- United States

- /

- Semiconductors

- /

- NasdaqGS:ALAB

Astera Labs, Inc.'s (NASDAQ:ALAB) Stock Retreats 27% But Revenues Haven't Escaped The Attention Of Investors

Astera Labs, Inc. (NASDAQ:ALAB) shares have had a horrible month, losing 27% after a relatively good period beforehand. Still, a bad month hasn't completely ruined the past year with the stock gaining 67%, which is great even in a bull market.

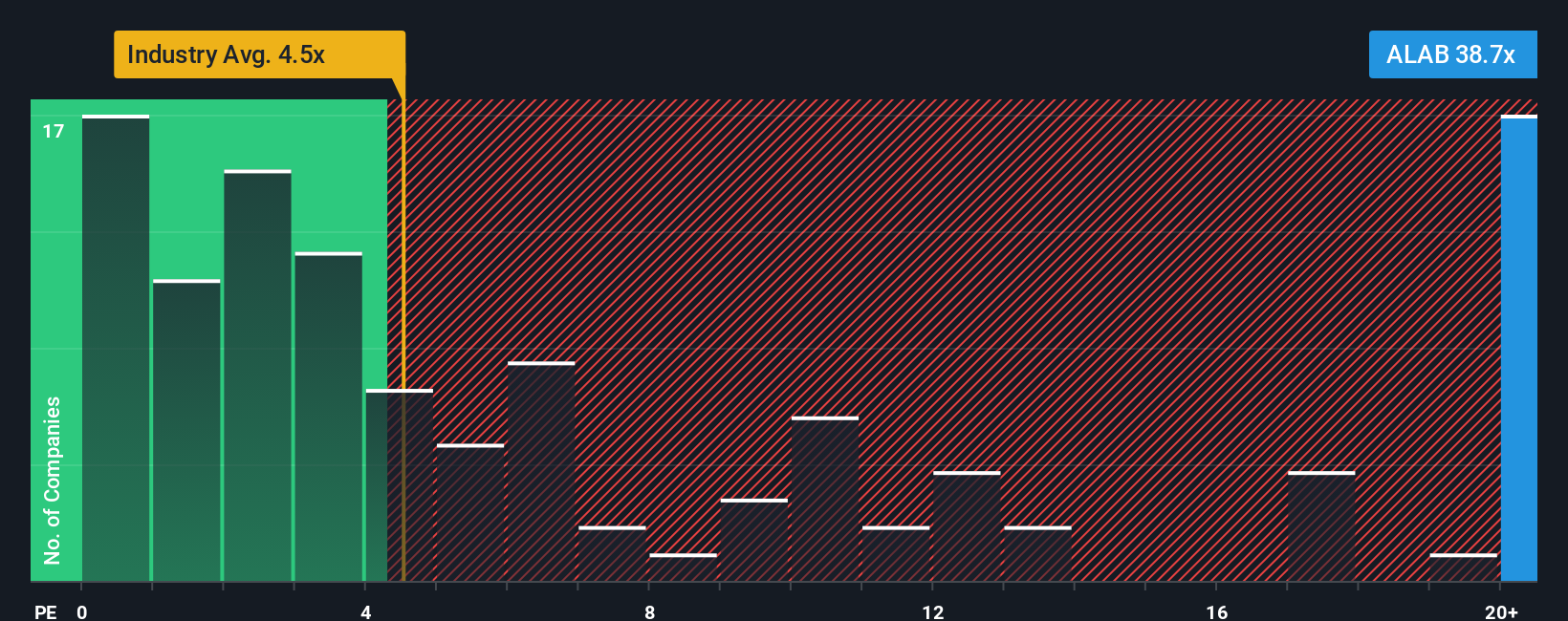

Even after such a large drop in price, Astera Labs may still be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 38.7x, when you consider almost half of the companies in the Semiconductor industry in the United States have P/S ratios under 4.5x and even P/S lower than 2x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Astera Labs

What Does Astera Labs' P/S Mean For Shareholders?

Astera Labs certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Astera Labs' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Astera Labs?

Astera Labs' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 137%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 37% per year during the coming three years according to the analysts following the company. That's shaping up to be materially higher than the 26% per year growth forecast for the broader industry.

In light of this, it's understandable that Astera Labs' P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Astera Labs' shares may have suffered, but its P/S remains high. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Astera Labs maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Semiconductor industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Astera Labs you should know about.

If you're unsure about the strength of Astera Labs' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ALAB

Astera Labs

Designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives