- United States

- /

- Semiconductors

- /

- NasdaqGS:ACLS

Axcelis Technologies (ACLS) Margin Miss Reinforces Concerns Over Sustained Profitability

Reviewed by Simply Wall St

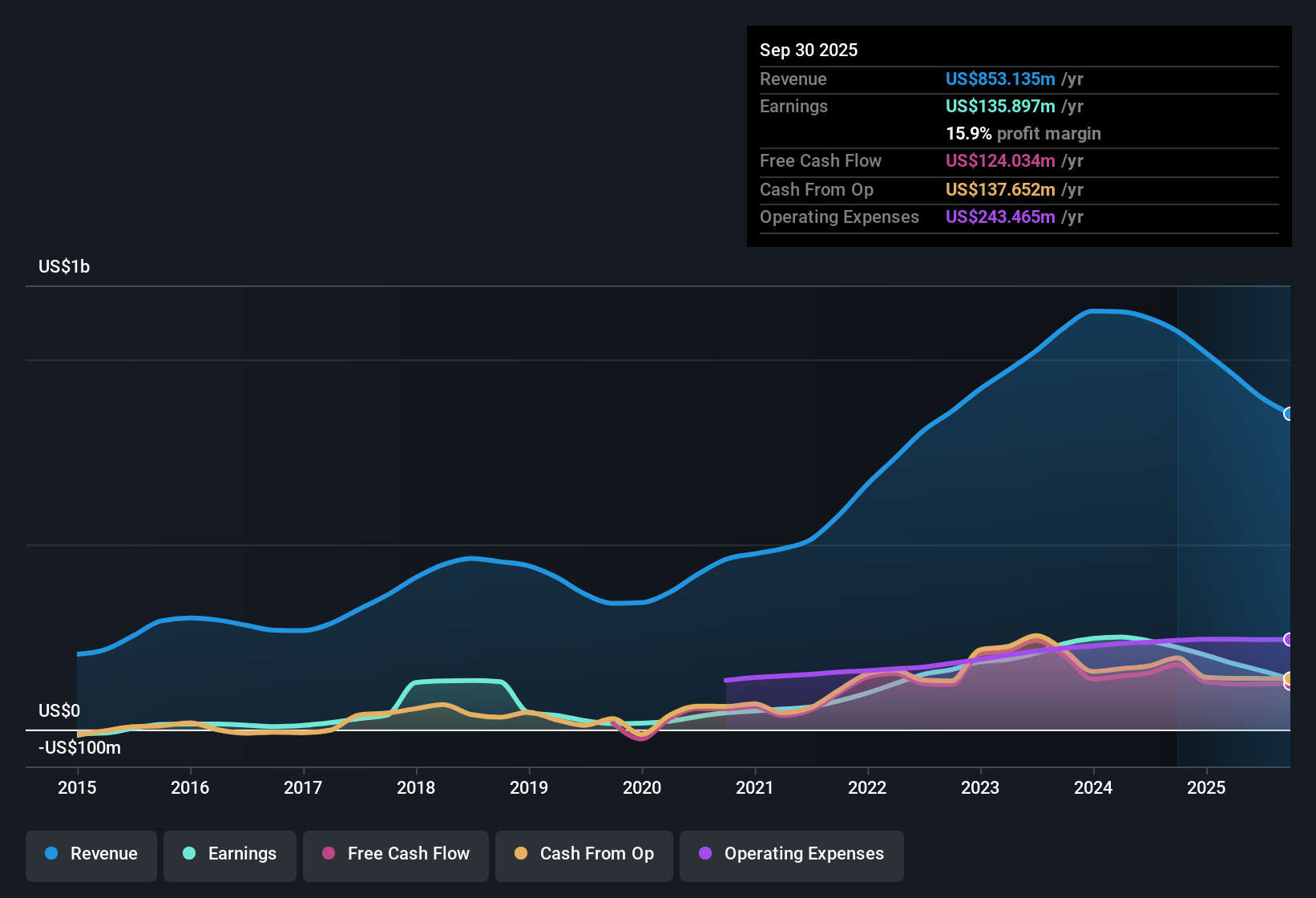

Axcelis Technologies (ACLS) posted a net profit margin of 15.9%, down from 20.6% a year ago, as recent earnings growth turned negative. Looking ahead, analysts forecast earnings to decline by 7.3% annually over the next three years, with revenue growth expected to slow to 1.1% per year compared to a much faster 10.5% rate for the broader US market. Despite slowing fundamentals, the stock trades at a favorable 18.4x price-to-earnings ratio, which is well below its semiconductor peers, and sits below analyst price targets. This suggests value-driven investors may see opportunity even as profitability trends lower.

See our full analysis for Axcelis Technologies.Next up, we’ll weigh these results against the most popular narratives from the Simply Wall St community to see which stories hold up and which ones get a reality check.

See what the community is saying about Axcelis Technologies

Margins Projected to Shrink Dramatically

- Analysts expect Axcelis's net profit margin to drop from 17.7% now to just 8.0% in three years, nearly halving the bottom line profitability over a short timeframe.

- According to the analysts' consensus view, shrinking profit margins are a bigger threat than slow revenue growth. Margin compression, resulting from both lower tool demand and pricing pressures, could erase most of the gains from new installations.

- Consensus narrative notes the combination of customer digestion, slow adoption of advanced technologies, and intensifying competition, especially in China, as key reasons why both revenue and margin expansion are at risk.

- This aligns with the risk that high-margin, high-energy tool sales may be limited unless global customers accelerate investment in advanced trench and superjunction designs.

- To see how analysts balance these margin pressures with long-term growth prospects, read the full Consensus Narrative for Axcelis Technologies. 📊 Read the full Axcelis Technologies Consensus Narrative.

China Exposure Presents Significant Revenue Risk

- With 65% of shipped system sales and 55% of total revenue coming from China, Axcelis's fortunes are highly tied to a single region facing geopolitical headwinds.

- Under the analysts' consensus view, this concentration exposes Axcelis to sudden changes in demand or export restrictions, pressuring not just quarter-to-quarter sales but the predictability of future cash flows.

- Critics highlight that recent tool demand in China has been driven primarily by legacy planar technologies, which may deliver lower margins than advanced applications targeted by the company’s R&D investments.

- Consensus tends to view this as a chief risk, noting that domestic competitors in China are gaining ground. This could pressure Axcelis’s pricing power and reduce its longer-term market share.

Valuation Remains Attractive Despite Headwinds

- At the current share price of $80.51, Axcelis trades at an 18.4x price-to-earnings ratio, which is well below both the US semiconductor industry average (36.6x) and peer average (40.3x), yet above its calculated DCF fair value of $34.20.

- Under the analysts' consensus view, the market sees Axcelis as underappreciated on relative multiples, since analyst price targets sit at 96.8—20% above where the stock trades today—even though both sales and earnings are forecast to decline.

- What stands out is that the analyst target incorporates much lower profits over the next several years, but still values the company at a premium multiple compared to its historic rate. This suggests some believe in a rebound or sustained quality of Axcelis's business model.

- This disconnect between multiple compression in near-term estimates and optimism in price targets highlights how sentiment about industry structure and technology leadership plays a role beyond simple earnings trajectory.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Axcelis Technologies on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique interpretation of the results? Share your viewpoint with the community and build your own narrative in just a few minutes. Do it your way

A great starting point for your Axcelis Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Axcelis’s narrowing margins, slowing sales, and heavy regional exposure point to uncertain earnings and less consistent performance ahead.

If you’re searching for steadier growth, use our stable growth stocks screener (2080 results) to zero in on companies that reliably expand revenue and profit across different market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACLS

Axcelis Technologies

Designs, manufactures, and services ion implantation and other processing equipment used in the fabrication of semiconductor chips in the United States, Europe, and the Asia Pacific.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives