- United States

- /

- Semiconductors

- /

- NasdaqGS:ALGM

Allegro MicroSystems (ALGM): Exploring Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

Allegro MicroSystems (ALGM) shares have drawn attention as investors look at a sharp drop over the past month. The semiconductor company’s performance, set against a challenging market backdrop, is prompting questions about how shares are currently valued.

See our latest analysis for Allegro MicroSystems.

This month’s slide adds to what’s already been a turbulent ride for Allegro MicroSystems. While the company is only up 1.75% on a share price basis year-to-date, its total shareholder return over the past year is a robust 19.1%. This illustrates just how much reinvested dividends can boost overall gains even as the market recalibrates its view on growth and risk. In the short term, momentum looks to be cooling, but the longer track record hints at potential for a rebound if sentiment shifts again.

If you’re curious what else is catching investor attention beyond the latest chip cycle swings, now’s a great moment to broaden your view and explore fast growing stocks with high insider ownership

With shares falling far below analyst price targets, strong underlying growth, and recent volatility, the key question emerges: is Allegro MicroSystems trading at a discount, or has the market already factored in future prospects?

Most Popular Narrative: 39.8% Undervalued

Allegro MicroSystems' current share price of $23.21 sits well below the most widely followed narrative fair value estimate of $38.58, creating buzz about a significant valuation gap. This disparity highlights the bold expectations built into future earnings and revenue growth forecasts.

Allegro is positioned to benefit from the growing electrification of vehicles and increased adoption of ADAS features. This is evidenced by strong sequential and year-over-year growth in e-Mobility sales, sizable design wins with global and Chinese OEMs, and ongoing innovation in current sensors and gate drivers. All of these factors support sustained revenue and earnings growth over the long term.

What if one key assumption flips everything? This narrative leans on projections that break industry averages, with profits, sales, and ambitious margin targets all pushing the envelope. Are these numbers realistic, or is something else driving such a strong valuation call? Find out which forecasts set this story apart.

Result: Fair Value of $38.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a downturn in automotive demand or intensifying competition in China could quickly undermine these optimistic growth projections.

Find out about the key risks to this Allegro MicroSystems narrative.

Another View: Looking at Price-to-Sales

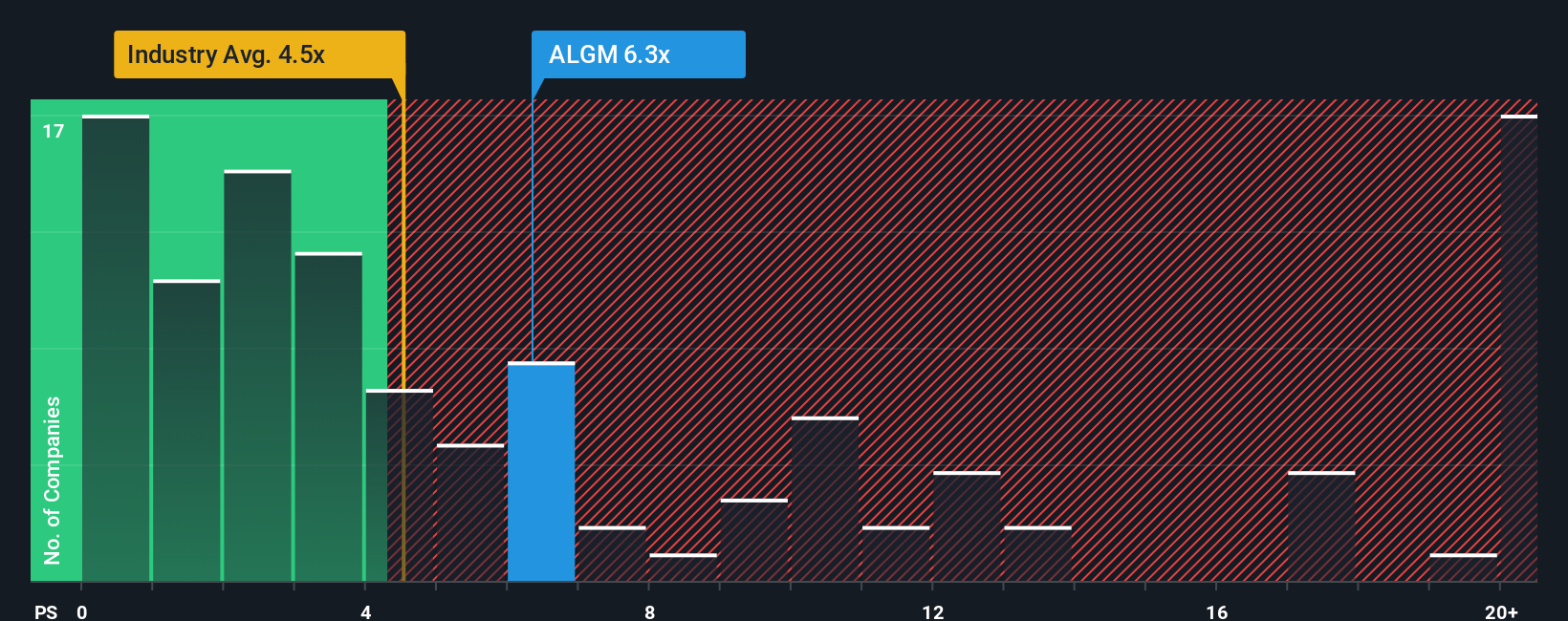

Yet, if we step back and use a price-to-sales approach, Allegro MicroSystems trades at 5.4 times sales, which is higher than both the US Semiconductor industry average of 4.7x and its peer average of 6.7x. The fair ratio stands at 5x, suggesting some valuation risk if the market adjusts. Will the current premium hold up if growth slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Allegro MicroSystems Narrative

If you're looking to dig deeper or want to craft your own insights, you can explore the data and build a story from scratch in just a few minutes, plus Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Allegro MicroSystems.

Looking for More Investment Ideas?

Don’t limit your strategy to just one stock. Open the door to new possibilities and smart opportunities using these powerful tools from Simply Wall Street:

- Grow your portfolio’s passive income with higher yields when you check out these 18 dividend stocks with yields > 3%, offering attractive returns above 3%.

- Capitalize on healthcare’s AI revolution by targeting these 31 healthcare AI stocks, where medical innovation meets artificial intelligence for transformative growth potential.

- Catch under-the-radar value by acting early on these 3575 penny stocks with strong financials, showing strong balance sheets and real financial substance before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALGM

Allegro MicroSystems

Designs, develops, manufactures, and markets sensor integrated circuits (ICs) and application-specific power ICs for motion control and energy-efficient systems.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Micron Technology will experience a robust 16.5% revenue growth

Amazon will rebound as AI investments start paying off by late 2026

Inside Harvey Norman: Asset-Heavy Retail in an Online World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion