- United States

- /

- Semiconductors

- /

- NasdaqGS:ALGM

Allegro MicroSystems (ALGM): 16.4% Annual Revenue Growth Reinforces Bullish Narratives Despite Ongoing Losses

Reviewed by Simply Wall St

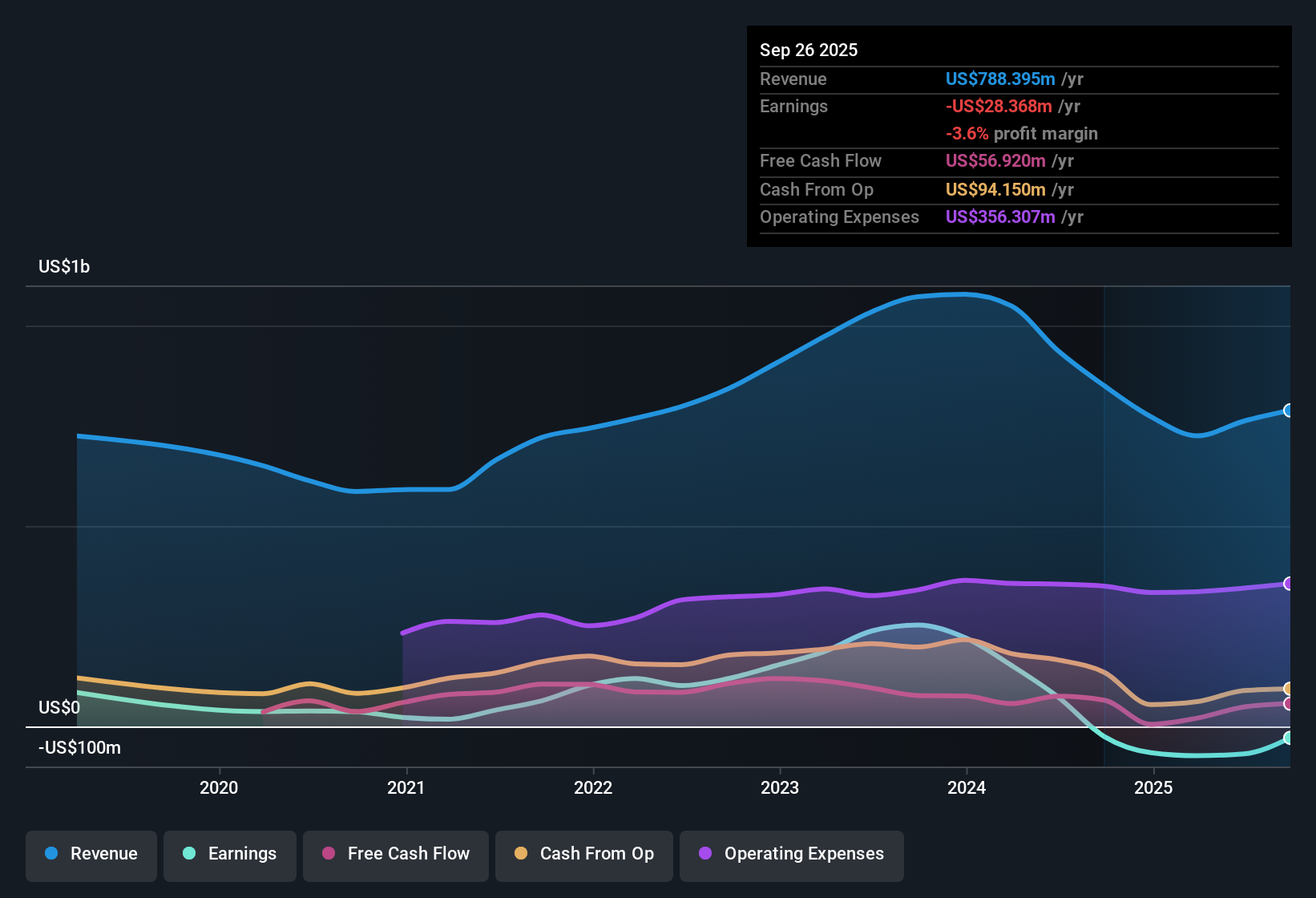

Allegro MicroSystems (ALGM) is forecasting revenue growth of 16.43% per year, significantly outpacing the US market’s projected 10.3% annual growth. While this robust growth outlook is a bright spot, investors should note that the company remains unprofitable and losses have increased at a 9.2% annual rate over the past five years, with net profit margin still in the red. The numbers point to strong top-line momentum but persistent bottom-line challenges for shareholders.

See our full analysis for Allegro MicroSystems.The real test is how these latest numbers compare with the prevailing market narratives. Some views will be reinforced while others could be up for debate in the next section.

See what the community is saying about Allegro MicroSystems

Gross Margin Trajectory: Industry Pressure vs. Upside Potential

- Despite strong sales growth, Allegro’s net profit margin remains negative, and there is no improvement in profitability signaled by recent filings. Consensus narrative notes that manufacturing improvements and robust demand are driving gross margin gains in an effort to support future net margin expansion, but the company is not yet breaking into the black.

- Analysts' consensus view anticipates sustained gross margin improvement, citing proprietary manufacturing investments and a rebound in the data center and automation markets.

- One key tension is that recurring yearly price declines and heavy R&D outlays could erode these margin gains if Allegro fails to outpace ongoing cost pressures.

- Secular demand trends, especially in automotive and e-Mobility, are expected to support long-term margin strengthening, but recent figures show that gains remain unproven at the bottom line.

- A mix of top-line growth and persistent bottom-line challenges puts Allegro's margin outlook under the microscope. See how analysts balance the risk and reward in the full consensus narrative. 📊 Read the full Allegro MicroSystems Consensus Narrative.

Automotive Dependency and China Competition Risks

- Allegro’s business remains highly reliant on the automotive sector, including e-Mobility and ADAS features, exposing it to customer concentration risks and competitive headwinds from China.

- Bears argue that Allegro’s growth could stall if price competition in China and flat global auto production pressure both sales and profitability.

- Ongoing price pressure from local Chinese players and auto OEMs may limit revenue growth and compress gross margins, challenging the optimism around Allegro’s strong design wins and expanding global customer base.

- Persistent heavy R&D and CapEx spending necessary to maintain technology leadership in the automotive segment could weigh on net margins if incremental sales from new products do not keep pace.

Valuation Premium Over Peers and DCF Fair Value

- Allegro’s Price-To-Sales Ratio stands at 7.4x, which is higher than the US semiconductor industry average of 5.3x, but notably lower than the peer group’s 10x multiple. The current share price of $30.37 sits above the DCF fair value of $28.74, but remains roughly 19% below the analyst consensus price target of $37.17.

- Analysts' consensus view frames this valuation as a balance of strong long-term growth potential against ongoing unprofitability and sector risks.

- Bulls highlight the company’s robust revenue forecast and deepening relationships in high-growth markets as justification for a higher multiple, despite the premium to industry average.

- Critics note that surpassing both the industry average multiple and DCF fair value may only be justified if forecast earnings gains and margin expansion actually materialize in future periods.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Allegro MicroSystems on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you spot something the data doesn't show? Take a few minutes to put your spin on the story and shape your unique perspective. Do it your way.

A great starting point for your Allegro MicroSystems research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

While Allegro’s revenue growth is impressive, ongoing losses and lack of bottom-line improvement signal that steady, reliable earnings remain elusive for investors.

If dependable performance matters, use stable growth stocks screener (2113 results) to target companies that consistently expand both sales and profits through all business cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALGM

Allegro MicroSystems

Designs, develops, manufactures, and markets sensor integrated circuits (ICs) and application-specific power ICs for motion control and energy-efficient systems.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives