- United States

- /

- Semiconductors

- /

- NasdaqGM:ACMR

ACM Research (ACMR): Valuation Insights Following Expansion Into Display Panel Market With Ultra Lith BK System

Reviewed by Simply Wall St

ACM Research (ACMR) just announced the delivery of its first Ultra Lith BK lithography system to a major global display panel manufacturer. This marks the company’s initial move into the display panel sector.

See our latest analysis for ACM Research.

The news of ACM Research’s expansion into display panel manufacturing comes after a string of technology milestones and industry presentations, including the delivery of its first panel electrochemical plating tool and recent conference appearances. While the share price pulled back 20.2% over the past month, momentum remains strong with a 92.9% year-to-date share price return and a three-year total shareholder return of nearly 248%. This signals positive longer-term sentiment and growth expectations in the market.

If ACM’s multi-sector momentum has you interested in other up-and-coming innovators, now is the perfect time to broaden your perspective and discover fast growing stocks with high insider ownership

With shares still well below analyst targets despite a powerful run this year, investors may wonder if ACM Research is trading at an attractive entry point or if the market is already factoring in all future growth.

Most Popular Narrative: 26.4% Undervalued

Compared to ACM Research's last close at $30.03, the most widely followed narrative places fair value much higher, with a sizable upside gap. This narrative draws on analyst projections and recent business developments to support a distinctly bullish stance.

Advanced digitalization and AI adoption are driving a surge in demand for next-generation semiconductor manufacturing. ACM's differentiated cleaning and plating solutions (such as its proprietary N2 bubbling and SPM tools) are positioned to capture increased orders as foundries invest in more complex 3D NAND, DRAM, and logic nodes, supporting long-term revenue growth.

Want to know the growth blueprint behind this high valuation? This narrative is built on bold revenue targets, future profit margins, and a fast-changing global landscape. Curious how these moving parts add up to a price target far above today’s level? Dive in and see what’s fueling the fair value calculation.

Result: Fair Value of $40.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, major risks remain, such as potential new export restrictions and ACM’s heavy reliance on China. Both factors could quickly disrupt these projections.

Find out about the key risks to this ACM Research narrative.

Another View: What Do Market Ratios Say?

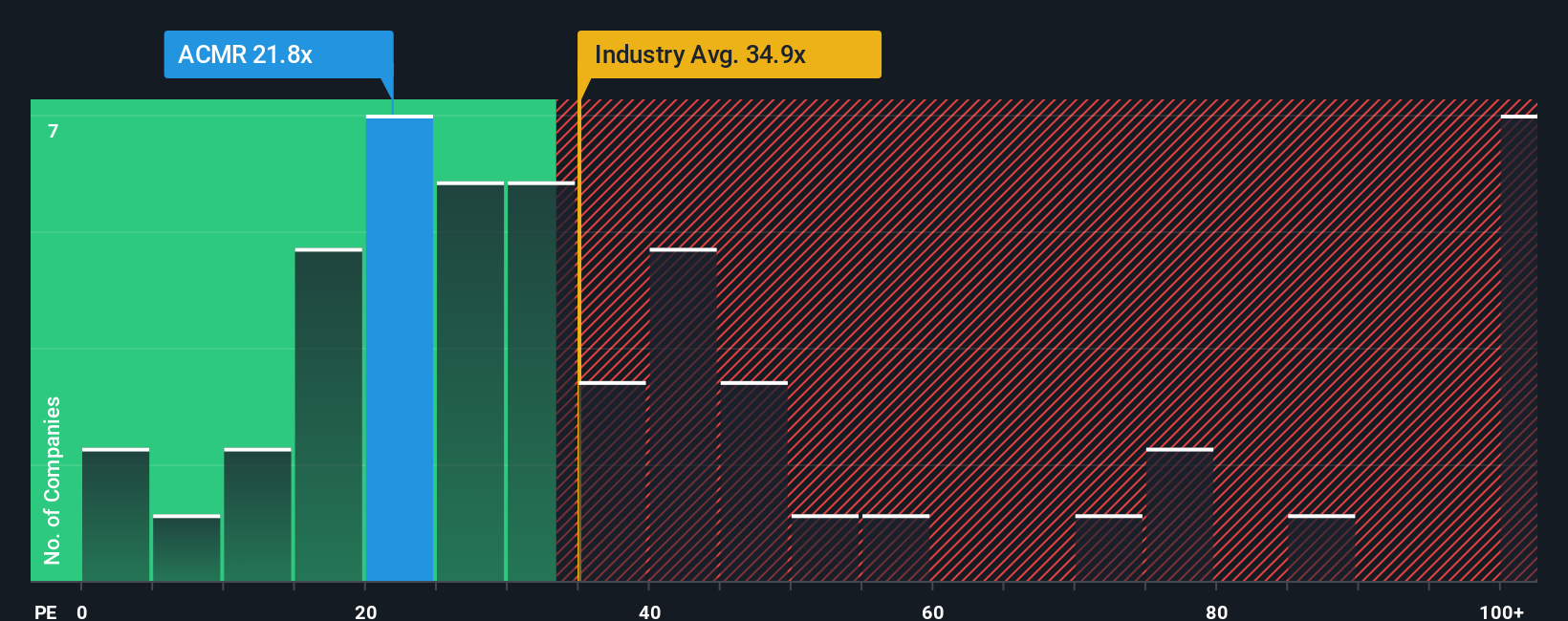

Looking at ACM Research through the lens of its price-to-earnings ratio, the company trades at 16.6x, which is far lower than both the industry average of 33.7x and its peer group at 38.2x. The fair ratio is estimated at 25.3x. This significant gap could mean untapped upside, or it could signal that the market sees risks others overlook. Is the stock truly undervalued, or are investors right to be cautious?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ACM Research for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ACM Research Narrative

If you see the numbers differently or want to dig deeper yourself, it only takes a few minutes to craft your own narrative: Do it your way

A great starting point for your ACM Research research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Sharpen your portfolio by targeting unique opportunities. Simply Wall Street’s advanced Screener puts the next wave of market winners at your fingertips. Skip the noise and see what smarter investing looks like before these trends take off.

- Lock in dependable income by targeting these 17 dividend stocks with yields > 3% with yields above 3%, providing stability and growth for your long-term plans.

- Ride the momentum of transformative tech by scanning these 25 AI penny stocks, where rapid advancements in artificial intelligence continue to reshape entire industries.

- Capture value early by seizing these 3605 penny stocks with strong financials that have resilient financials and strong upside potential before they hit Wall Street’s radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ACMR

ACM Research

Develops, manufactures, and sells capital equipment worldwide.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives