- United States

- /

- Specialty Stores

- /

- NYSE:SBH

Assessing Sally Beauty Holdings (SBH) Valuation After Recent 15% Stock Momentum

Reviewed by Kshitija Bhandaru

Sally Beauty Holdings (SBH) stock has been showing steady momentum lately, rising almost 15% over the past month. Investors are taking note as the company’s shares continue to build on recent gains as the summer approaches.

See our latest analysis for Sally Beauty Holdings.

Sally Beauty Holdings’ recent surge fits into a broader story of building momentum over the past year. While its 30-day share price return stands at a robust 14%, the 1-year total shareholder return of 22% highlights that longer-term investors have also been rewarded. The latest move signals a pickup in sentiment, possibly hinting at renewed confidence in underlying growth prospects and reminding investors that sentiment can shift quickly in the retail space.

If you’re watching the action unfold and wondering what other opportunities are out there, this is a great time to expand your search and discover fast growing stocks with high insider ownership

But with shares running higher, investors now face a key question: is Sally Beauty Holdings still undervalued, or has the market already priced in the optimism surrounding its future growth prospects?

Most Popular Narrative: 15% Overvalued

With Sally Beauty Holdings last closing at $16.60 and the popular narrative fair value at $14.45, there is a clear split between market optimism and analyst caution. This section reveals which catalysts are fueling that analyst stance and the rationale behind the fair value assessment.

Expansion of personalized digital initiatives, such as Licensed Colorist OnDemand and enhanced e-commerce and marketplace partnerships with DoorDash, Instacart, Amazon, and Walmart, are supporting new customer acquisition and higher-ticket transactions. This progress could drive future revenue growth and improved operating earnings as digital sales comprise a larger share of the mix.

Curious what is underpinning this bold valuation call? The narrative centers around ambitious revenue expansion, higher margins, and a forward-looking profit multiple that does not align with sector averages. Want to know which specific growth bets and financial levers could influence this target? Dive deeper to unpack the assumptions and see whether the outlook stands up to scrutiny.

Result: Fair Value of $14.45 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent consumer frugality and slower digital adoption could limit revenue growth. This may make it harder for Sally Beauty Holdings to sustain its current momentum.

Find out about the key risks to this Sally Beauty Holdings narrative.

Another View: Value by the Numbers

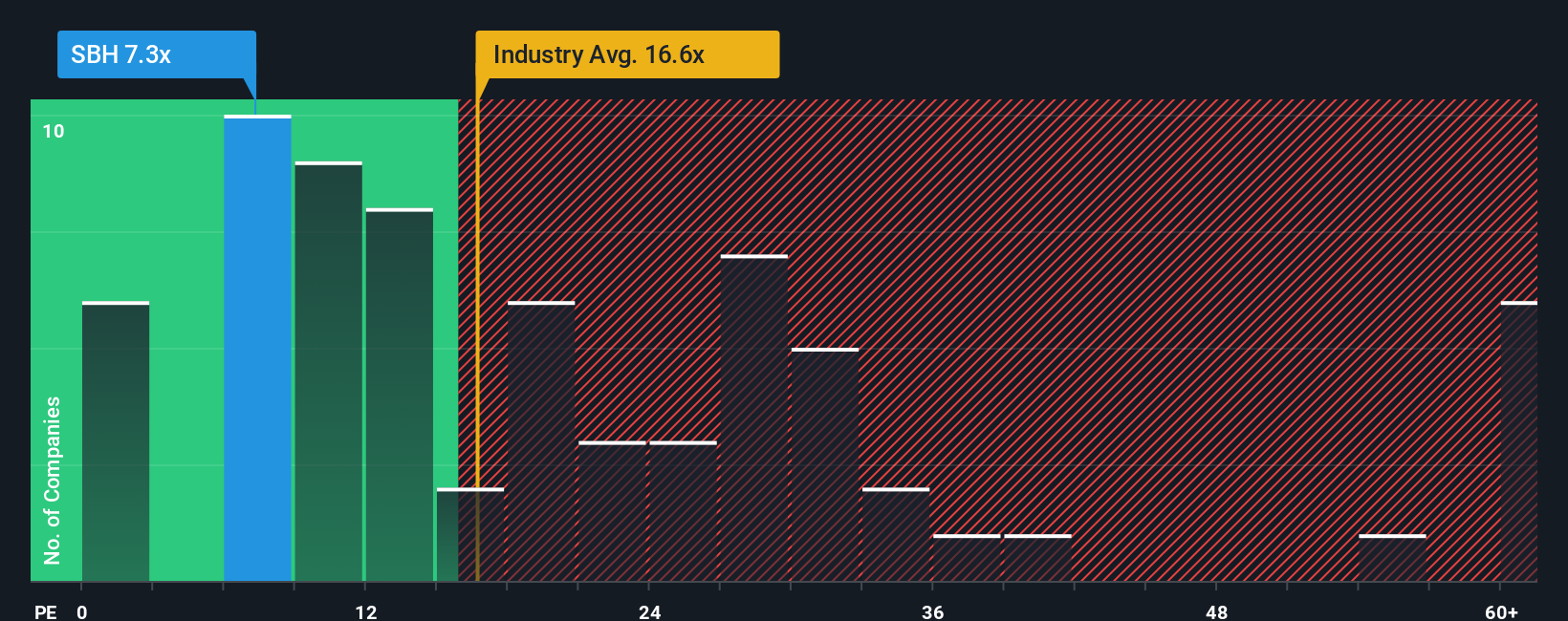

On the other hand, if you look at Sally Beauty Holdings based on its price-to-earnings ratio, it is trading at 8.5x earnings. That is much cheaper than the US Specialty Retail industry average of 17.3x and the peer average of 28.7x. Even compared to the fair ratio of 13.7x, the stock looks undervalued. This big valuation gap could signal opportunity, or perhaps the market sees risks others are missing. Which side will prove right?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sally Beauty Holdings Narrative

If you want to dig deeper or chart your own story for Sally Beauty Holdings, the data is at your fingertips. It takes just a few minutes to shape your personal view. Do it your way

A great starting point for your Sally Beauty Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why settle for just one stock? Stay ahead by tapping into unique themes and fresh opportunities. These screener ideas are here so you never miss an edge.

- Unlock passive income potential and boost your portfolio’s yield by checking out these 19 dividend stocks with yields > 3%.

- Catch the wave of innovation as you scan these 24 AI penny stocks, featuring companies revolutionizing industries with artificial intelligence.

- Multiply your growth prospects by taking a closer look at these 896 undervalued stocks based on cash flows, where quality stocks may be trading at attractive prices right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SBH

Sally Beauty Holdings

Operates as a specialty retailer and distributor of professional beauty supplies.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives