Stock Analysis

- United States

- /

- Specialty Stores

- /

- NYSE:WRBY

Three Growth Companies With High Insider Ownership And A Minimum 25% Earnings Increase

Reviewed by Simply Wall St

As global markets show signs of recovery and resilience, with indices like the S&P 500 nearing record highs amid fluctuating economic indicators, investors are keenly observing market trends and potential opportunities. In this context, growth companies with high insider ownership can be particularly compelling, as significant insider stakes often signal confidence in the company's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Gaming Innovation Group (OB:GIG) | 22.8% | 38.8% |

| Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

| Cettire (ASX:CTT) | 28.7% | 29.9% |

| Selvas AI (KOSDAQ:A108860) | 13.1% | 98.9% |

| Elliptic Laboratories (OB:ELABS) | 31.4% | 124.6% |

| EHang Holdings (NasdaqGM:EH) | 33% | 98% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Nordic Halibut (OB:NOHAL) | 29.9% | 56.0% |

| La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 40% | 87.5% |

We'll examine a selection from our screener results.

Enchem (KOSDAQ:A348370)

Simply Wall St Growth Rating: ★★★★★★

Overview: Enchem Co., Ltd. specializes in manufacturing and selling electrolytes and additives for secondary batteries and electric double-layer capacitors (EDLC), with a market capitalization of approximately ₩5.74 billion.

Operations: The company's revenue from electronic components and parts reached approximately ₩0.42 billion.

Insider Ownership: 21.3%

Earnings Growth Forecast: 105.6% p.a.

Enchem, characterized by high insider ownership, shows promising financial forecasts with expected annual revenue growth at 45.7% and earnings potentially increasing by 105.59% per year. Despite this robust growth outlook, there are concerns: shareholder dilution occurred last year and the stock price has been highly volatile recently. Nevertheless, Enchem's Return on Equity is anticipated to reach a strong 23.2%, signaling potential for substantial profitability within three years.

- Get an in-depth perspective on Enchem's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Enchem is priced higher than what may be justified by its financials.

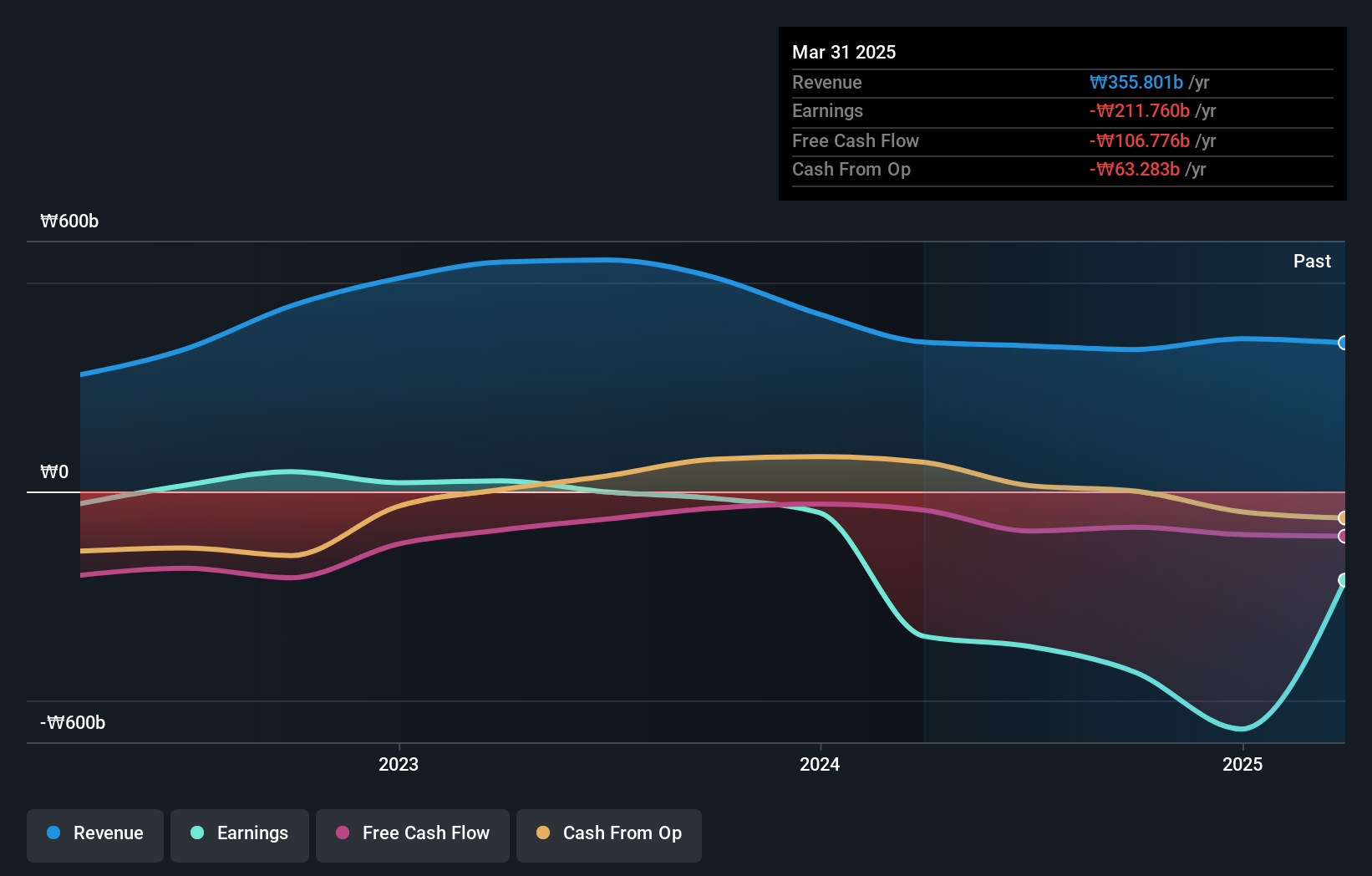

Warby Parker (NYSE:WRBY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Warby Parker Inc. operates in the United States and Canada, specializing in the provision of eyewear products, with a market capitalization of approximately $1.76 billion.

Operations: The company generates revenue primarily through the sale of optical supplies, totaling approximately $697.80 million.

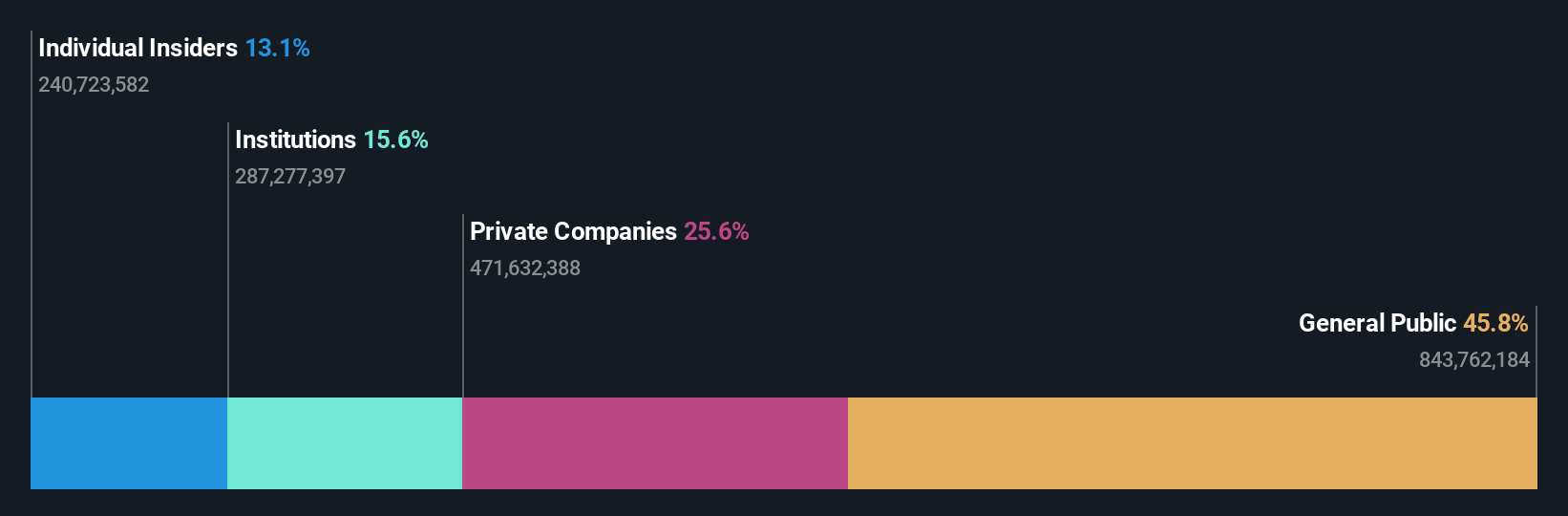

Insider Ownership: 20.1%

Earnings Growth Forecast: 125% p.a.

Warby Parker, a growth company with high insider ownership, recently revised its full-year 2024 revenue guidance to US$753 million to US$761 million, indicating a solid year-over-year growth. Despite this optimistic outlook and reduced net losses in Q1 2024 compared to the previous year, concerns persist due to significant insider selling over the past three months and shareholder dilution within the last year. The company's profitability is expected to improve markedly over the next three years, aligning with an above-market forecast for revenue growth.

- Click to explore a detailed breakdown of our findings in Warby Parker's earnings growth report.

- Our expertly prepared valuation report Warby Parker implies its share price may be too high.

Lepu Medical Technology (Beijing) (SZSE:300003)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lepu Medical Technology (Beijing) Co., Ltd. is a company specializing in the development, production, and distribution of medical devices and pharmaceutical products, with a market capitalization of approximately CN¥30.60 billion.

Operations: The revenue segments for the company are not specified in the provided text.

Insider Ownership: 13.1%

Earnings Growth Forecast: 25.3% p.a.

Lepu Medical Technology, a company with high insider ownership, reported a decrease in Q1 2024 earnings and revenue compared to the previous year. Despite this, its earnings are expected to grow by 25.27% annually, outpacing the Chinese market's growth. The firm trades at a P/E ratio of 26.8x, below the market average of 32.4x, suggesting good value relative to its peers. However, its return on equity is projected to remain low at 11.7% in three years' time.

- Click here and access our complete growth analysis report to understand the dynamics of Lepu Medical Technology (Beijing).

- According our valuation report, there's an indication that Lepu Medical Technology (Beijing)'s share price might be on the cheaper side.

Next Steps

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1495 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Warby Parker is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WRBY

Flawless balance sheet with reasonable growth potential.