- United States

- /

- Specialty Stores

- /

- NYSE:HD

Is Home Depot’s Recent 4.5% Stock Slide an Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

- Wondering if now is the right time to pick up shares of Home Depot? You are not alone, as many investors are keeping a close eye on its valuation and growth story.

- Recently, Home Depot's stock has seen some turbulence, losing 2.2% over the past week and 3.3% in the last month. This has contributed to a 4.5% slide year-to-date.

- Much of this movement is happening as the company navigates changes in consumer spending and shifting trends in the DIY market. Recent headlines have highlighted the impact of interest rates and housing market uncertainty on retail demand. Investors are parsing this news to decide whether these headwinds are short-term noise or signs of a bigger shift for the home improvement giant.

- With a current valuation score of 0 out of 6, there are important questions to be answered about whether Home Depot is truly undervalued or if further declines could be ahead. Let us break down the main ways to judge value, and later, we will reveal a smarter approach to understanding what the numbers mean for investors.

Home Depot scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Home Depot Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and discounting them back to their present value. This method helps gauge what the company is actually worth based on its ability to generate cash over time.

For Home Depot, current Free Cash Flow stands at $14.34 Billion. Analysts have provided estimates for the next five years, with projections indicating steady growth. By 2030, free cash flow is expected to reach $18.45 Billion. Projections beyond these five years are extrapolated, offering a glimpse into potential long-term performance.

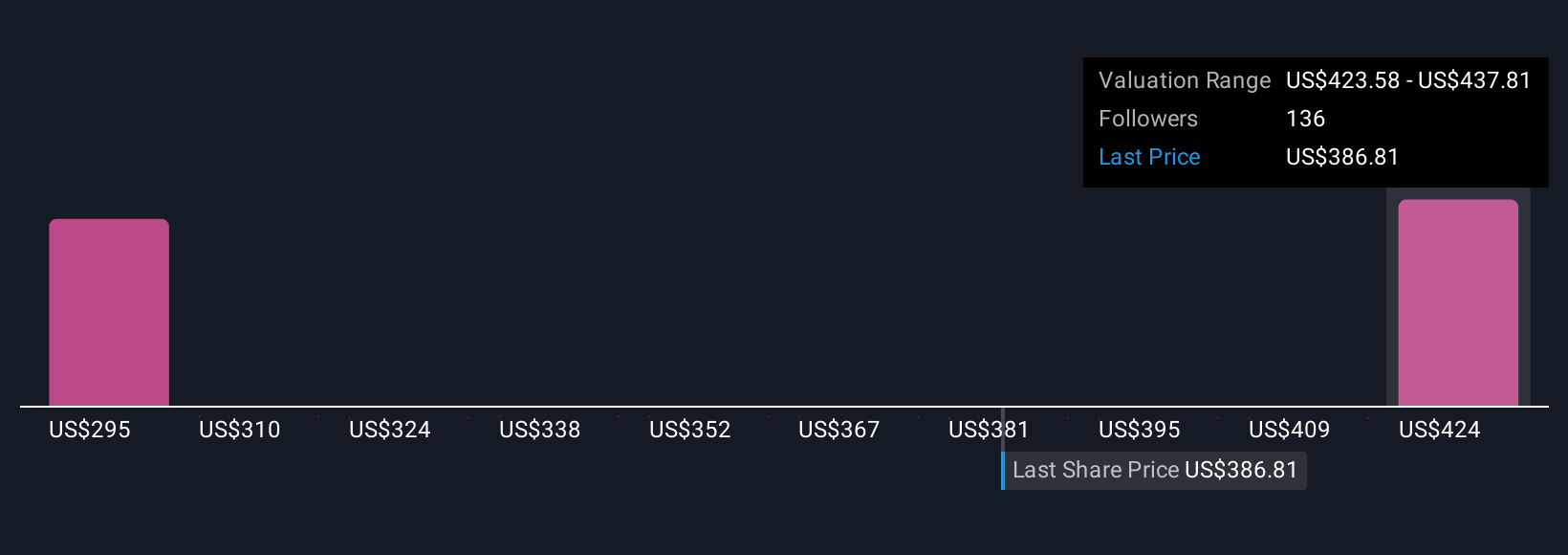

After crunching all the numbers, the DCF approach produces an estimated fair value of $301.99 per share. However, when compared to the market price, there is an implied discount of 22.9%. This means Home Depot's shares are currently trading about 22.9% above what the DCF model suggests is fair value.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Home Depot may be overvalued by 22.9%. Discover 870 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Home Depot Price vs Earnings

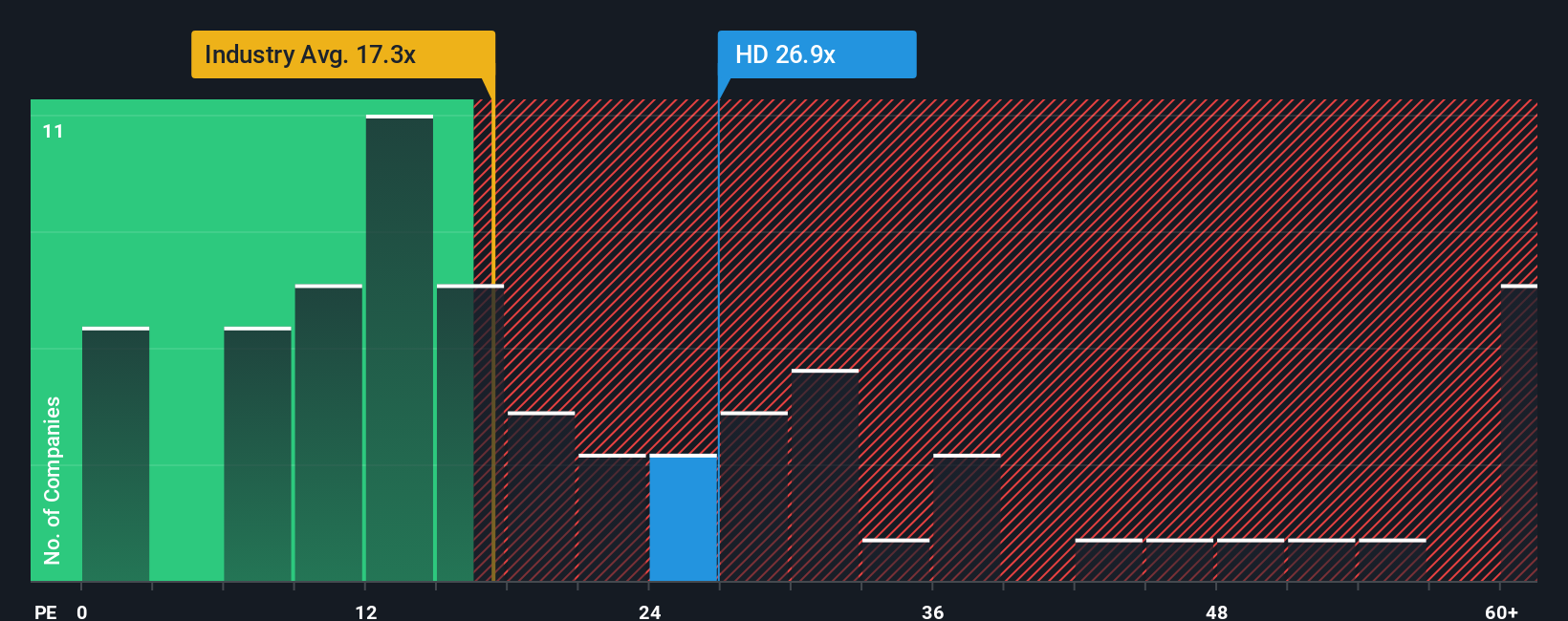

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like Home Depot, as it connects the stock price to the company’s actual earning power. For investors, the PE ratio offers a simple way to gauge what the market is willing to pay today for each dollar of earnings generated by the business.

Growth expectations and risk play a crucial role in determining a normal or fair PE ratio. Companies with strong future growth prospects or lower risks can typically command a higher multiple, reflecting investor optimism. In contrast, during periods of slower expected growth or heightened risks, a lower PE ratio is often considered reasonable.

Currently, Home Depot trades at a PE ratio of 25.3x. That is slightly above the peer average of 24.7x and well above the specialty retail industry average of 18.0x. While some might simply compare to these benchmarks, Simply Wall St’s proprietary "Fair Ratio" offers a custom view. For Home Depot, the Fair Ratio is 22.9x, taking into account factors such as earnings growth, profit margin, the company’s size, and sector-specific dynamics.

The Fair Ratio provides a more tailored perspective than generic industry or peer statistics because it weighs factors most relevant to Home Depot’s unique growth drivers, risks, and scale. This approach aims to provide a clearer sense of what multiple the stock deserves.

Comparing Home Depot’s actual PE of 25.3x with its Fair Ratio of 22.9x indicates the stock is modestly overvalued based on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1395 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Home Depot Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are a simple, yet powerful tool that helps you create a story behind the numbers by forming your personal perspective on a company like Home Depot, supported by your own fair value estimate and forecasts for revenue, earnings, and margins.

By connecting a company's story to its financial forecasts and ultimately to a fair value, Narratives empower you to see how your outlook translates into buy or sell signals. Available on Simply Wall St's Community page and used by millions of investors, Narratives make it easy for anyone to test scenarios using real-time financial models without spreadsheets required. As new information such as earnings or major news hits the market, your Narrative and fair value update dynamically, keeping your decisions relevant and up to date.

For example, some investors see Home Depot’s tech investments and housing trends as setting the stage for long-term outperformance, supporting a bullish price target of $481.00. Others, more cautious about economic risks, estimate a fair value as low as $335.00. Narratives help you make sense of these different stories, giving you clarity on what matters most for your investing decisions.

Do you think there's more to the story for Home Depot? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Home Depot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HD

Home Depot

Operates as a home improvement retailer in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives