- United States

- /

- Specialty Stores

- /

- NYSE:TJX

How TJX’s Raised Guidance and Holiday Momentum Have Changed Its Investment Story (TJX)

Reviewed by Sasha Jovanovic

- The TJX Companies, Inc. recently reported third-quarter results for the period ended November 1, 2025, with sales of US$15.12 billion and net income of US$1.44 billion, both up from the prior year, and raised its full-year Fiscal 2026 guidance for sales, profit margin, and diluted earnings per share.

- Management pointed to strong momentum in customer demand across all divisions, ongoing share buybacks, and robust expectations for the holiday season as key factors supporting this outlook.

- We'll examine how TJX's upward guidance revision and confident holiday outlook might influence its investment narrative going forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

TJX Companies Investment Narrative Recap

Owning TJX Companies stock is essentially a bet on the staying power of off-price retail, ongoing strong customer demand, and the company's ability to secure quality branded merchandise at appealing prices. The company's raised outlook following third-quarter results suggests confidence in the near-term holiday catalyst, but it does not fundamentally change the risk that improving brand inventory management or a significant consumer shift to e-commerce could weigh on future growth.

Among recent announcements, the most relevant is TJX's full-year Fiscal 2026 guidance increase: management now expects comparable sales up 4%, with higher margins and diluted EPS climbing 9% year-over-year, following a quarter of robust comp sales. This strengthened outlook directly reflects the continuing catalyst of broad-based growth in customer transactions, particularly as the company prepares for the crucial holiday period.

But on the flip side, investors should be aware that competition from digitally native retailers and evolving consumer shopping habits could...

Read the full narrative on TJX Companies (it's free!)

TJX Companies' outlook anticipates $68.6 billion in revenue and $6.3 billion in earnings by 2028. This forecast implies a 5.8% annual revenue growth rate and a $1.3 billion increase in earnings from the current $5.0 billion level.

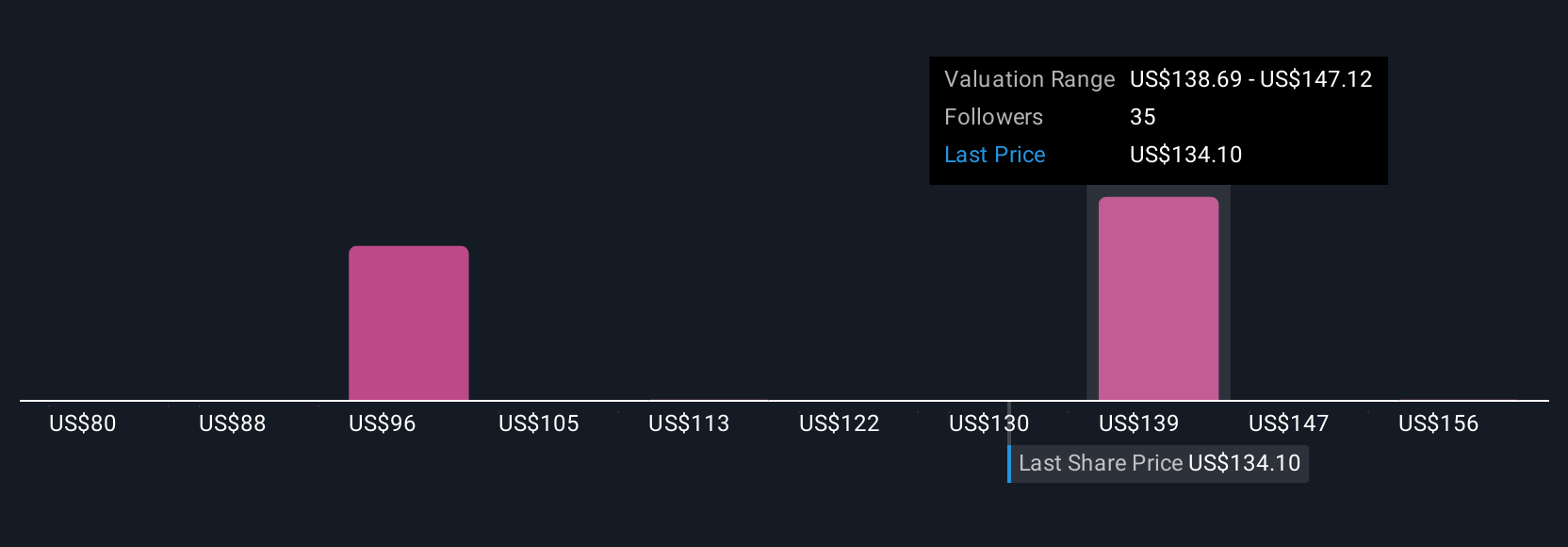

Uncover how TJX Companies' forecasts yield a $151.84 fair value, in line with its current price.

Exploring Other Perspectives

Some analysts were forecasting annual revenue of US$71.0 billion and earnings of US$6.6 billion by 2028, much higher than the average. If you believe that global expansion and e-commerce improvements are poised to drive even faster growth, your view may be far more optimistic than consensus. Perspectives can vary widely, so it’s worth considering how recent news could shape these differing forecasts.

Explore 6 other fair value estimates on TJX Companies - why the stock might be worth as much as 8% more than the current price!

Build Your Own TJX Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TJX Companies research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free TJX Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TJX Companies' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TJX Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TJX

TJX Companies

Operates as an off-price apparel and home fashions retailer worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives