- United States

- /

- Semiconductors

- /

- NasdaqGS:ARM

Can Arm Stock’s AI Partnerships Justify Its 15% Drop in 2025?

Reviewed by Bailey Pemberton

- Wondering whether Arm Holdings is the type of stock that could be a steal or if it is just riding the hype? You are not alone, and we are about to dig into what the market might be missing.

- The share price has been on a rollercoaster recently, dropping 9.4% in the last week and down 15.3% over the last month. However, it is still positive for the year with a 9.4% gain.

- Market watchers have been abuzz following headlines about Arm’s growing partnership deals in the AI and mobile chip space. This comes alongside shifts in industry sentiment as chip stocks surge and then cool off. Investor optimism has been tested by both competitive announcements from large tech names and wider sector volatility.

- On our six-point valuation check, Arm Holdings scores just 1 out of 6 for being undervalued. We will be examining what that really means, how other popular methods line up, and why the real story might emerge through a more holistic lens at the end of this piece.

Arm Holdings scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Arm Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. This approach tries to answer the question, “Given what we expect the company to earn, what is it actually worth right now?”

For Arm Holdings, current Free Cash Flow (FCF) stands at $1.29 Billion. Analyst estimates forecast steady growth, projecting the company’s FCF to reach $5.27 Billion by 2030. Notably, concrete analyst projections are only available for the next five years. The outlook beyond that is an extrapolation based on available growth trends.

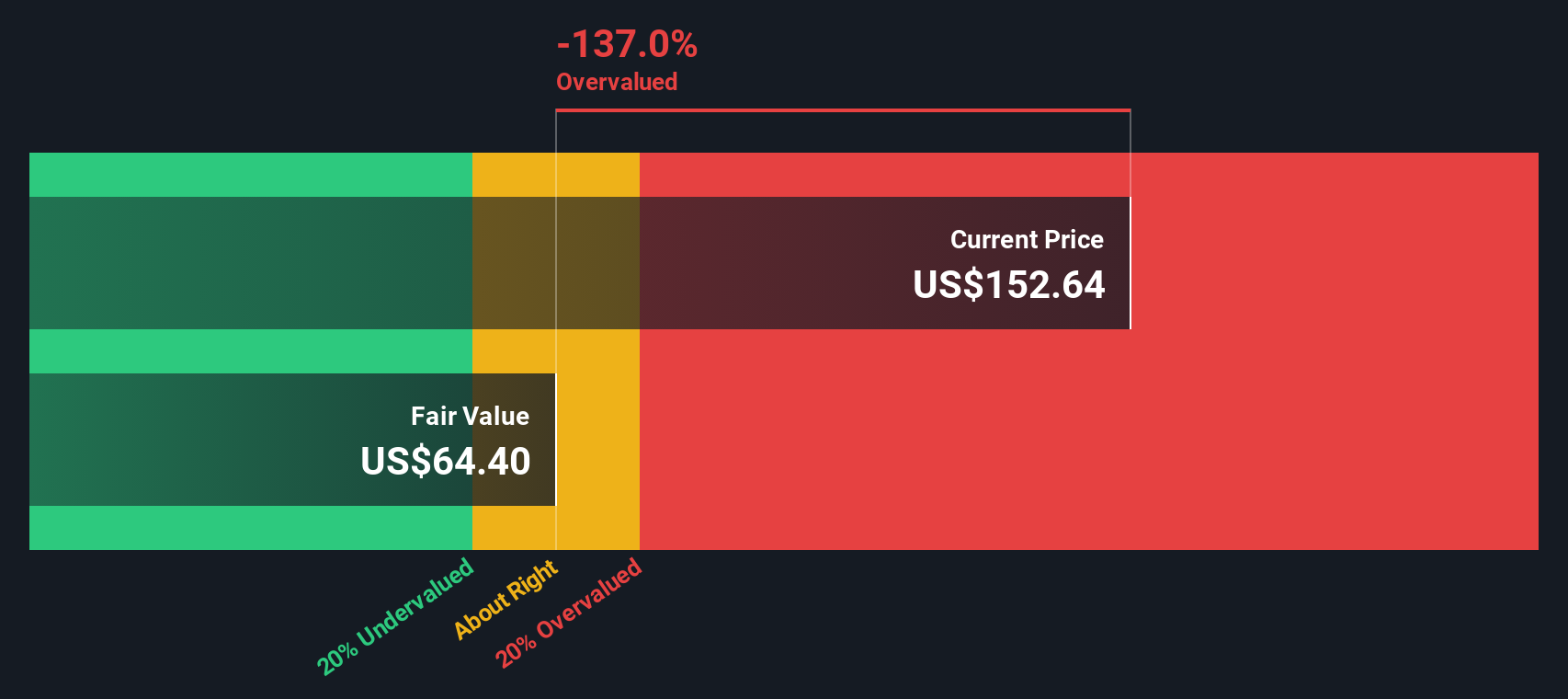

The result of this two-stage DCF analysis is a fair value estimate of $63.54 per share. However, this calculation finds that Arm Holdings is trading at a 120.8% premium to its intrinsic value, meaning the current share price is well above what the long-term cash flow outlook suggests is justified.

In short, even with optimistic growth in its cash-generating ability, Arm’s stock appears significantly overvalued by this measure.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Arm Holdings may be overvalued by 120.8%. Discover 894 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Arm Holdings Price vs Sales

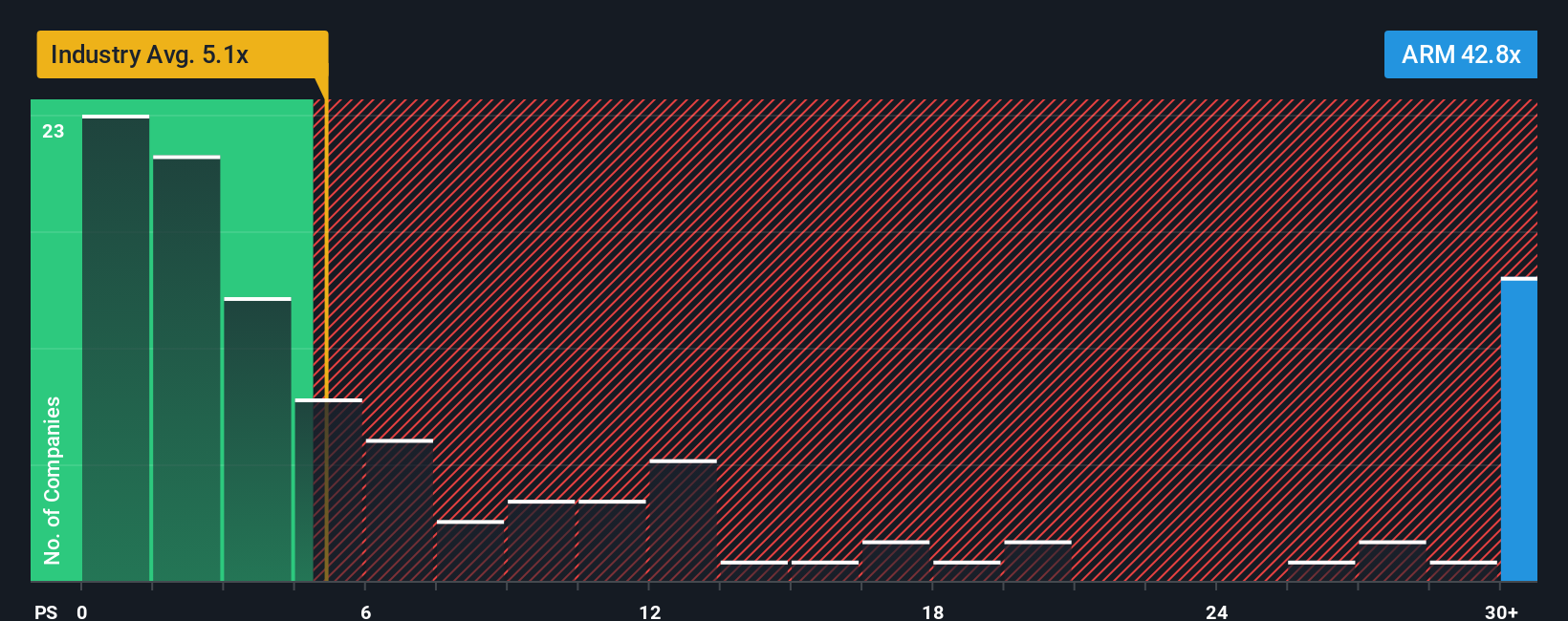

When valuing a high-growth, profitable technology business like Arm Holdings, the Price-to-Sales (P/S) ratio is a particularly useful metric. The P/S ratio allows investors to compare how much they are paying for each dollar of the company’s revenue. This can be helpful when profits are growing but may still be volatile due to rapid expansion.

Growth expectations and risk both impact what a “normal” or “fair” P/S ratio looks like. Companies with faster projected growth and lower perceived risks generally command higher multiples because investors are willing to pay a premium for future potential and stability. Conversely, higher risks or lower growth reduce what is reasonable to pay for each sales dollar.

Arm Holdings currently trades at a P/S ratio of 33.7x, which is significantly above the Semiconductor industry average of 4.7x and also higher than the peer group average of 6.5x. To put this in perspective, the Simply Wall St Fair Ratio is an advanced figure that reflects Arm’s expected growth, margins, risk profile, market cap, and its industry. The Fair Ratio comes in at 43.4x. This measure goes beyond basic peer or industry comparisons by factoring in what is unique about Arm’s business outlook and financial strength.

Here, Arm’s actual multiple is notably below its Fair Ratio. This suggests that, relative to its fundamentals, the market might not be fully accounting for the company’s growth potential or quality.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1417 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Arm Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives.

A Narrative is your own story behind a stock: it is how you connect your perspective on the company with what you believe its future revenues, earnings, and margins will look like, leading you to an estimated fair value.

By building a Narrative, you are not just reacting to historical data or analyst forecasts. You are defining why the company might be undervalued, overvalued, or just right, all based on your view of its business drivers and trajectory.

On the Simply Wall St Community page, Narratives are an easy, powerful tool used by millions of investors to ground their decisions. Each Narrative links a company’s evolving story to a fresh financial model and fair value estimate.

Narratives help you know when to buy or sell by allowing you to compare your fair value against the current share price, and they automatically update as new information such as news headlines or company earnings comes to light.

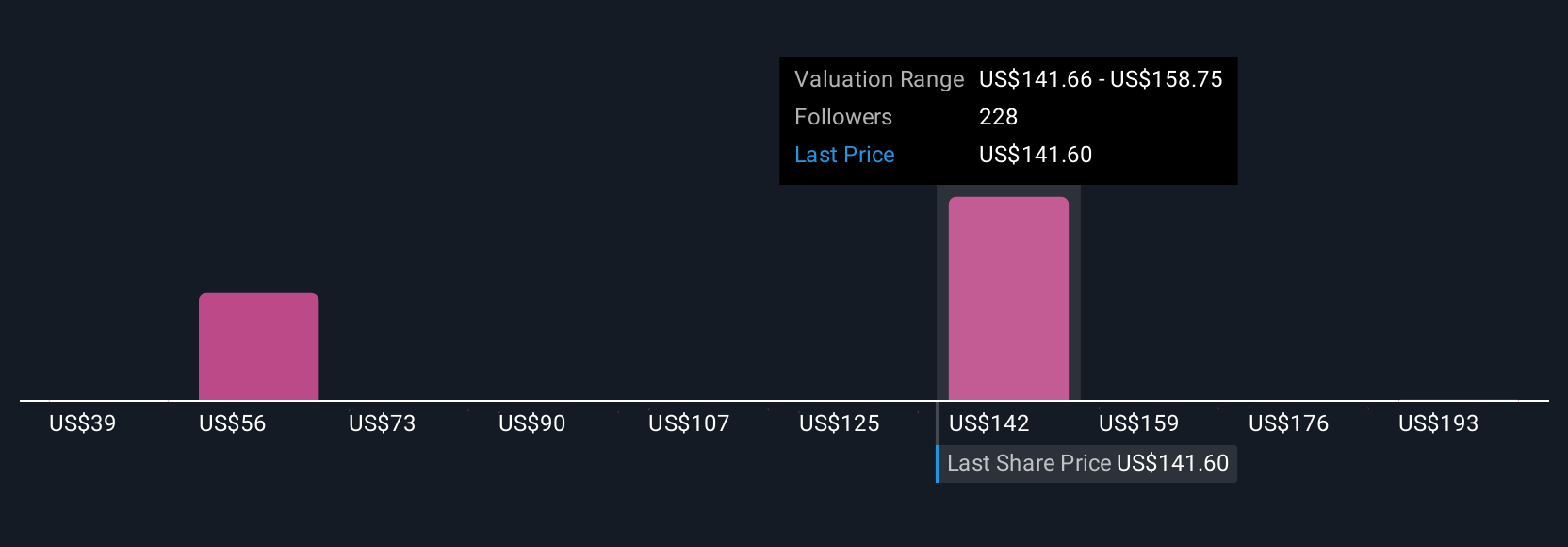

For example, some investors currently estimate Arm Holdings’ fair value as high as $210 per share, while others are as cautious as $70, reflecting completely different stories about Arm’s future.

For Arm Holdings, however, we'll make it really easy for you with previews of two leading Arm Holdings Narratives:

Fair Value: $166.72

Undervalued by: 15.9%

Projected Revenue Growth: 22.1%

- Custom silicon adoption and higher royalty rates are driving substantial royalty and earnings growth, while premium IP boosts per-chip monetization.

- Expanding reach in AI, IoT, and the edge market, combined with a vast developer ecosystem, ensures recurring revenues and sustainable margin expansion.

- Analysts expect continued licensing momentum, AI gains, and margin improvements to support a consensus fair value above today's share price, with most forecasting strong double-digit growth and margin expansion in coming years.

Fair Value: $70.00

Overvalued by: 100.4%

Projected Revenue Growth: -4.2%

- Valuation appears decoupled from fundamentals, with the stock trading well above intrinsic value estimated via a risk-adjusted earnings model.

- Current price levels reflect speculative excess, driven by AI hype and liquidity, rather than sustainable structural earnings or cash flow growth.

- Investors should be wary of a “bubble wave,” as rising rates, earnings disappointments, or risk shifts could trigger sharp corrections despite long-term relevance.

Do you think there's more to the story for Arm Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARM

Arm Holdings

Arm Holdings plc architects, develops, and licenses central processing unit products and related technologies for semiconductor companies and original equipment manufacturers.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives