- United States

- /

- Semiconductors

- /

- NasdaqGS:ADI

Analog Devices (ADI): A Fresh Look at Valuation After CodeFusion Studio 2.0 Release

Reviewed by Simply Wall St

Analog Devices (ADI) just announced the launch of CodeFusion Studio 2.0, an updated open source platform designed to make AI and machine learning development smoother for engineers working across its chips and processors. This upgrade features expanded model compatibility and deeper hardware integration, which has sparked a fresh look at the stock’s appeal for tech-focused investors.

See our latest analysis for Analog Devices.

Following the CodeFusion Studio 2.0 announcement, Analog Devices has seen its momentum shift. Although the share price dipped 3.87% over the last week, it is still up 10.53% year-to-date and boasts an impressive 65% total shareholder return over three years, suggesting optimism about its longer-term prospects.

If this fresh push in digital innovation grabbed your attention, consider exploring more tech and AI leaders set for high growth. See the full list here: See the full list for free.

With shares recently retreating but still outperforming over the longer term, the key question is whether Analog Devices is undervalued by the market or if all this digital progress is already reflected in the price. Could this be a buying opportunity, or is future growth already baked in?

Most Popular Narrative: 12.7% Undervalued

Analog Devices' widely followed fair value estimate stands noticeably above the last close, suggesting the consensus narrative sees upside ahead. This premium hints at confidence around future growth and profitability, especially as industrial and AI-related tailwinds gather momentum.

Disciplined capital allocation, with a focus on R&D, strategic partnerships (such as with NVIDIA and Teradyne), and shareholder returns, positions ADI to drive sustainable EPS growth and further enhance financial resilience as secular growth drivers unfold across its diversified end-markets.

Curious what bold bets and game-changing growth assumptions are fueling that eye-popping fair value? There is a high-octane earnings projection and ambitious profitability target lurking behind this narrative. Only the full story reveals the numbers that could drive the next breakout move.

Result: Fair Value of $267.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition and geopolitical tensions could disrupt Analog Devices' growth trajectory. This could potentially lead to margin pressure or revenue volatility in the coming years.

Find out about the key risks to this Analog Devices narrative.

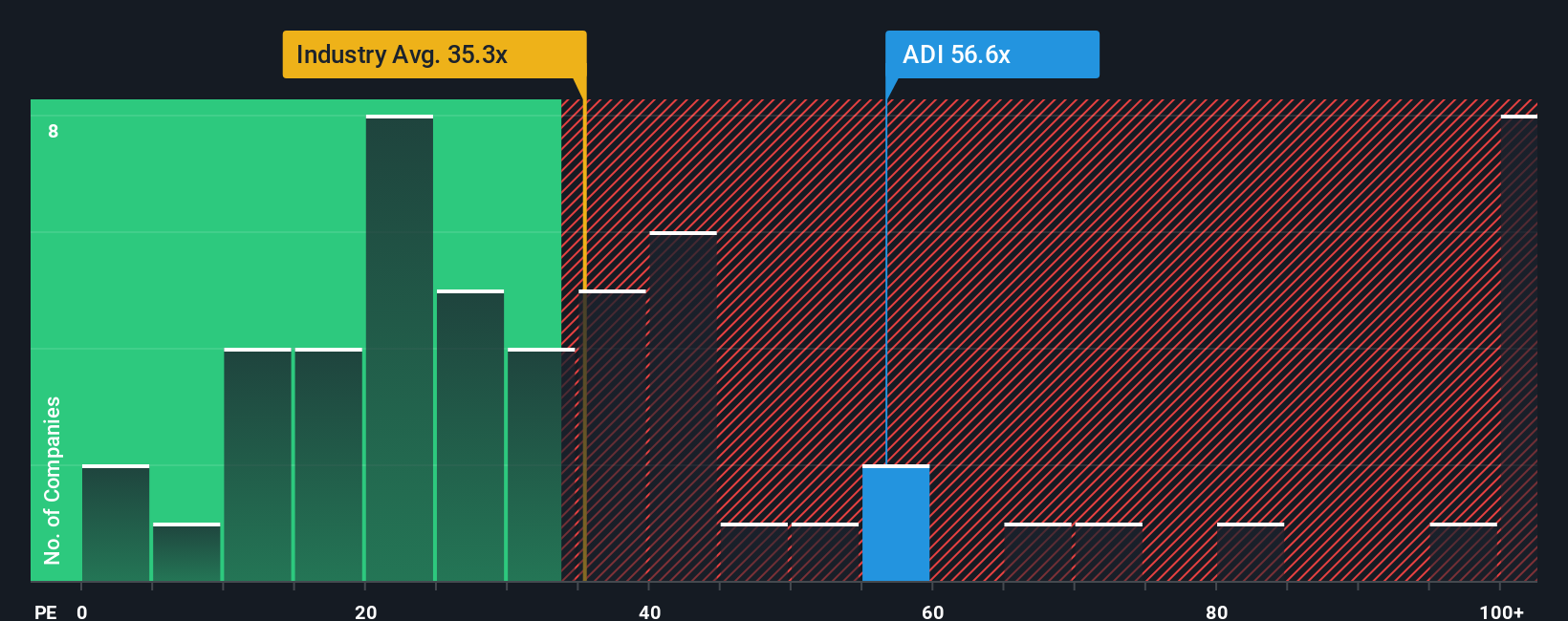

Another View: Market Multiples Raise a Flag

While fair value estimates hint at more upside for Analog Devices, the market’s current earnings multiple tells another story. With the company trading at 58.7x earnings, well above both its peer average of 25.6x and the industry’s 36.1x, investors should consider that such a high premium may leave little margin for disappointment if trends shift. Could the stock’s momentum be running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Analog Devices Narrative

If you see the story differently or prefer to dig into the numbers on your own terms, you can easily craft your unique narrative in under three minutes with Do it your way.

A great starting point for your Analog Devices research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors constantly scan the market for emerging opportunities. Don’t let yourself miss out on fresh, high-potential stocks. Set yourself up for success with these handpicked ideas:

- Fuel your portfolio with high-yield opportunities by researching these 18 dividend stocks with yields > 3% delivering reliable income and steady performance.

- Stay ahead of financial innovation by tapping into these 82 cryptocurrency and blockchain stocks as blockchain and crypto ideas continue to transform global markets.

- Spot tomorrow’s tech giants early by evaluating these 27 AI penny stocks set for rapid growth in AI-driven industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADI

Analog Devices

Engages in the design, manufacture, testing, and marketing of integrated circuits (ICs), software, and subsystems products in the United States, rest of North and South America, Europe, Japan, China, and rest of Asia.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives