- United States

- /

- Retail Distributors

- /

- NYSE:GPC

Genuine Parts (GPC): Exploring Valuation After a Recent Dip in Share Price

Reviewed by Simply Wall St

Genuine Parts (GPC) shares recently saw a small dip this week, drawing attention from investors who are watching the stock following a steady run so far this year. With recent shifts in performance, there is renewed interest in the company’s overall value and future direction.

See our latest analysis for Genuine Parts.

This week’s share price slip comes after a steady climb for Genuine Parts through 2024 and has investors watching for signs of shifting momentum, especially with the latest close at $128.4. While the 1-day share price return is down, the stock’s strong year-to-date share price return of 10.63% highlights a resilient run. The one-year total shareholder return of 15.56% signals that long-term investors are still seeing notable gains.

If the latest pullback has you curious about broader opportunities, now’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares off their highs but long-term returns still impressive, investors may be wondering if Genuine Parts is trading at an attractive discount or if the market has already factored in the company’s future growth potential.

Most Popular Narrative: 11.3% Undervalued

The most tracked narrative for Genuine Parts sees its fair value at $144.78, which is notably above the latest close of $128.40, suggesting potential upside if the forecasts play out. This difference catches the eye, especially for investors focused on future catalysts and potential value unlocks.

Execution of global supply chain optimization, pricing strategies, and recent restructuring initiatives is expected to generate over $200 million in annualized cost savings by 2026, supporting future net margin expansion and enhancing long-term earnings power.

Curious what’s behind this valuation? The key is a bold outlook for earnings and margin expansion, driven by sweeping efficiency moves and revenue growth assumptions that could reshape Genuine Parts' financial profile. Want the full story? Dive into the detailed narrative and see which numbers set this price target apart.

Result: Fair Value of $144.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent inflation and sluggish international markets could pressure Genuine Parts’ profitability and limit the expected margin expansion if conditions do not improve.

Find out about the key risks to this Genuine Parts narrative.

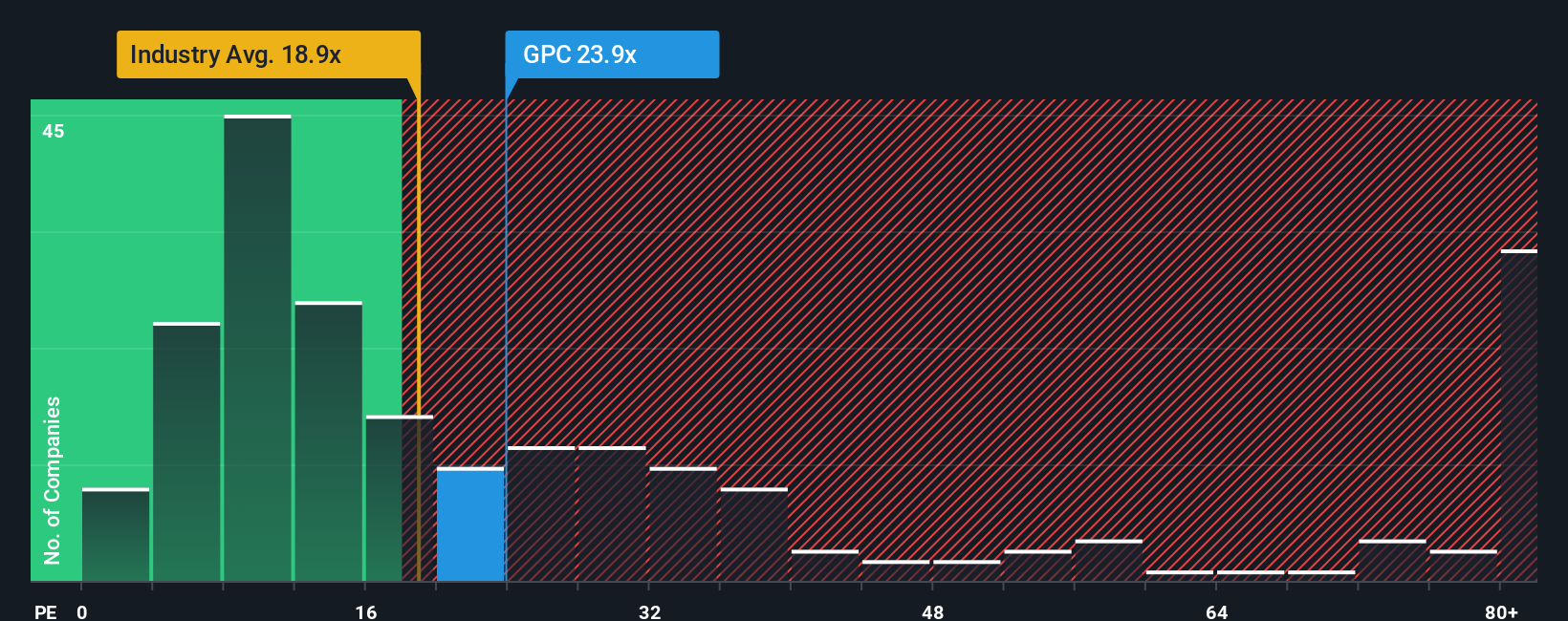

Another View: Multiples Tell a Different Story

While the fair value model suggests Genuine Parts is undervalued, a closer look at the price-to-earnings ratio paints a less optimistic picture. The company trades at 22.1x earnings, which is higher than both its peer average of 20.6x and the industry average of 18x. This is also above its fair ratio of 18.7x. This gap points to a premium that could signal valuation risk rather than opportunity. Is the market expecting more from Genuine Parts than the numbers can deliver?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Genuine Parts Narrative

If you see things differently or want to interpret the numbers yourself, you can shape an independent view for Genuine Parts in just a few minutes. Do it your way

A great starting point for your Genuine Parts research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Expand your investing playbook with handpicked opportunities you might be overlooking. Take action now to spot sectors and hidden gems with the potential to transform your portfolio.

- Seize high yields and dependable performance by checking out these 24 dividend stocks with yields > 3% with payouts above 3% that can add stability and growth to your income strategy.

- Supercharge your watchlist with these 26 AI penny stocks that harness the power of artificial intelligence and set the pace in tomorrow’s biggest tech breakthroughs.

- Capitalize on tomorrow’s success stories by uncovering these 848 undervalued stocks based on cash flows with strong cash flows that could be trading below their true worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GPC

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives