- United States

- /

- Semiconductors

- /

- NasdaqGS:ARM

Arm (NasdaqGS:ARM) Margin Expansion Reinforces Bull Narratives as Valuation Premium Widens

Reviewed by Simply Wall St

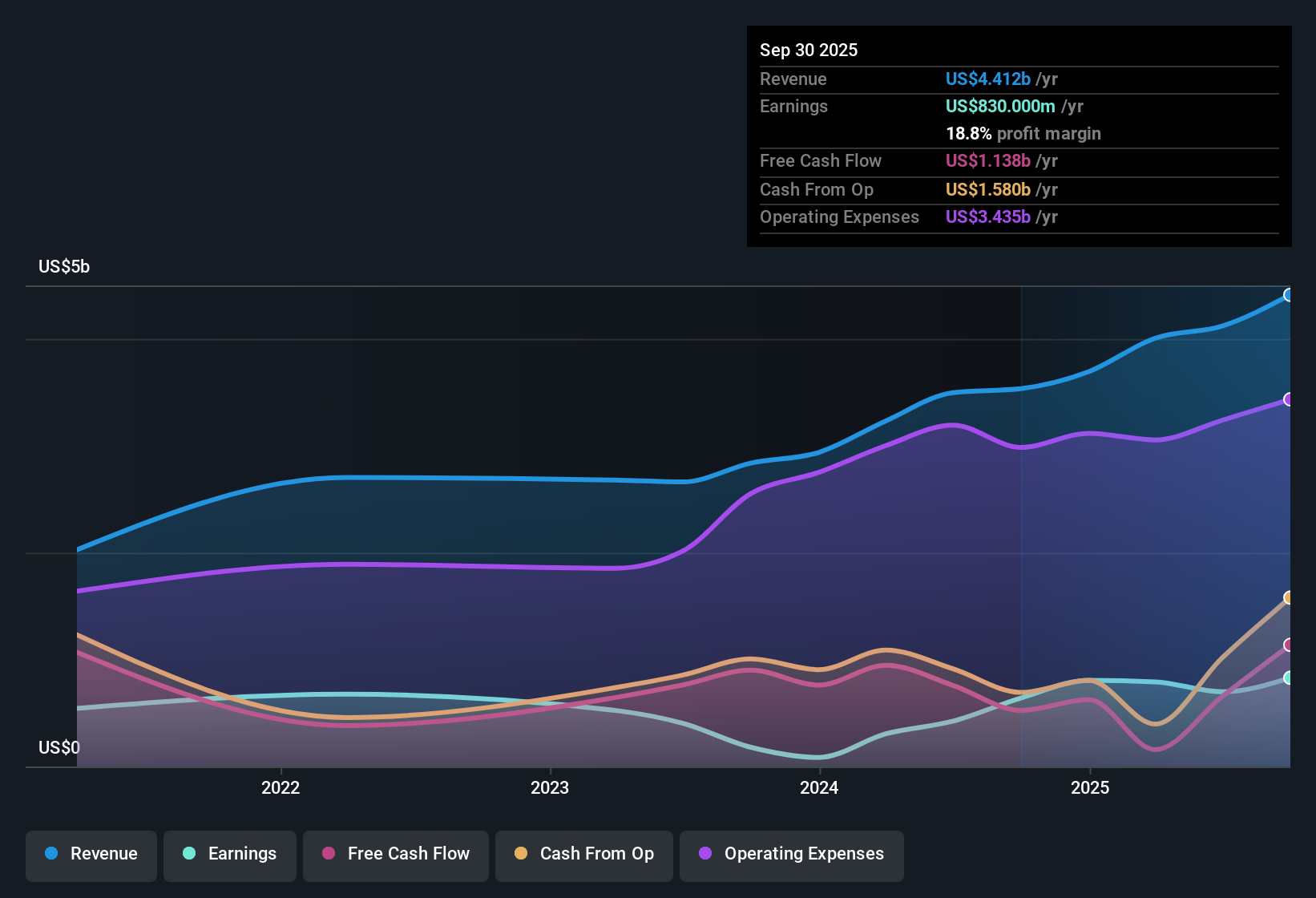

Arm Holdings (ARM) posted a net profit margin of 18.8%, improving from 18.1% a year earlier, as earnings surged 29.5% in the latest period. This increase is well ahead of its five-year compound annual growth rate of 11.3%. Earnings are forecast to grow another 29% annually in the future, and revenue is expected to climb by 18.3% per year, both well above US market averages. While high quality earnings and robust profit growth are clear rewards for investors, the stock's $160.19 share price is significantly higher than the estimated fair value. This sets the stage for a debate between future growth potential and its premium valuation multiples.

See our full analysis for Arm Holdings.Next up, we’ll see how this strong set of numbers compares with the narratives that investors and the market have built around Arm. Some perspectives will be reinforced, while others may face new questions.

See what the community is saying about Arm Holdings

Royalty Rate Uplift Outruns Peers

- Arm's Price-To-Sales Ratio stands at 38.4x, more than six times higher than both its peer average (5.9x) and the US Semiconductor sector average (5x). This highlights just how large a premium investors are paying for its royalty and licensing streams compared to similar companies.

- Heavily supporting the bullish narrative, bulls argue that this premium is justified by Arm’s extensive edge AI leadership and the rapid rise in next-gen royalty rates.

- Arm’s new chip designs and software ecosystem now capture royalty rates that exceed 10% of average selling prices, with v9 platform deals already beating previous ceiling marks. This accelerates both per-chip revenue and multiplies total addressable market across AI and IoT, outpacing the sector’s slower averages.

- Bulls also point to Arm’s expansion into subsystems and custom silicon, allowing it to capture a larger share of the semiconductor value chain. Peer companies have struggled to achieve this at such a scale.

Bulls see this revenue engine as far from peaking. Find out what drives their conviction in the full bull case. 🐂 Arm Holdings Bull Case

Profit Margin Expansion Raises Debate

- Net profit margin improved from 18.1% to 18.8% this year, outstripping the five-year compound margin trend of 11.3%. This increase is notable, and analysts debate whether it is sustainable as Arm’s product mix and customer base rapidly diversify.

- According to the analysts' consensus view, margin expansion and broad developer adoption are strong positives, but success also depends on Arm executing flawlessly as it enters new categories like chiplets and full system designs.

- The consensus notes that while new markets like automotive and IoT could provide recurring, higher-margin revenues, rising R&D costs and the challenge of maintaining focus in multiple segments may pressure future margins, especially if top-line growth lags expectations.

- Analysts also underscore that execution risk, particularly in unfamiliar segments and against increasingly vertically integrated customers, remains a material hurdle to further margin expansion.

DCF Fair Value Gap Grows Wider

- At $160.19 per share, Arm trades at over 2.5 times its estimated DCF fair value of $62.85. This underlines a significant disconnect between fundamentals-based valuation and prevailing market optimism.

- Consensus narrative highlights that this fair value gap, despite Arm's growth rates and recurring revenue moat, points to success being already priced far above the sector.

- Even with consensus assuming 21.5% annualized revenue growth and expanding profit margins, the current share price leaves limited room for error, especially versus a sector where median price targets are much closer to market prices.

- Analysts caution that while Arm’s growth prospects are unique, owning shares at today's premium means depending not only on the company’s execution but also on continued strong industry demand and royalty adoption at the elevated levels bulls expect.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Arm Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Thinking about these figures from a new angle? You can shape your own unique perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Arm Holdings.

See What Else Is Out There

While Arm's profit growth impresses, its sky-high valuation compared to discounted cash flow fair value suggests investors face steep risks if expectations falter.

If you want more confidence that you’re not overpaying, focus on opportunities among these 836 undervalued stocks based on cash flows where solid fundamentals meet compelling price tags right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARM

Arm Holdings

Arm Holdings plc architects, develops, and licenses central processing unit products and related technologies for semiconductor companies and original equipment manufacturers.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives