- United States

- /

- Semiconductors

- /

- NasdaqGS:ALAB

Astera Labs (ALAB): Assessing Valuation After Strong Q3 Earnings and Upbeat AI Outlook

Reviewed by Simply Wall St

Astera Labs reported third quarter earnings that caught the eye of many investors, as the company moved from a net loss last year to a strong net income and delivered a jump in revenue. The upbeat guidance for the next quarter suggests Astera Labs is maintaining momentum, supported by solid demand and optimism around its positioning in AI infrastructure.

See our latest analysis for Astera Labs.

It’s been a lively year for Astera Labs, with investors encouraged by the company’s rapid transition to profitability and ambitious AI infrastructure goals. Even after a recent pullback that saw the 30-day share price return land at -15.75%, the stock is still up 29.05% year-to-date and has delivered an impressive 88.34% total shareholder return over the past year. This suggests building momentum despite some short-term volatility.

If Astera Labs' breakout caught your attention, it's worth seeing what else is happening across high-growth tech and AI. Check out See the full list for free..

But with shares still trading well above last year’s levels and expectations for future growth running high, the question now is whether Astera Labs offers a genuine value opportunity or if markets have already priced in its AI-powered trajectory.

Most Popular Narrative: 8.1% Undervalued

With Astera Labs' fair value estimate of $189.11 sitting above the last close of $173.74, the market appears slightly behind the narrative's bullish stance. This context helps frame what analysts are watching as key catalysts for the next stage of growth.

Rapid ramp-up and continued customer diversification of the Scorpio P-Series and soon-to-launch Scorpio X-Series switches are driving increased dollar content per AI accelerator. This is establishing a higher baseline for revenues as Astera Labs moves from early product adoption to large-scale rack-level AI infrastructure deployments, which will materially impact top-line growth and revenue stability.

Want to know why analysts are projecting future profits and margins that tech titans would envy? Their fair value hinges on aggressive revenue expansion and a profitability leap that could rewrite industry benchmarks. Discover what financial assumptions are fueling this bold price target forecast.

Result: Fair Value of $189.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing competitive threats and the risk of slowing AI infrastructure spending could quickly challenge today’s upbeat scenario for Astera Labs.

Find out about the key risks to this Astera Labs narrative.

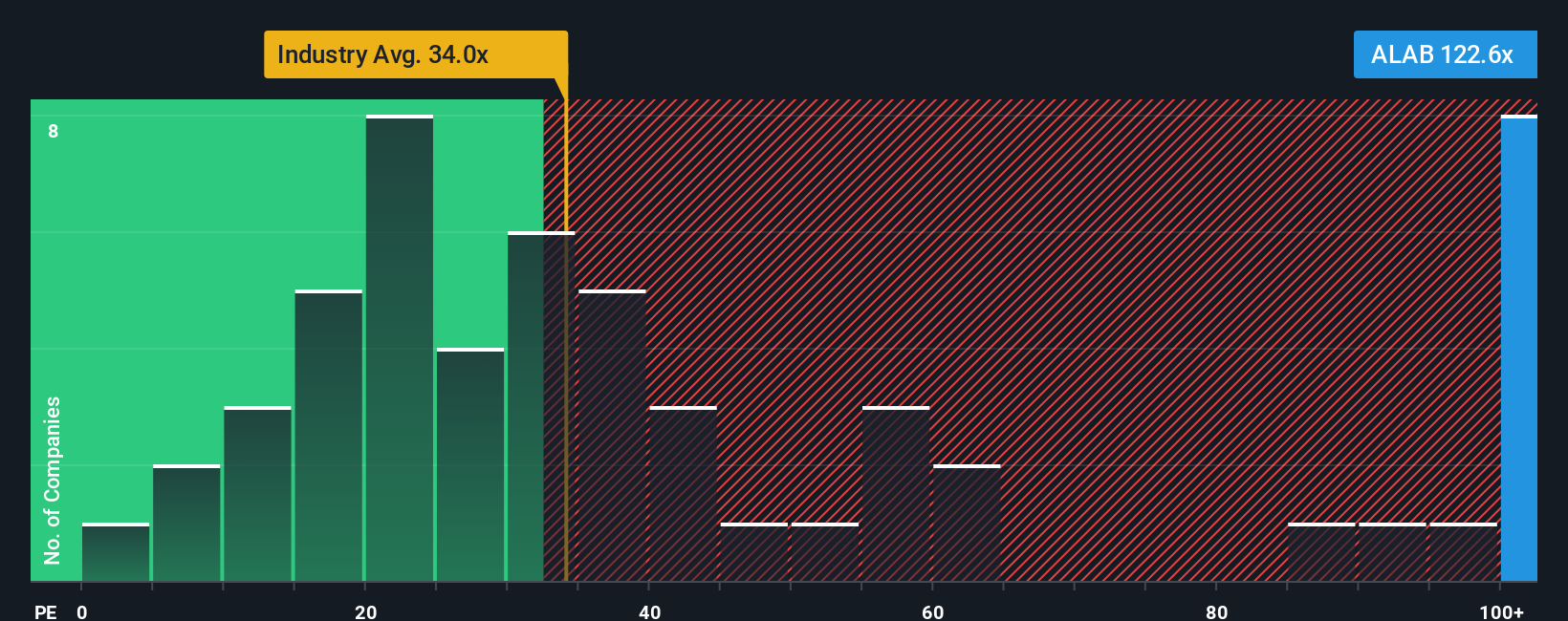

Another View: High Earnings Multiple Raises Questions

Looking at Astera Labs through the lens of earnings multiples paints a more cautious picture. Shares trade at a hefty 147.6 times earnings, which is much higher than the semiconductor industry average of 36.4 and the peer average of 39.7. Even the fair ratio, the level the market could move toward, is just 43.9. This makes the current valuation look stretched by any classic comparison. Does this rich multiple signal belief in extraordinary growth, or bring heightened risk if expectations falter?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Astera Labs Narrative

If you think there’s another angle to the Astera Labs story or want to crunch the numbers firsthand, you can easily shape your own view in just a few minutes. Do it your way

A great starting point for your Astera Labs research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Smart investors seize new opportunities before the crowd. Don’t let tomorrow’s best performers pass you by. Use these powerful tools to uncover your next potential winner today.

- Spot real value by targeting companies that markets have yet to fully appreciate with these 871 undervalued stocks based on cash flows.

- Tap into the next wave of healthcare breakthroughs and innovation by using these 32 healthcare AI stocks for cutting-edge stocks in this booming sector.

- Capture potential upside with these 82 cryptocurrency and blockchain stocks, where smart capital is tracking businesses harnessing blockchain and digital currency trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALAB

Astera Labs

Designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives