Savers Value Village (SVV) Is Down 14.2% After Cutting Profit Guidance Amid Q3 Loss and Expansion Plans

Reviewed by Sasha Jovanovic

- In late October 2025, Savers Value Village announced it expects to open 25 new stores in 2025, reported a year-over-year increase in third-quarter sales to US$426.94 million but posted a net loss of US$14 million, and also initiated a US$50 million share buyback program.

- A significant update was the company’s decision to lower full-year net income guidance to US$17 million–US$21 million, down from an earlier range of US$47 million–US$58 million.

- We’ll examine how the lowered profit guidance and recent quarterly loss affect Savers Value Village’s investment narrative and future outlook.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Savers Value Village Investment Narrative Recap

To believe in Savers Value Village as a shareholder right now, you need confidence in its ability to translate large-scale store expansion, such as the 25 new openings planned for 2025, into profitable, operationally sound growth. The recent quarterly net loss and sharply lowered full-year profit guidance have made profitability the most important short-term catalyst, with margin pressure from expansion now the most significant risk. While the guidance cut is material, it intensifies focus on execution risk rather than changing the fundamental investment thesis.

Among the recent announcements, the launch of a US$50 million share buyback program stands out, especially against a backdrop of lower profit expectations. Share repurchases can signal management’s view on undervaluation and may help support share prices in the near term, but they do not address the underlying execution risks tied to rapid expansion or the return to sustained profitability.

However, with increasing store openings, one key risk investors should be aware of relates to how quickly new locations can turn profitable and avoid ...

Read the full narrative on Savers Value Village (it's free!)

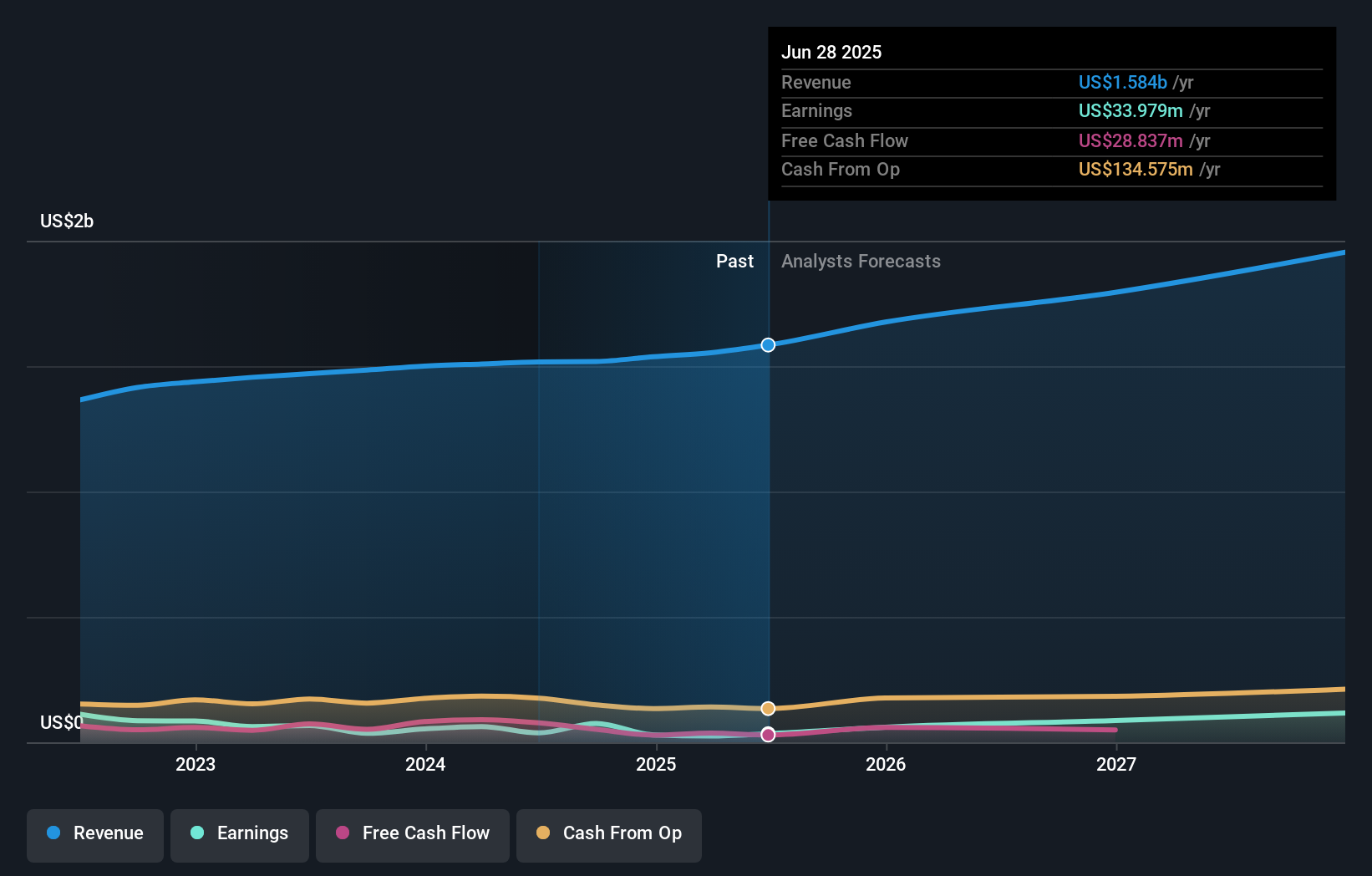

Savers Value Village's narrative projects $2.0 billion revenue and $145.8 million earnings by 2028. This requires 8.5% yearly revenue growth and a $111.8 million earnings increase from current earnings of $34.0 million.

Uncover how Savers Value Village's forecasts yield a $14.22 fair value, a 80% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community pooled 1 fair value estimate for Savers Value Village, all at US$10.94 per share. Against this consensus, the company’s recent profit warning puts further emphasis on whether rapid expansion can deliver the earnings growth many are counting on.

Explore another fair value estimate on Savers Value Village - why the stock might be worth as much as 38% more than the current price!

Build Your Own Savers Value Village Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Savers Value Village research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Savers Value Village research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Savers Value Village's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SVV

Savers Value Village

Sells second-hand merchandise in retail stores in the United States, Canada, and Australia.

Undervalued with moderate growth potential.

Market Insights

Community Narratives