- United States

- /

- Semiconductors

- /

- NasdaqGS:ADI

Did Strong Analyst Forecasts for Q4 Earnings Just Shift Analog Devices' (ADI) Investment Narrative?

Reviewed by Sasha Jovanovic

- Leading up to its upcoming earnings report on November 25, 2025, Analog Devices received analyst projections for quarterly earnings per share of $2.22 and revenue of $3.01 billion, which would mark year-over-year increases of 32.9% and 23.2%, respectively.

- The anticipated gains are largely attributed to strong expected performance in key segments like Communications and Industrial, highlighting the company’s broad-based momentum across end markets.

- With analysts forecasting double-digit revenue and earnings growth, we'll explore how these outlooks influence Analog Devices’ investment narrative and future prospects.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Analog Devices Investment Narrative Recap

To be a shareholder in Analog Devices, you need conviction in the company’s ability to translate secular growth drivers, like automation and high-margin analog solutions, into sustained earnings and revenue expansion. While analysts anticipate strong results next week, catalysts such as robust communications and industrial growth remain the biggest short-term drivers; however, the persistent risk from global competitive pressures hasn’t been meaningfully reduced by the latest projections or news.

Among recent company updates, the launch of CodeFusion Studio™ 2.0 stands out, aligning with expectations for segment growth that leans heavily on advanced workflow tools and embedded AI. This product upgrade supports the narrative that continued investment in proprietary development solutions underpins near-term catalysts, aiming to reinforce Analog Devices’ innovation edge in high-value segments.

Yet, in contrast, investors should also be mindful of emerging threats in international markets that could...

Read the full narrative on Analog Devices (it's free!)

Analog Devices' outlook projects $14.3 billion in revenue and $4.9 billion in earnings by 2028. This requires an 11.3% annual revenue growth rate and a $2.9 billion increase in earnings from the current $2.0 billion.

Uncover how Analog Devices' forecasts yield a $267.47 fair value, a 15% upside to its current price.

Exploring Other Perspectives

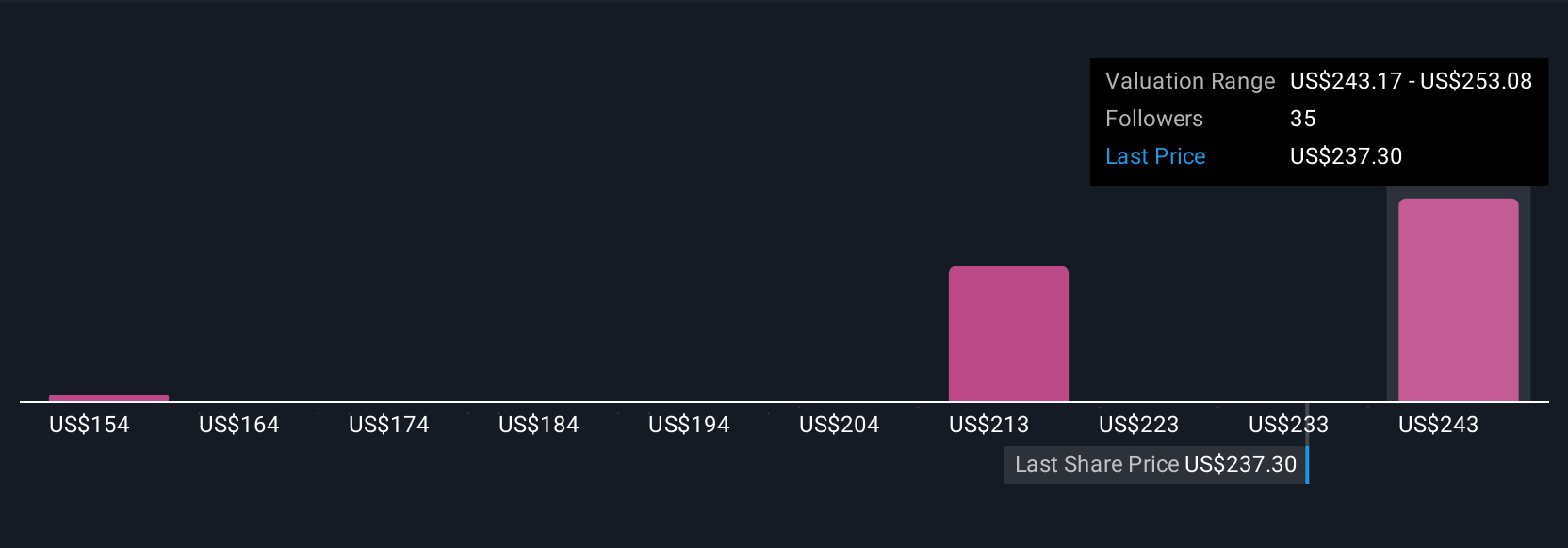

Seven private investors from the Simply Wall St Community have modeled fair value for Analog Devices between US$145.90 and US$310, reflecting a wide dispersion in expectations. Against this backdrop, ongoing competition from lower-cost global players may play a significant role in shaping future growth and margins, making these alternative viewpoints even more relevant for your research.

Explore 7 other fair value estimates on Analog Devices - why the stock might be worth as much as 33% more than the current price!

Build Your Own Analog Devices Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Analog Devices research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Analog Devices research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Analog Devices' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADI

Analog Devices

Engages in the design, manufacture, testing, and marketing of integrated circuits (ICs), software, and subsystems products in the United States, rest of North and South America, Europe, Japan, China, and rest of Asia.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives