- United States

- /

- Semiconductors

- /

- NasdaqGS:AOSL

Alpha and Omega Semiconductor Limited's (NASDAQ:AOSL) Share Price Boosted 30% But Its Business Prospects Need A Lift Too

Those holding Alpha and Omega Semiconductor Limited (NASDAQ:AOSL) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

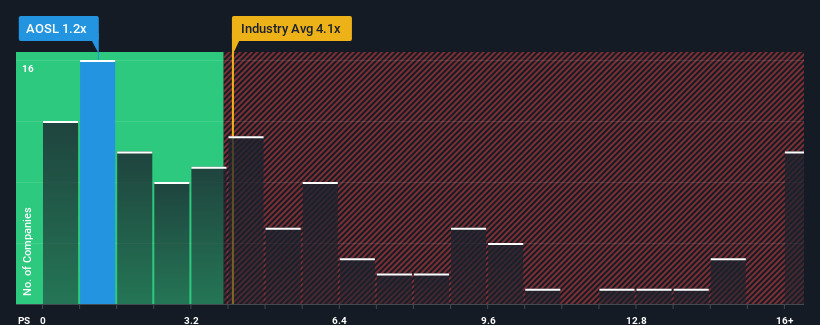

Even after such a large jump in price, Alpha and Omega Semiconductor may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.2x, considering almost half of all companies in the Semiconductor industry in the United States have P/S ratios greater than 4.1x and even P/S higher than 8x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Alpha and Omega Semiconductor

What Does Alpha and Omega Semiconductor's Recent Performance Look Like?

Alpha and Omega Semiconductor hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Alpha and Omega Semiconductor's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Alpha and Omega Semiconductor's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 33% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 3.0% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 40%, which is noticeably more attractive.

With this information, we can see why Alpha and Omega Semiconductor is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Alpha and Omega Semiconductor's recent share price jump still sees fails to bring its P/S alongside the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Alpha and Omega Semiconductor maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Alpha and Omega Semiconductor with six simple checks on some of these key factors.

If you're unsure about the strength of Alpha and Omega Semiconductor's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AOSL

Alpha and Omega Semiconductor

Designs, develops, and supplies power semiconductor products for computing, consumer electronics, communication, and industrial applications in Hong Kong, China, South Korea, the United States, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives