- United States

- /

- Specialty Stores

- /

- NYSE:VSCO

Victoria's Secret (VSCO): Evaluating the Stock’s Value as Rate Cut Hopes Boost Retailer Sentiment

Reviewed by Simply Wall St

Shares of Victoria's Secret (VSCO) climbed after comments from a leading Federal Reserve official suggested a greater chance of interest rate cuts. This sent a wave of optimism through retail stocks ahead of the holiday season.

See our latest analysis for Victoria's Secret.

Victoria's Secret has seen its share price claw back impressive ground in recent months, with a 67% share price return over the past 90 days. This reflects revived investor confidence following hopes for looser monetary policy. However, its one-year total shareholder return is still slightly negative, suggesting momentum is building but has not yet translated into sustained long-term gains.

If renewed optimism in retail sparks your curiosity, it could be the perfect moment to broaden your investing search and discover fast growing stocks with high insider ownership

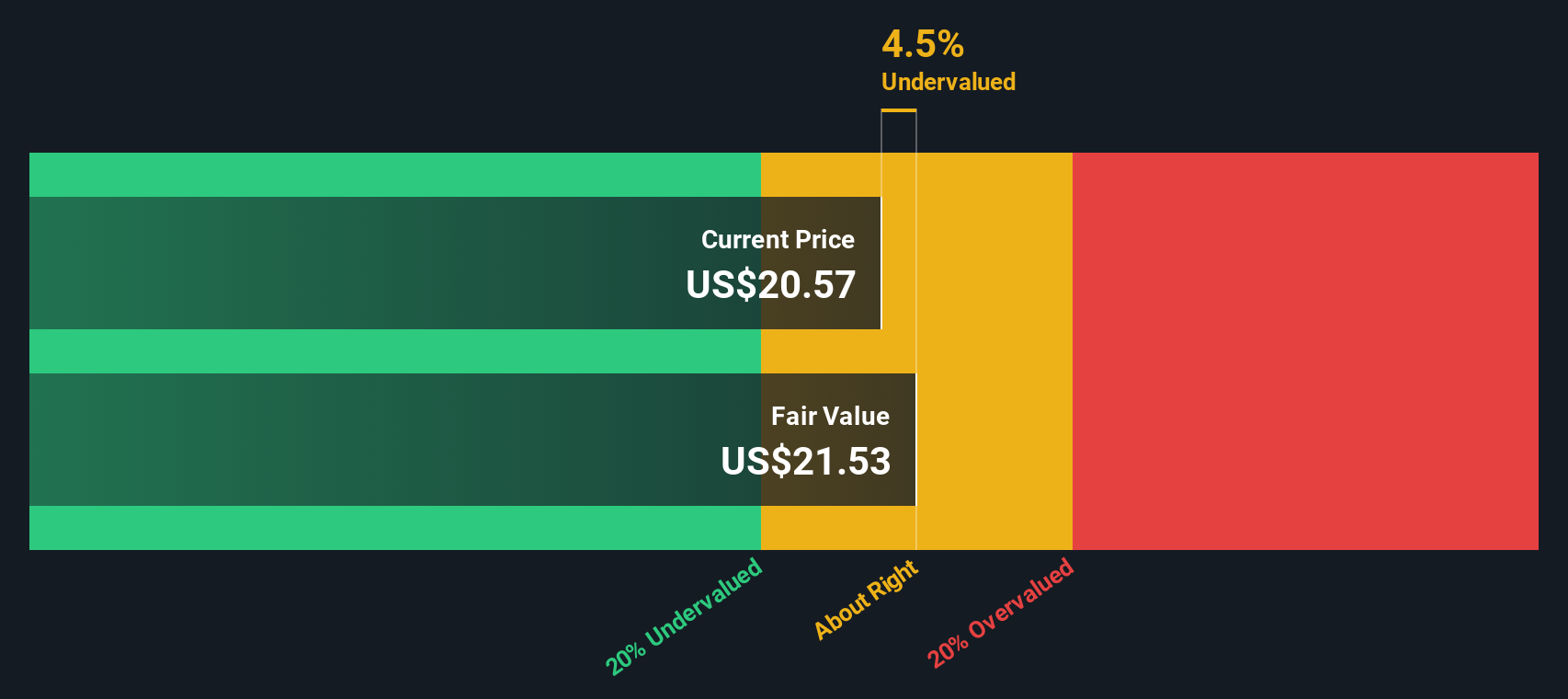

With shares rebounding sharply, yet still trading below analyst targets, investors must now ask: are Victoria's Secret shares undervalued at current levels, or is the market already accounting for future growth prospects?

Most Popular Narrative: 22.6% Overvalued

With Victoria's Secret shares closing at $36.67, the most widely followed fair value estimate stands at $29.90. This gap has investors questioning whether current optimism is running ahead of fundamental value.

Solid financial performance, including multiple mentions of Q2 earnings beats, is seen as evidence of effective execution and progress under new leadership. Expansion of product assortment and positive initial responses to major brand events such as the 2025 Fashion Show suggest additional share gain opportunities.

Want to know the reason behind this bold valuation call? This narrative hinges on ambitious top-line growth and a profit multiple that exceeds the industry norm. Which future growth drivers and pricing signals are supporting this outlook? Uncover the full backstory and see what drives this fair value estimate.

Result: Fair Value of $29.90 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff headwinds and ongoing reliance on physical retail could limit Victoria's Secret's ability to sustain improved margins and topline growth.

Find out about the key risks to this Victoria's Secret narrative.

Another View: Discounted Cash Flow Model Signals Opportunity

While many analysts believe Victoria's Secret is overvalued on current market multiples, our DCF model suggests a different story. According to the SWS DCF model, the fair value estimate is $46.01 per share, which is roughly 20% above the current market price. Could the market be underestimating future cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Victoria's Secret for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Victoria's Secret Narrative

If our analyses spark different ideas or you want to dig deeper, it only takes a few minutes to explore the numbers and build your own perspective, so why not Do it your way

A great starting point for your Victoria's Secret research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Great opportunities abound beyond Victoria's Secret. Let Simply Wall Street help you spot powerful trends and unique stocks you might otherwise overlook.

- Tap into the momentum of artificial intelligence by checking out these 26 AI penny stocks to see which fast-growing companies are setting new standards in tech.

- Strengthen your portfolio with steady income potential by exploring these 14 dividend stocks with yields > 3%, which consistently deliver yields above 3%.

- Uncover hidden gems before the market catches on with these 924 undervalued stocks based on cash flows based on the latest cash flow valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VSCO

Victoria's Secret

Operates as a specialty retailer of women’s intimate, and other apparel and beauty products worldwide.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives