- United States

- /

- Semiconductors

- /

- NasdaqGS:ADI

How CodeFusion Studio 2.0’s AI Upgrades at Analog Devices (ADI) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Analog Devices, Inc. recently launched CodeFusion Studio 2.0, a major upgrade to its open source embedded development platform, now featuring end-to-end AI workflow support and advanced multi-core debugging tools across its processor range.

- This release introduces a unified environment that enables developers to deploy and profile AI models seamlessly on ADI’s hardware, simplifying embedded system complexity and broadening the accessibility of edge AI integration.

- We'll examine how the integration of AI workflows and streamlined deployment in CodeFusion Studio 2.0 may shift Analog Devices' investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Analog Devices Investment Narrative Recap

To be a shareholder in Analog Devices, you need to believe in the company’s ability to capitalize on the rapid adoption of AI and automation across its end markets, transforming deep product innovation into long-term growth despite cyclical volatility. While the launch of CodeFusion Studio 2.0 boosts ADI’s AI integration potential, it is not likely to materially change the most important catalyst in the near term: accelerating demand for advanced robotics solutions. However, competitive price pressures from lower-cost analog players, especially in global markets, remain a key risk to watch.

Among recent announcements, the October debut of ADI Power Studio stands out alongside CodeFusion Studio 2.0. By addressing efficient system-level power management, this new platform complements the trend driving ADI’s potential, higher content per device as AI and automation adoption accelerates across industries.

By contrast, investors should not overlook the risks that come with rising fixed costs if market demand softens, as ...

Read the full narrative on Analog Devices (it's free!)

Analog Devices' narrative projects $14.3 billion revenue and $4.9 billion earnings by 2028. This requires 11.3% yearly revenue growth and a $2.9 billion increase in earnings from $2.0 billion today.

Uncover how Analog Devices' forecasts yield a $267.47 fair value, a 17% upside to its current price.

Exploring Other Perspectives

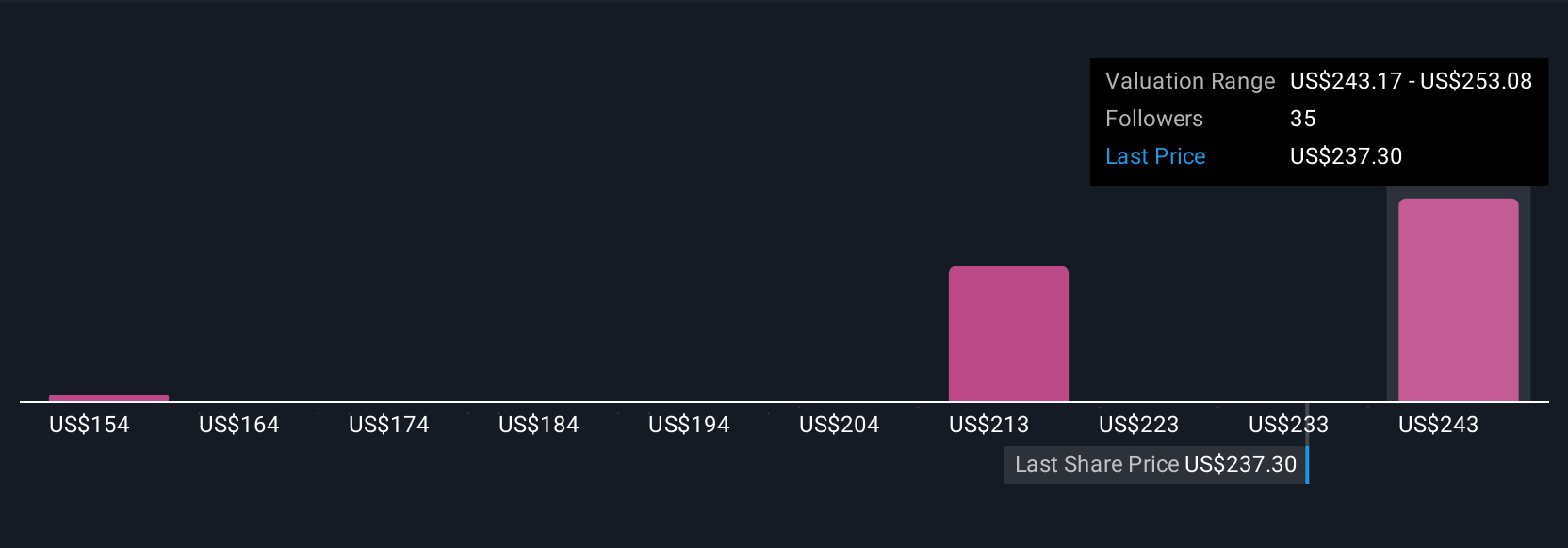

Five individual fair value estimates from the Simply Wall St Community range from US$204.69 to US$310 per share, illustrating a wide spectrum of opinions. Against this backdrop, ongoing threats from lower-cost competitors could influence ADI’s ability to sustain its innovation-led premium, making an informed review of these community perspectives essential.

Explore 5 other fair value estimates on Analog Devices - why the stock might be worth 11% less than the current price!

Build Your Own Analog Devices Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Analog Devices research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Analog Devices research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Analog Devices' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADI

Analog Devices

Engages in the design, manufacture, testing, and marketing of integrated circuits (ICs), software, and subsystems products in the United States, rest of North and South America, Europe, Japan, China, and rest of Asia.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives