- United States

- /

- Specialty Stores

- /

- NYSE:WRBY

Warby Parker (WRBY): Evaluating Valuation After Q3 Earnings Miss and Lowered Revenue Outlook

Reviewed by Simply Wall St

Warby Parker (NYSE:WRBY) shares slipped after the company posted its third-quarter earnings, reporting solid revenue growth and stronger profits, but coming up short of analyst sales estimates and lowering its full-year forecast.

See our latest analysis for Warby Parker.

After an upbeat start to the year, Warby Parker’s share price has slid in recent months, reflecting shifting investor sentiment following earnings that, while strong on growth and innovation, missed sales estimates and included a lowered revenue outlook. The 1-year total shareholder return stands at -16%, with the stock down 22.6% over the past month and trading at $17.22. Momentum has clearly cooled despite continued gains in active customers and a wave of new tech partnerships.

If you’re looking beyond eyewear for new growth stories, this is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

So with the stock now trading notably below analyst targets and Warby Parker projecting steady growth but lower sales than hoped, is this a discounted entry point or a sign that the market already sees what is ahead?

Most Popular Narrative: 31.3% Undervalued

Warby Parker’s most widely followed narrative suggests its fair value sits well above the latest share price of $17.22, signaling significant upside if those projections materialize. Driven by expectations of robust revenue expansion and new business opportunities, this view highlights optimism around the company’s forward trajectory.

The partnership with Google to develop AI-powered intelligent eyewear positions Warby Parker to enter a substantially larger market, leveraging advancements in wearable technology and artificial intelligence to drive new, higher-margin revenue streams in the future.

Curious how a tech alliance could redefine Warby Parker’s future? This narrative is built on a growth engine powered by market-changing strategic bets. Wondering which core assumptions are fueling the forecast? The answers might surprise you. Dive in to see what’s behind this bold fair value.

Result: Fair Value of $25.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, falling e-commerce sales or stumbles in the new AI partnership could quickly challenge the optimism surrounding Warby Parker's projected expansion.

Find out about the key risks to this Warby Parker narrative.

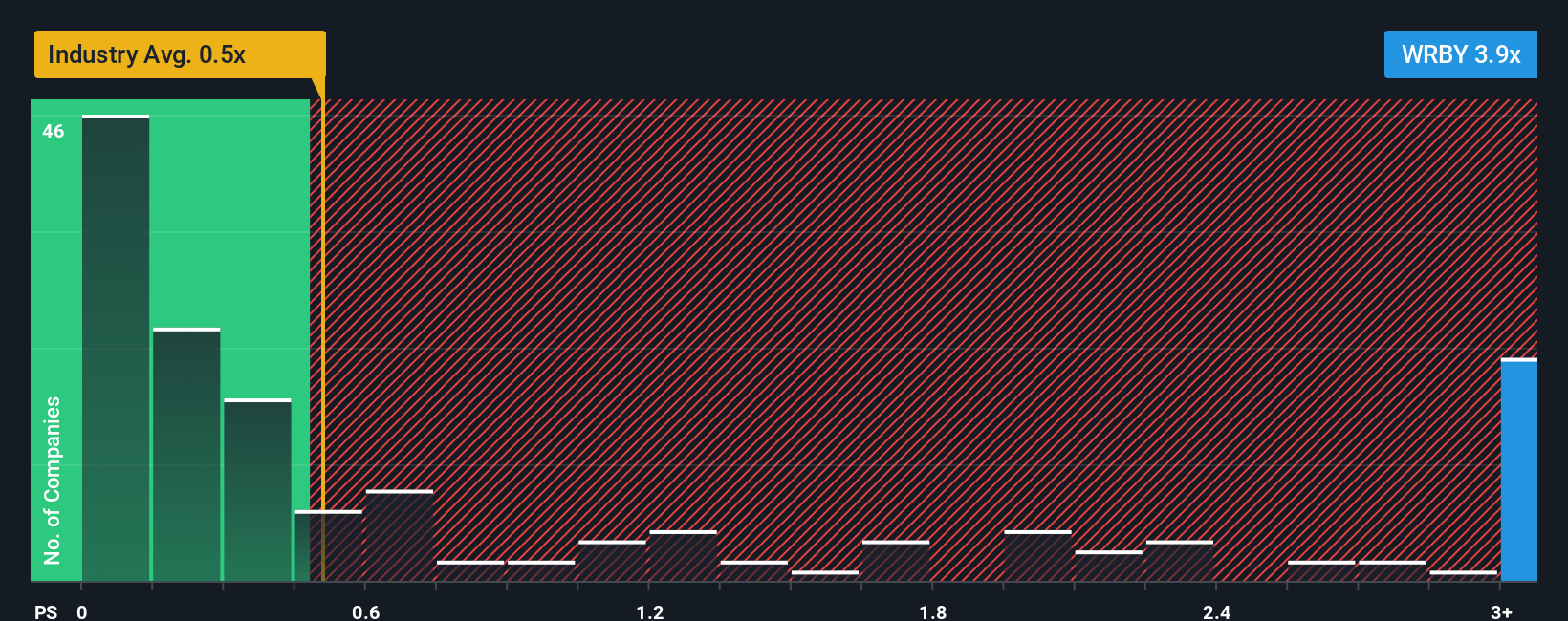

Another View: A Look at Sales Multiples

While some see Warby Parker as undervalued, its price-to-sales ratio (2.5x) is much higher than both the US Specialty Retail industry average (0.4x) and the fair ratio (1.4x). This sizeable gap signals investors may be paying up for growth that has yet to fully materialize. Should this premium concern value-minded investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Warby Parker Narrative

If you have a different perspective or want to draw your own conclusions from the numbers, you can craft a unique view in just a few minutes. Do it your way

A great starting point for your Warby Parker research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock new opportunities and avoid missing the next breakout star. Use these tailored screens to uncover companies with growth potential, strong yields, and breakthrough innovation.

- Capture high yields and strengthen your portfolio by checking out these 16 dividend stocks with yields > 3%, which offers payouts above 3% with stable fundamentals.

- Target rapid growth with these 28 quantum computing stocks, which features top contenders advancing the future of quantum computing and reshaping entire industries.

- Boost exposure to AI-driven trends and benefit from emerging opportunities by selecting these 25 AI penny stocks, which are shaping tomorrow’s technology landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warby Parker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WRBY

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives