- United States

- /

- Semiconductors

- /

- NasdaqGS:AMKR

Amkor Technology (AMKR) Rises 7.3% After Dividend Hike and Upbeat Earnings Revision Is Confidence Building?

Reviewed by Sasha Jovanovic

- Amkor Technology recently announced a 1% increase in its quarterly cash dividend to US$0.08352 per share, payable to shareholders on December 23, 2025.

- This move coincided with a positive shift in analyst earnings estimates and better-than-expected quarterly results, indicating renewed confidence in the company’s outlook.

- With the company reporting an upward earnings revision and dividend increase, we'll explore how these factors influence Amkor’s investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

What Is Amkor Technology's Investment Narrative?

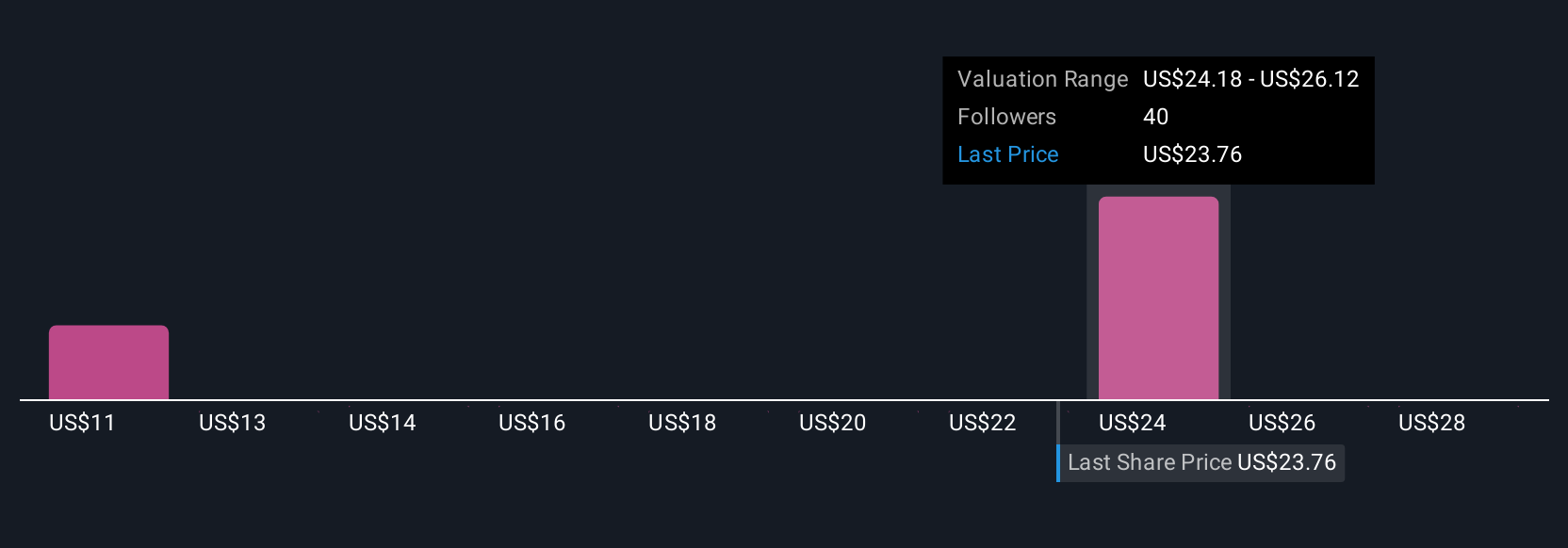

To own shares in Amkor Technology, you need to believe in the semiconductor sector’s long-term growth story and the company’s ability to execute on its multi-billion dollar expansion, including new facilities supporting major clients. After the recent 1% dividend increase and a significant uptick in analyst earnings estimates, the mood around Amkor’s short-term prospects has become more upbeat. The boost in dividend and strong quarterly results both add to management’s credibility and indicate mid-term resilience, potentially influencing the valuation narrative for those watching near-term catalysts like further revenue beats or contract wins. Risks that still hover include industry competition, exposure to market giants like TSMC and NVIDIA, and upcoming changes in executive leadership, though the Q3 results and positive surprises have helped to temper those concerns for now. The latest news does not appear to materially affect the key underlying risks, but does lend momentum to the thesis for operational improvement and stable returns. Yet, executive transitions could tip the scale in unexpected ways, something investors should keep in mind.

Amkor Technology's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 8 other fair value estimates on Amkor Technology - why the stock might be worth as much as 10% more than the current price!

Build Your Own Amkor Technology Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amkor Technology research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Amkor Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amkor Technology's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMKR

Amkor Technology

Provides outsourced semiconductor packaging and test services in the United States, Japan, Europe, and the Asia Pacific.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success