- United States

- /

- Semiconductors

- /

- NasdaqGS:ALGM

Allegro MicroSystems (ALGM): Evaluating Valuation Opportunities After Recent Share Price Volatility

Reviewed by Simply Wall St

Allegro MicroSystems (ALGM) shares have seen some movement over the past week, and investors are taking a closer look at its latest financials and overall growth story for clues on future direction.

See our latest analysis for Allegro MicroSystems.

After climbing sharply year-to-date, Allegro MicroSystems has hit a stretch of volatility. Last week’s 6.8% decline follows a run-up of 18.3% in the share price since January. Even so, long-term investors have seen a solid total shareholder return of 29.3% over the past year, indicating underlying optimism for the business despite recent price swings.

If you’re keen to spot other momentum shifts in the market, it might be the perfect moment to discover See the full list for free.

Yet with shares still trading around 43% below the average analyst price target, investors are left to consider if Allegro MicroSystems remains a bargain or if strong growth expectations are already reflected in today’s price.

Most Popular Narrative: 26.6% Undervalued

With Allegro MicroSystems closing at $26.98 and the narrative fair value set at $36.75, the most followed analysis suggests there is notable upside potential from current levels. The driving force behind this view centers on robust operational catalysts and the promise of sustained top- and bottom-line improvement.

“Ongoing investments and recent improvements in proprietary manufacturing and test yield (notably in TMR sensor ICs) are translating to cost reductions and enhanced gross margins. This trend is expected to continue as product differentiation and scale improve, positively impacting net margins.”

Curious which bold financial leap underpins this high fair value? One powerful assumption could flip the entire earnings trajectory, pushing profits into a league normally reserved for elite semiconductor players. Ready to discover the pivotal driver behind the optimism? Dive into the full narrative to see exactly what’s fueling these bullish expectations.

Result: Fair Value of $36.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition in China and Allegro’s heavy reliance on automotive demand could limit revenue growth and challenge the company’s bullish outlook.

Find out about the key risks to this Allegro MicroSystems narrative.

Another View: What Does the Market Multiple Say?

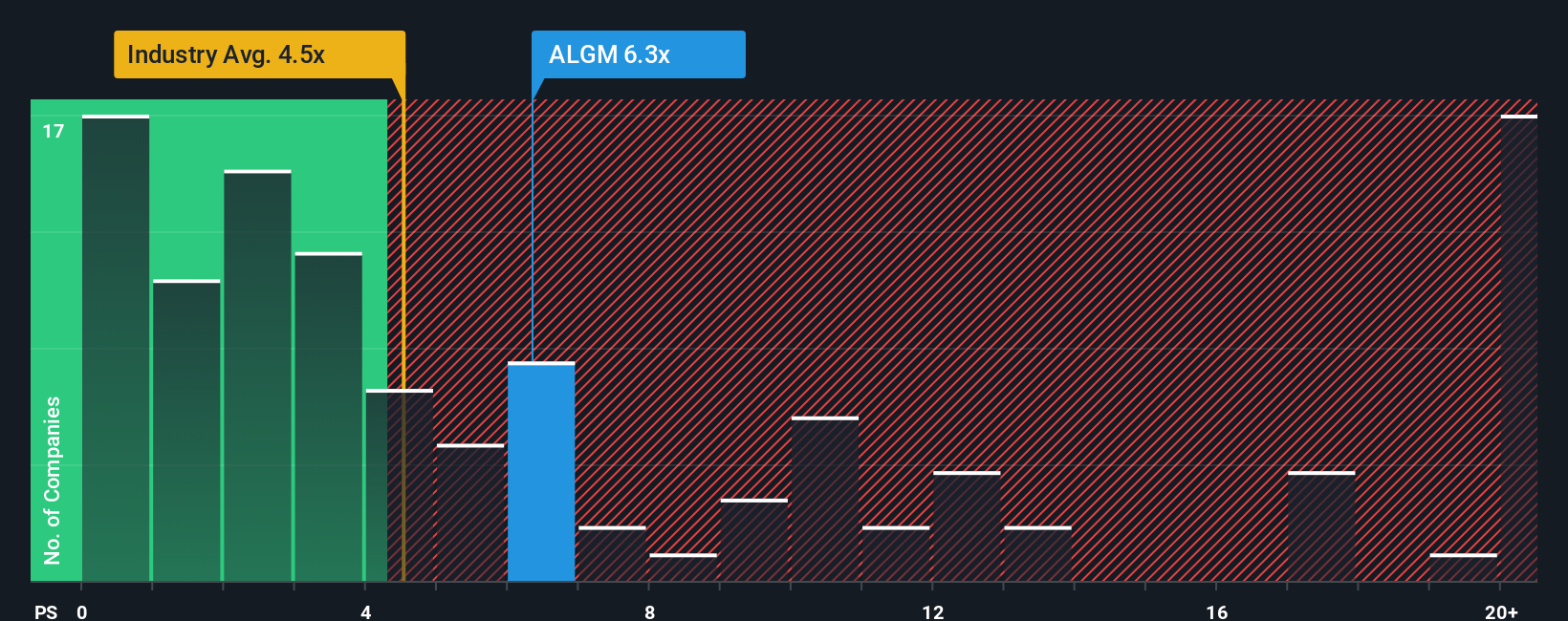

While narrative-based fair value points to strong upside, the market’s favorite valuation ratio, the price-to-sales, tells a more cautious story. Allegro trades at 6.3x sales, well above the industry average of 4.5x and even its own fair ratio of 5.1x. This premium suggests investor optimism, but also increases valuation risk if growth does not keep pace. Could the market be ahead of itself, or is this a sign of future outperformance?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Allegro MicroSystems Narrative

Prefer charting your own path or bringing a fresh perspective to Allegro's story? Crafting your personal narrative takes less than three minutes, so why not give it a try and Do it your way

A great starting point for your Allegro MicroSystems research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Opportunities?

Great investors look beyond the obvious. Seize your chance to spot emerging trends, hidden value, and bold innovations you might otherwise miss out on.

- Uncover potential high-yield surprises when you check out these 16 dividend stocks with yields > 3% offering steady returns and resilience in changing markets.

- Tap into the future of medical technology and innovation by exploring these 32 healthcare AI stocks reshaping how healthcare is delivered and experienced.

- Ride the momentum behind the AI revolution by zeroing in on these 25 AI penny stocks that are influencing everything from automation to smarter investing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALGM

Allegro MicroSystems

Designs, develops, manufactures, and markets sensor integrated circuits (ICs) and application-specific power ICs for motion control and energy-efficient systems.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Micron Technology will experience a robust 16.5% revenue growth

Amazon will rebound as AI investments start paying off by late 2026

Inside Harvey Norman: Asset-Heavy Retail in an Online World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion