- United States

- /

- Semiconductors

- /

- NasdaqCM:AEHR

Aehr Test Systems, Inc. (NASDAQ:AEHR) Shares May Have Slumped 31% But Getting In Cheap Is Still Unlikely

Aehr Test Systems, Inc. (NASDAQ:AEHR) shares have retraced a considerable 31% in the last month, reversing a fair amount of their solid recent performance. Looking at the bigger picture, even after this poor month the stock is up 76% in the last year.

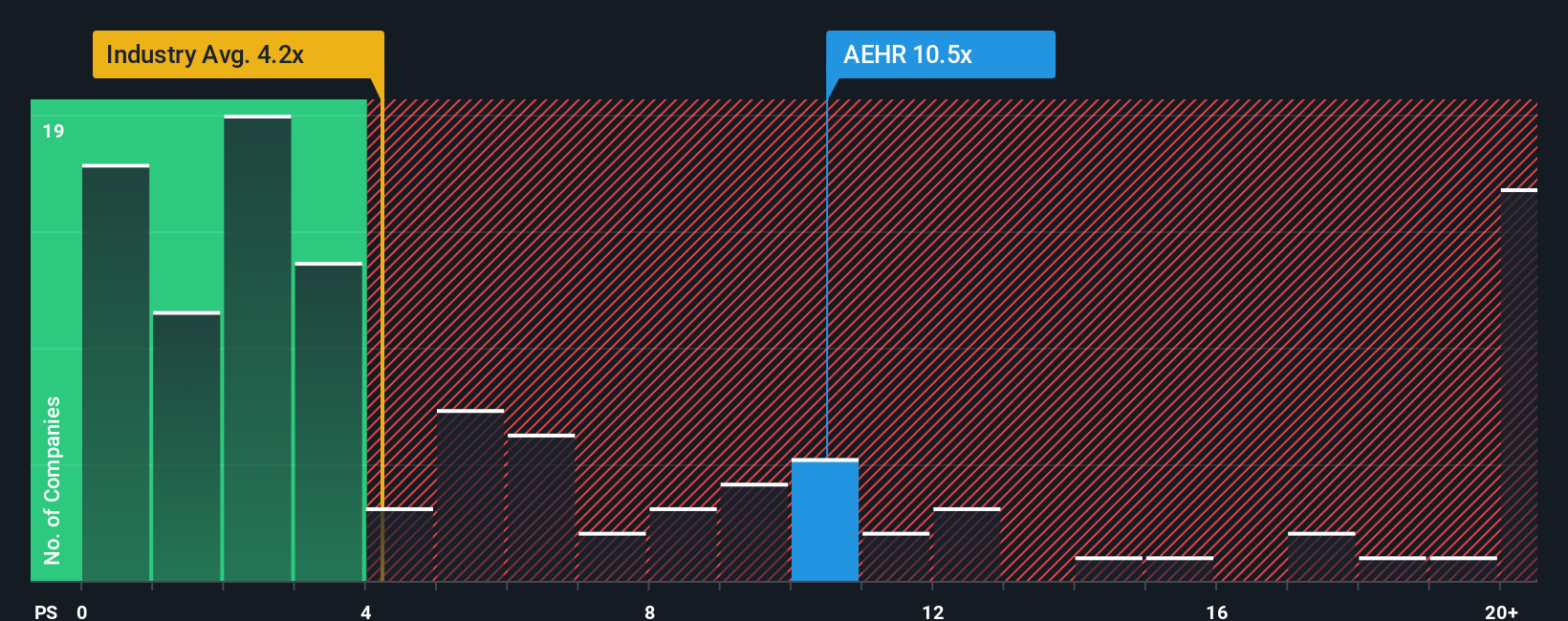

In spite of the heavy fall in price, Aehr Test Systems' price-to-sales (or "P/S") ratio of 10.5x might still make it look like a strong sell right now compared to other companies in the Semiconductor industry in the United States, where around half of the companies have P/S ratios below 4.2x and even P/S below 2x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Aehr Test Systems

How Aehr Test Systems Has Been Performing

While the industry has experienced revenue growth lately, Aehr Test Systems' revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Aehr Test Systems' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Aehr Test Systems' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 3.4% decrease to the company's top line. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 13% over the next year. That's shaping up to be materially lower than the 38% growth forecast for the broader industry.

In light of this, it's alarming that Aehr Test Systems' P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Aehr Test Systems' P/S Mean For Investors?

A significant share price dive has done very little to deflate Aehr Test Systems' very lofty P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It comes as a surprise to see Aehr Test Systems trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you take the next step, you should know about the 2 warning signs for Aehr Test Systems that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:AEHR

Aehr Test Systems

Provides test solutions for testing, burning-in, and semiconductor devices in wafer level, singulated die, package part form, and installed systems in the United States, Asia, and Europe.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives