- United States

- /

- Semiconductors

- /

- NasdaqGS:ARM

Does Arm Holdings’ 33% Rally in 2025 Match Its Latest Growth Partnerships?

Reviewed by Bailey Pemberton

- Ever wondered if Arm Holdings’ recent hype actually makes it a good buy? Let’s dig beneath the headlines and find out what the numbers are telling us about the stock’s true value.

- Arm Holdings’ share price has shown serious action lately, climbing 12.9% over the past month and now up 32.5% year-to-date, even after a slight dip of 0.5% in the last week.

- Some of those moves are thanks to reports of fresh partnerships and tech advancements, as Arm pushes into new markets amid growing demand for its chip designs. These developments have captured investor attention and hint at big bets on future growth while aligning with broader industry trends.

- But does the market momentum match up with value? According to our valuation checks, Arm Holdings is undervalued in 0 out of 6 areas. We’ll look at traditional approaches next, so stay tuned for a smarter way to size up the stock’s worth by the end of this article.

Arm Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Arm Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to what they are worth today. This method puts a price tag on all the money a company could earn in the years ahead, adjusted for the risk and the time value of money.

For Arm Holdings, the DCF model used is a 2 Stage Free Cash Flow to Equity approach. The company's most recent Free Cash Flow sits at $774.47 million. Analyst forecasts see strong growth, with cash flows expected to exceed $2 billion annually by 2026. By 2030, projections (including extrapolations beyond analyst consensus) place free cash flow at roughly $5 billion.

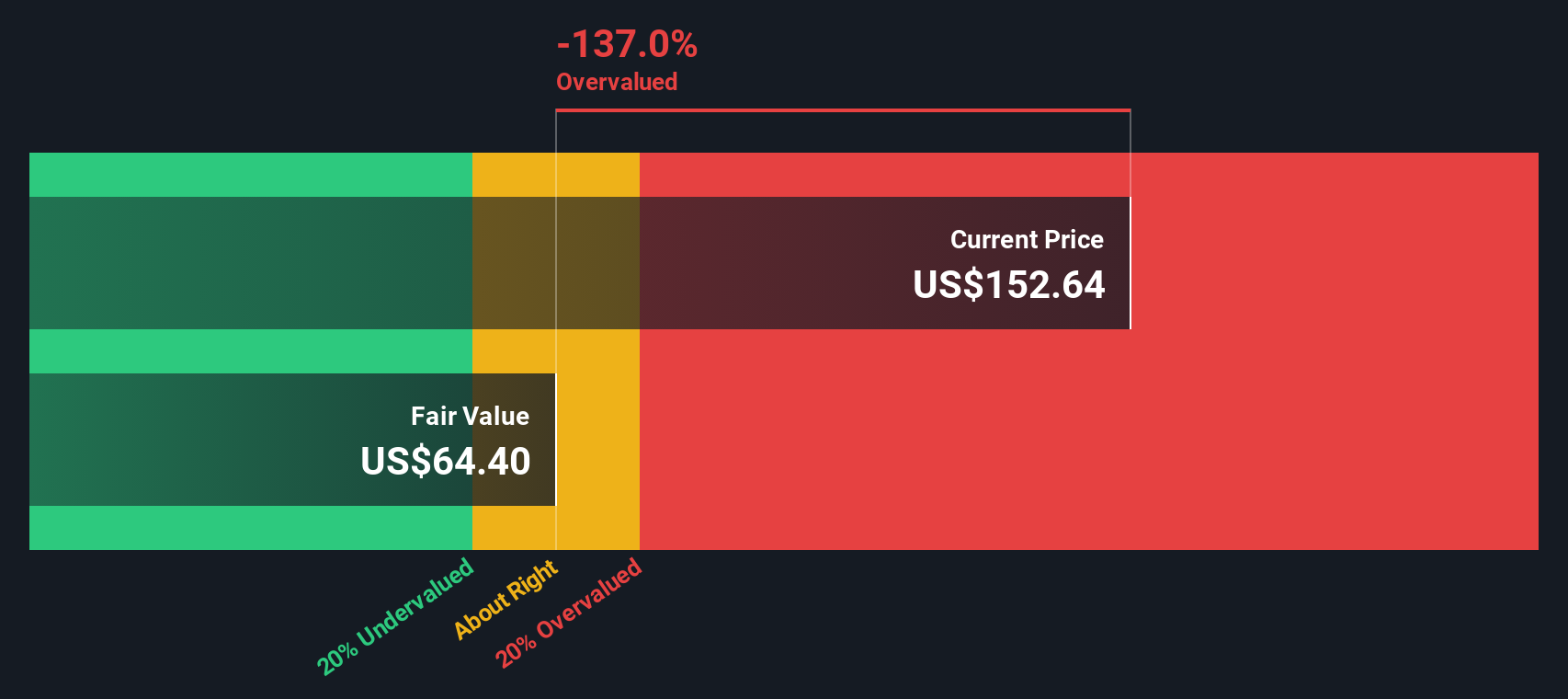

This model returns an estimated intrinsic value for Arm Holdings shares of $64.24. However, the intrinsic discount is -164.4%, meaning the stock is trading far above this fair value calculation. In short, the DCF suggests Arm Holdings is currently 164.4% overvalued based on these long-term cash flow expectations.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Arm Holdings may be overvalued by 164.4%. Discover 833 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Arm Holdings Price vs Sales

When it comes to valuing profitable and growing technology companies, the Price-to-Sales (P/S) ratio is a widely used metric. It is especially helpful when earnings can fluctuate due to heavy reinvestment in growth or when profit margins are evolving. The P/S ratio focuses on the top line sales number that companies like Arm are able to produce consistently.

Market optimism and industry risk both play key roles in shaping whether a P/S ratio is considered reasonable or stretched. High-growth firms with strong prospects and lower risk generally command higher multiples. In contrast, riskier or slow-growth companies tend to warrant discounts, resulting in lower typical P/S ratios.

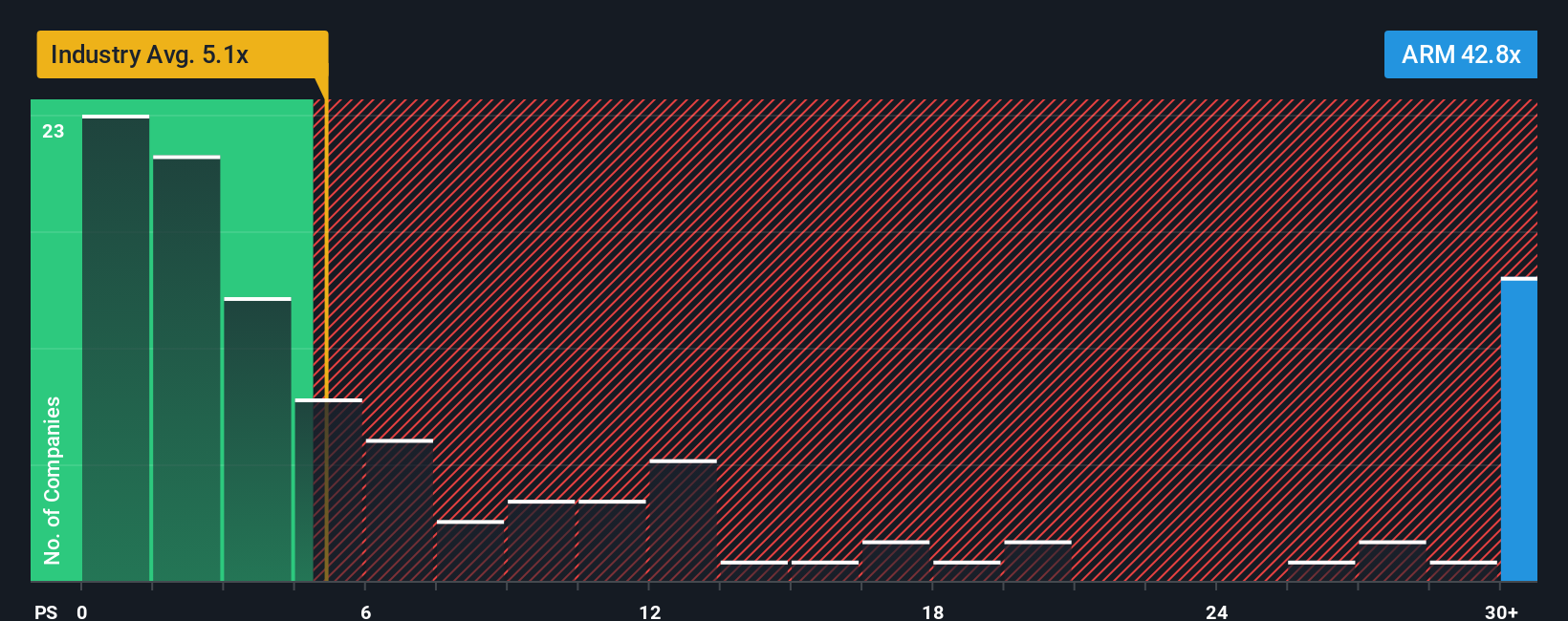

Arm Holdings currently trades at a P/S of 43.6x. This is exceptionally high compared to the semiconductor industry average of 5.5x and even above the average for its close peers at 5.8x. On the surface, this steep premium signals that investors are expecting extraordinary sales growth or superior margins from Arm in the future.

However, Simply Wall St's proprietary “Fair Ratio” goes beyond industry averages and peer comparisons. It estimates what a reasonable multiple should be for a stock by considering Arm’s true growth outlook, profit margins, the competitive landscape, its market cap, and overall risk profile. For Arm, this Fair Ratio comes in at 42.1x. This suggests that, while expensive by broader industry standards, the valuation is largely justified by Arm’s unique prospects and fundamentals.

With the current P/S and Fair Ratio nearly aligned, Arm Holdings stock appears to be fairly valued based on this approach.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Arm Holdings Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple yet powerful tool that lets you capture your unique perspective on a company by combining the story you believe in with your forecasts for key numbers like revenue growth, profit margins, and fair value.

Instead of just relying on static ratios or analyst consensus, Narratives help you make decisions by linking Arm Holdings’ story to financial projections and then comparing your fair value against the current share price. This approach is designed to be accessible and intuitive and is available to everyone on Simply Wall St’s Community page, where millions of investors share and refine their thinking.

What makes Narratives truly dynamic is how they update instantly as new information such as earnings reports or market-moving news emerges, enabling your thesis and numbers to remain relevant and actionable. This can help you decide exactly when to buy, sell, or hold by comparing your view of fair value to where the stock is trading right now.

For Arm Holdings, for example, one bullish Narrative sees a fair value as high as $210 by assuming rapid AI and data center adoption, while a more conservative view values the company near $70, focusing on historic trends and risk factors.

For Arm Holdings, we’ll make it really easy for you with previews of two leading Arm Holdings Narratives:

Fair Value: $210.00

Current Price vs Fair Value: -19.1%

Expected Revenue Growth: 27.7%

- Projects explosive growth in royalties and earnings as Arm rapidly expands into AI, data centers, and edge computing. This is driven by a dominant software ecosystem and next-generation chip solutions.

- Predicts high profit margins as a result of rising royalty rates, increased software monetization, and deeper expansion into subsystem and chiplet markets across IoT, automotive, and wearables.

- Warns that competition from open architectures (like RISC-V), major customers designing chips in-house, and geopolitical barriers could threaten growth and profitability if not managed well.

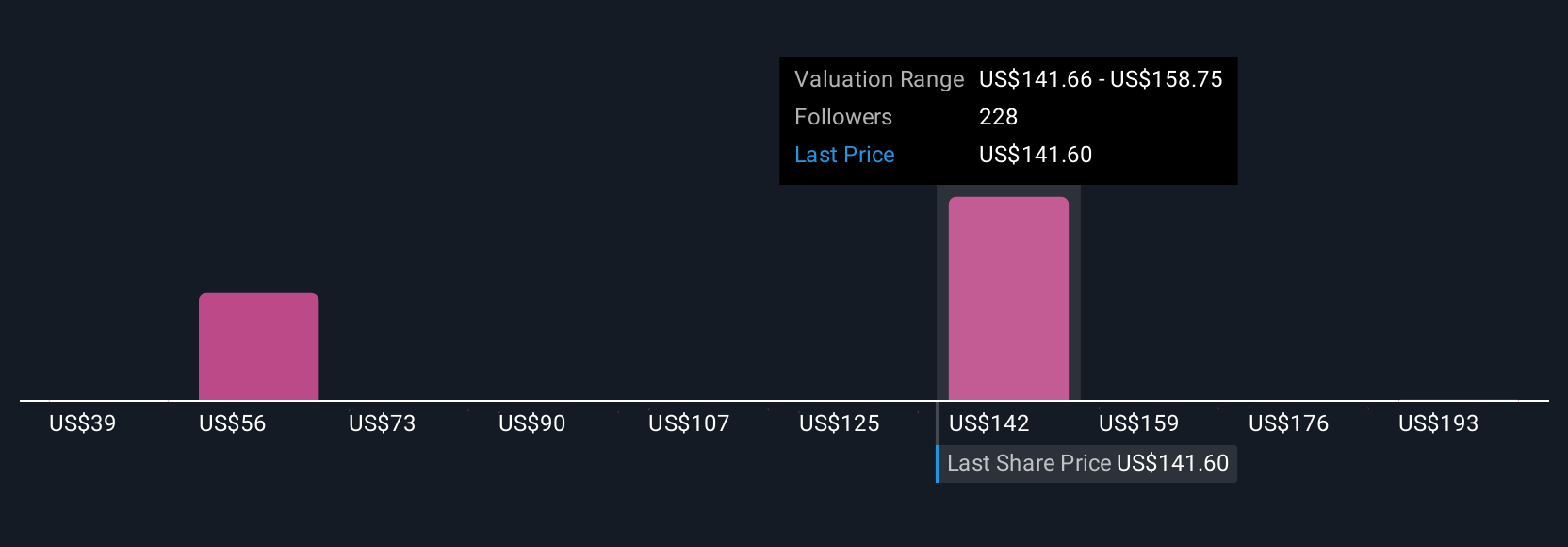

Fair Value: $157.52

Current Price vs Fair Value: +7.8%

Expected Revenue Growth: 21.6%

- Sees robust growth from AI and edge markets. However, it highlights that execution risks, margin pressures, and heavy R&D investment may limit longer-term returns.

- Raises concern about Arm’s reliance on flagship smartphones and possible market saturation, as well as risks if diversification efforts in new compute areas fall short.

- Notes that rising operating costs, potential customer concentration, and uncertainty in markets like China could weigh on earnings and future growth if not offset by recurring revenues.

Do you think there's more to the story for Arm Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARM

Arm Holdings

Arm Holdings plc architects, develops, and licenses central processing unit products and related technologies for semiconductor companies and original equipment manufacturers.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives