- United States

- /

- Specialty Stores

- /

- NYSE:TJX

TJX Companies (TJX): Evaluating Valuation After Steady Gains and Strong Shareholder Returns

Reviewed by Simply Wall St

TJX Companies (TJX) shares have edged higher recently. The stock has shown steady gains over the past month. Investors seem to be weighing the company’s consistent retail performance and long-term growth track record as they consider its current valuation.

See our latest analysis for TJX Companies.

With the share price recently reaching $145.58 and posting a year-to-date gain of just over 20%, momentum for TJX Companies has been picking up. Investors are clearly rewarding the company’s reliable performance, as reflected in a 1-year total shareholder return of 23% and an even more impressive 3-year total return of 89%. This suggests an appetite for both its steady growth and long-term stability.

If you’re curious to see what other market standouts look like, this is a perfect moment to broaden your horizons and discover fast growing stocks with high insider ownership

But with TJX Companies trading near its recent highs, is there still room for further upside? Or have investors already factored in all the company’s future growth prospects, leaving little room for a bargain?

Most Popular Narrative: 4.1% Undervalued

With TJX Companies closing at $145.58, the most widely followed narrative projects a fair value just above $151, suggesting the market may be underestimating its near-term potential. This sets up a compelling case backed by recent performance for readers to consider.

The company's uniquely flexible, discovery-driven in-store experience is driving higher store traffic from a wide demographic range, including increased engagement from younger customers, capitalizing on consumer desire for experiential shopping and repeat visits, thus supporting both top-line revenue and frequency of purchases.

Wondering why this valuation is grabbing attention? It hinges on bold margin expansion and revenue acceleration, as well as a striking future earnings multiple. Want to know the engine behind that premium price call? The full narrative unlocks the real financial assumptions and what they signal for TJX’s next chapter.

Result: Fair Value of $151.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if digital competition accelerates or brands reduce surplus inventory, TJX’s strong momentum and future earnings growth could face significant challenges.

Find out about the key risks to this TJX Companies narrative.

Another View: Price Tag Premium?

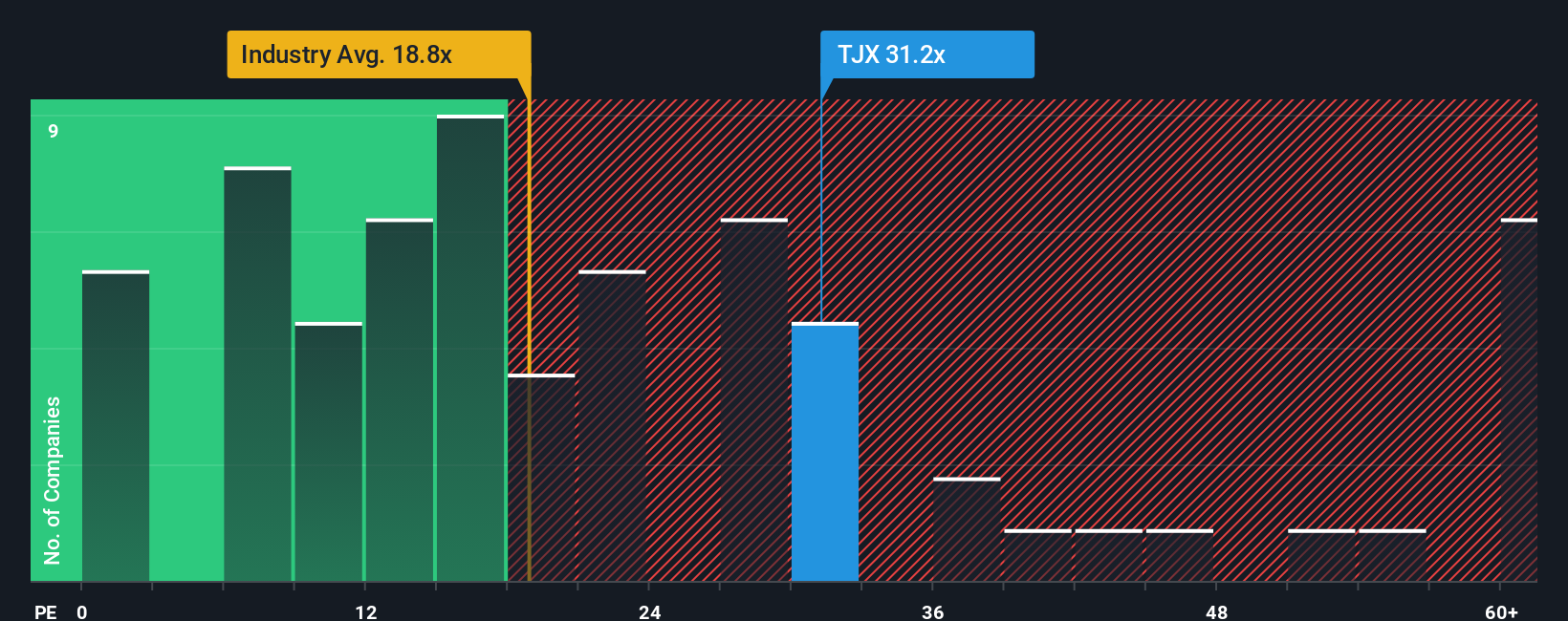

Looking at valuation from another angle, TJX Companies is trading at a price-to-earnings ratio of 32.6x, which stands well above both the US Specialty Retail industry average of 16.6x and the peer average of 19.5x. The fair ratio sits at just 20.7x, indicating the shares are expensive by this measure and potentially exposed to shifts in market sentiment. Does this premium price reflect enduring strength, or could it signal limited upside from here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TJX Companies Narrative

If you want to dig deeper or see things from your own angle, you can quickly build your own narrative and interpretation in just a few minutes: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding TJX Companies.

Looking for More Investment Ideas?

Broaden your portfolio by acting now and tapping into new opportunities, all based on data-driven insights from the Simply Wall Street Screener.

- Catch up on high-yield income by targeting these 18 dividend stocks with yields > 3% with consistently strong yields above 3% and solid fundamentals behind their payouts.

- Get ahead of the mainstream and pursue these 27 AI penny stocks at the frontier of artificial intelligence, where innovation is fueling profit potential in tomorrow’s market leaders.

- Accelerate your investment strategy by adding these 900 undervalued stocks based on cash flows with strong cash flow metrics and the potential for outsized returns as the market catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TJX Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TJX

TJX Companies

Operates as an off-price apparel and home fashions retailer worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives