- United States

- /

- Specialty Stores

- /

- NYSE:GROV

Revenues Not Telling The Story For Grove Collaborative Holdings, Inc. (NYSE:GROV) After Shares Rise 38%

The Grove Collaborative Holdings, Inc. (NYSE:GROV) share price has done very well over the last month, posting an excellent gain of 38%. Unfortunately, despite the strong performance over the last month, the full year gain of 6.4% isn't as attractive.

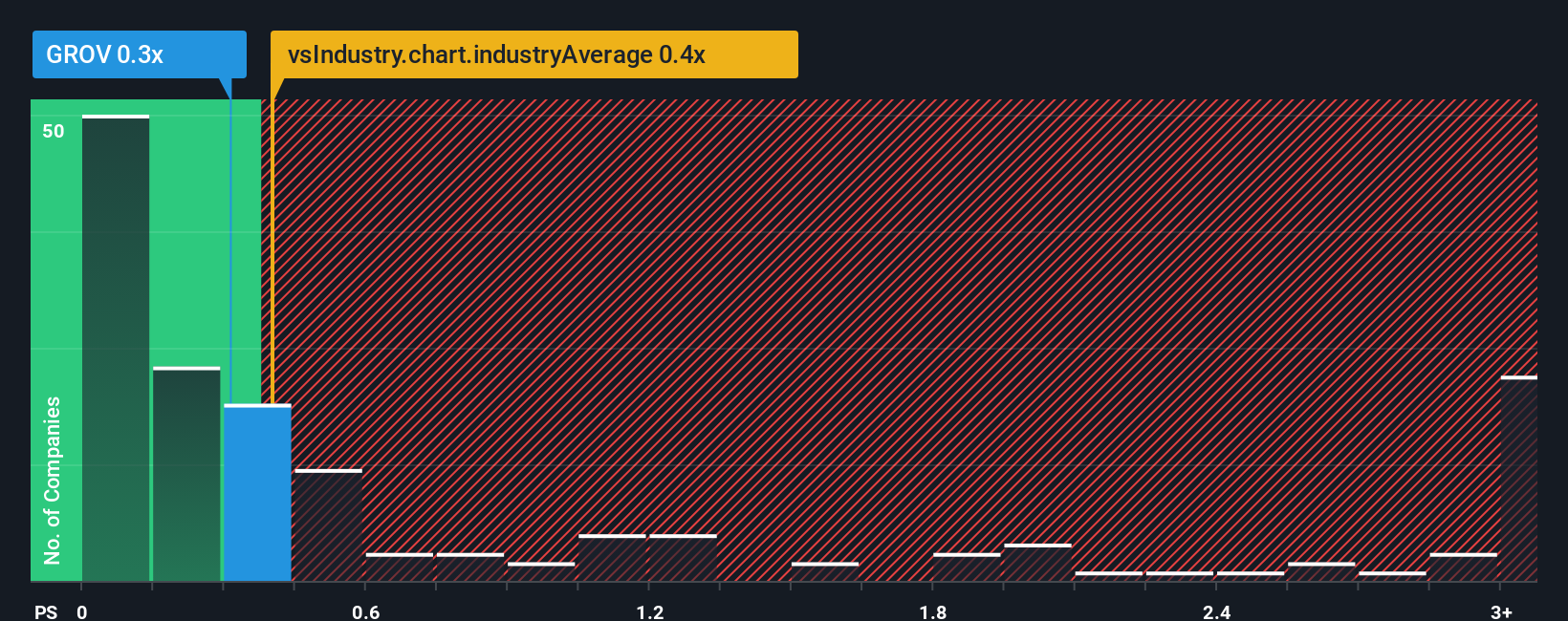

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Grove Collaborative Holdings' P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Specialty Retail industry in the United States is also close to 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Grove Collaborative Holdings

How Grove Collaborative Holdings Has Been Performing

While the industry has experienced revenue growth lately, Grove Collaborative Holdings' revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Grove Collaborative Holdings' future stacks up against the industry? In that case, our free report is a great place to start.How Is Grove Collaborative Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Grove Collaborative Holdings would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. As a result, revenue from three years ago have also fallen 48% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 2.6% as estimated by the only analyst watching the company. Meanwhile, the broader industry is forecast to expand by 5.6%, which paints a poor picture.

With this information, we find it concerning that Grove Collaborative Holdings is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What Does Grove Collaborative Holdings' P/S Mean For Investors?

Grove Collaborative Holdings appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It appears that Grove Collaborative Holdings currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

It is also worth noting that we have found 4 warning signs for Grove Collaborative Holdings (1 is a bit concerning!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Grove Collaborative Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:GROV

Grove Collaborative Holdings

A consumer products company, develops and sells household, personal care, beauty, and other consumer products in the United States.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026