- United States

- /

- Semiconductors

- /

- NasdaqGS:ACLS

Axcelis Technologies (ACLS): Is the Stock Undervalued After Recent Sector-Aligned Move?

Reviewed by Simply Wall St

See our latest analysis for Axcelis Technologies.

Axcelis Technologies has turned a corner lately, with short-term momentum picking up as its share price bounced 12% in the last three months. However, that recent surge contrasts with a modest fade in long-term terms, as its one-year total shareholder return sits at -7%. This comes despite the company still boasting a substantial 45% total return over three years. Investors seem to be reassessing growth prospects, balancing last year’s volatility against the broader gains posted over the long run.

If you’re keeping an eye on where the next wave of innovation might come from in tech, this is a great moment to check out See the full list for free.

With the share price still trailing its recent highs, but key growth metrics showing mixed signals, investors are left to ponder whether Axcelis is trading at a bargain or if the market is already factoring in future gains.

Most Popular Narrative: 13.5% Undervalued

According to the most widely followed narrative, Axcelis Technologies’ fair value sits noticeably higher than its latest close of $83.88. This context shapes the debate about the company’s future prospects as investors weigh short-term uncertainty against long-term opportunity.

Adoption of silicon carbide (SiC) power devices in electric vehicles and industrial applications remains early stage, with penetration rates and SiC content per vehicle expected to rise globally and across hybrids. Axcelis's leadership in high-energy ion implantation positions it to benefit from this ramp, supporting future revenue and gross margin expansion as SiC demand multiplies.

The full narrative uncovers bold assumptions behind this higher valuation. Want to know which future business trends and financial projections drive the bullish target? Dive deeper to see what the analysts are betting on for Axcelis’s next chapter.

Result: Fair Value of $97 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant reliance on Chinese customers and sluggish uptake of advanced technologies could quickly undermine Axcelis’s current valuation outlook.

Find out about the key risks to this Axcelis Technologies narrative.

Another Perspective: What About Traditional Multiples?

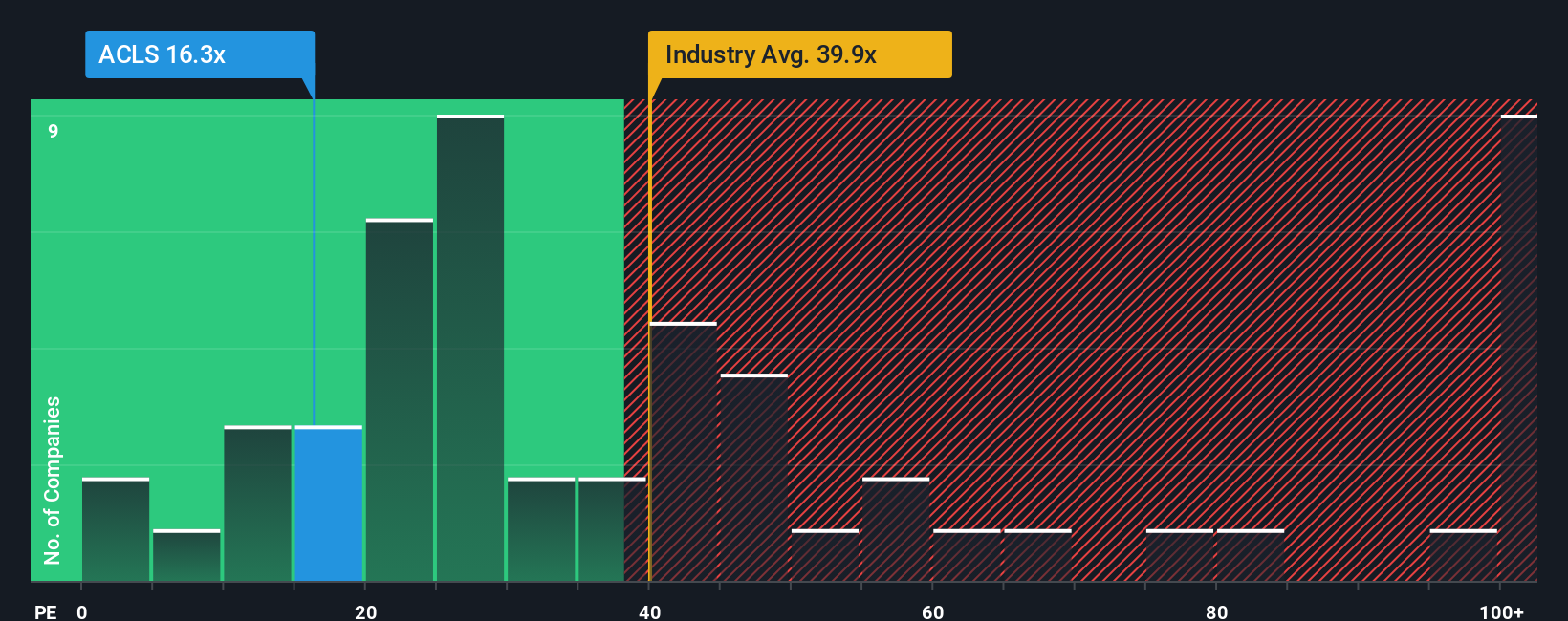

While analyst price targets suggest Axcelis is undervalued, a look at its price-to-earnings ratio tells a mixed story. Trading at 16.4x earnings, Axcelis looks cheaper than both its industry average (37.4x) and peers (35.7x), yet it still trades above its fair ratio of 12.1x. This means the market is assigning a premium for Axcelis relative to its expected growth, which might signal optimism or highlight future valuation risks. The market could continue to reward this premium, or it may revert toward fair value as business trends play out.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Axcelis Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Axcelis Technologies Narrative

If you think a different story emerges from the numbers or want to dig into the data yourself, you can craft your own take in just a few minutes. Do it your way

A great starting point for your Axcelis Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't sit on the sidelines while others uncover new winners. Let your next smart move start here, using tailored screeners to match your investing style and financial goals.

- Tap into the unstoppable momentum of artificial intelligence by checking out these 24 AI penny stocks, where you can find innovators driving technology’s future.

- Secure stable income streams with ease when you browse these 17 dividend stocks with yields > 3%, featuring companies with dividend yields above 3%.

- Catch undervalued opportunities with upside potential by using these 875 undervalued stocks based on cash flows before the rest of the market spots them.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACLS

Axcelis Technologies

Designs, manufactures, and services ion implantation and other processing equipment used in the fabrication of semiconductor chips in the United States, Europe, and the Asia Pacific.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives