Stock Analysis

- United States

- /

- Semiconductors

- /

- NasdaqGM:ACMR

ACM Research's (NASDAQ:ACMR) earnings growth rate lags the 33% CAGR delivered to shareholders

It might be of some concern to shareholders to see the ACM Research, Inc. (NASDAQ:ACMR) share price down 25% in the last month. But that doesn't undermine the fantastic longer term performance (measured over five years). To be precise, the stock price is 310% higher than it was five years ago, a wonderful performance by any measure. So we don't think the recent decline in the share price means its story is a sad one. The most important thing for savvy investors to consider is whether the underlying business can justify the share price gain. While the returns over the last 5 years have been good, we do feel sorry for those shareholders who haven't held shares that long, because the share price is down 42% in the last three years.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

See our latest analysis for ACM Research

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

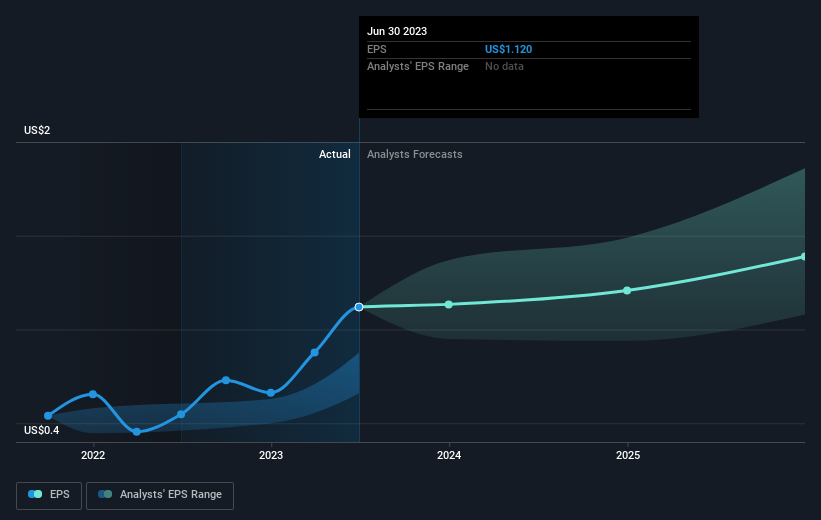

During five years of share price growth, ACM Research achieved compound earnings per share (EPS) growth of 70% per year. The EPS growth is more impressive than the yearly share price gain of 33% over the same period. Therefore, it seems the market has become relatively pessimistic about the company.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on ACM Research's earnings, revenue and cash flow.

A Different Perspective

It's good to see that ACM Research has rewarded shareholders with a total shareholder return of 101% in the last twelve months. That's better than the annualised return of 33% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for ACM Research you should be aware of, and 1 of them makes us a bit uncomfortable.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:ACMR

ACM Research

Develops, manufactures, and sells single-wafer wet cleaning equipment for enhancing the manufacturing process and yield for integrated chips worldwide.

Excellent balance sheet with proven track record.