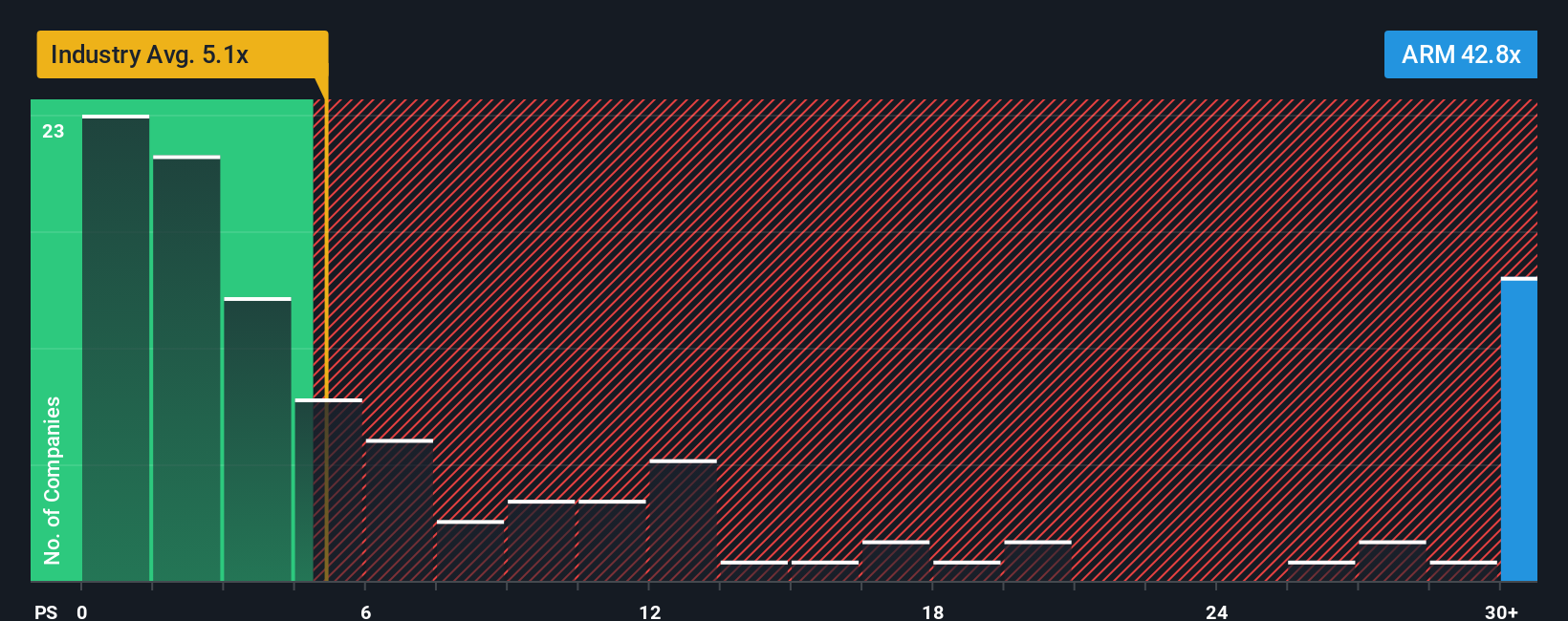

There is another way to value Arm Holdings by looking at its price-to-sales ratio. At 43.3x, Arm’s ratio stands sharply above both the US semiconductor industry average of 5.3x and the peer group average of 5.9x. Even the market’s fair ratio is set lower at 44.7x, which points towards a premium that leaves little margin for error if sentiment shifts. Is this a warning sign, or could the market sustain such lofty expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arm Holdings Narrative

If you want a fresh perspective or believe your own research could lead to different insights, you can easily build your personal narrative in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Arm Holdings.

Want More Investment Opportunities?

You can uncover fresh investment angles with a few smart clicks, all tailored to your goals. Don’t pass up the chance to spot hidden gems before the crowd.

- Tap into a wave of innovation by checking out these 26 AI penny stocks as they make major advancements in artificial intelligence and automation.

- Boost your portfolio’s yield by finding these 18 dividend stocks with yields > 3% that deliver reliable income with strong dividends above 3%.

- Position yourself ahead of the curve with these 28 quantum computing stocks as they drive breakthroughs in computation and next-generation tech solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARM

Arm Holdings

Arm Holdings plc architects, develops, and licenses central processing unit products and related technologies for semiconductor companies and original equipment manufacturers.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives