- United States

- /

- Semiconductors

- /

- NasdaqGS:AMAT

Applied Materials (AMAT): Valuation in Focus After Three-Month Share Price Surge

Reviewed by Simply Wall St

See our latest analysis for Applied Materials.

Applied Materials’ share price has surged nearly 38% over the past three months as momentum builds, helping drive a 29% total shareholder return for the year and extending its outperformance over the longer term. The stock’s strong rally signals growing optimism about future growth and sector leadership.

If you’re interested in what else is powering the chip rally, it’s a great time to discover See the full list for free.

But with shares now near all-time highs, investors are left to wonder if Applied Materials is currently undervalued or if the market has already factored in all of the company’s growth. Could this still be a buying opportunity, or has the next chapter of gains been priced in?

Most Popular Narrative: 0.5% Overvalued

With Applied Materials’ fair value estimate nearly matching its last close price, the market appears to be closely aligned with the most closely watched narrative. This tight pricing gap invites a closer look at what’s driving analyst expectations.

The ongoing explosion in data creation and rapid adoption of digital transformation (IoT, automotive, industrial automation) continue to accelerate wafer fab buildouts globally. Over 100 new fabs or expansions have been tracked this year, with governments incentivizing regional manufacturing. Applied's broad portfolio and investments in local manufacturing infrastructure (for example, new Arizona and EPIC centers) position it to capture a greater share of this growing and more geographically diverse capital expenditure, supporting both revenue growth and margin resilience.

Want the real story behind these numbers? This narrative hinges on big bets in future industry buildouts and margin expansion. The future price is all about ambitious growth. See which accelerating business lines and global developments are driving the math behind this valuation.

Result: Fair Value of $222.94 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing export restrictions in China and increased competition in advanced equipment could quickly change the outlook and put pressure on Applied Materials' growth projections.

Find out about the key risks to this Applied Materials narrative.

Another View: Market Multiples Tell a Different Story

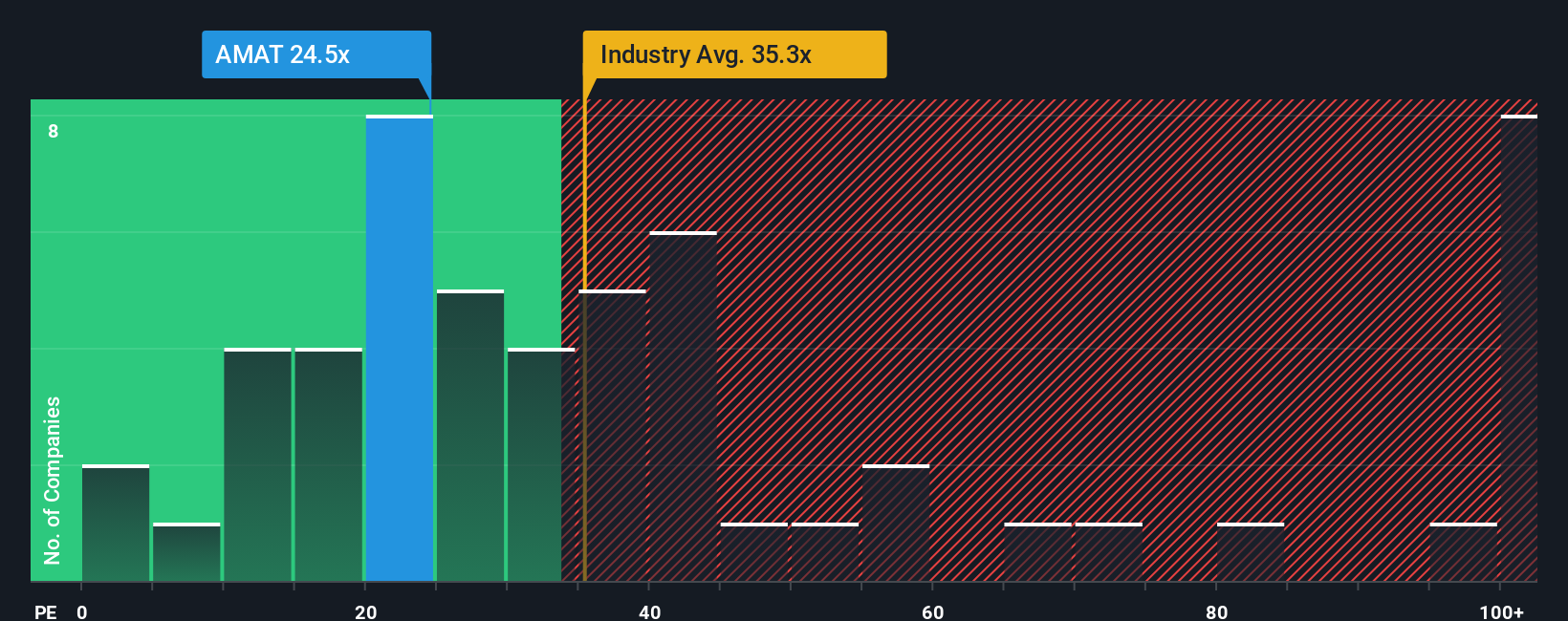

Looking at valuation through the lens of the price-to-earnings ratio puts Applied Materials in a favorable light. Its ratio of 25.5x sits well below the US semiconductor industry average of 33.7x, the peer average of 36.1x, and even below the fair ratio estimate of 33.1x. Does this suggest the market is underestimating future potential, or could a rerating be around the corner?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Applied Materials Narrative

If you see things differently or want to shape your own perspective, take a moment to dive into the data and assemble your unique view. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Applied Materials.

Looking for More Smart Investment Moves?

Serious about outpacing the market? Don’t let today’s winners distract you from tomorrow’s potential. Expand your outlook and seize these targeted opportunities before the crowd does:

- Spot the next wave of medical innovation and get ahead of the curve with these 30 healthcare AI stocks which is shaping healthcare breakthroughs powered by artificial intelligence.

- Boost your income and stability as you browse these 17 dividend stocks with yields > 3% featuring companies delivering yields above 3% for reliable returns.

- Ride unique growth themes in the frontier of technology by checking out these 26 quantum computing stocks with companies pushing boundaries in quantum computing and next-level performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMAT

Applied Materials

Engages in the provision of manufacturing equipment, services, and software to the semiconductor, display, and related industries.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives