- United States

- /

- Specialty Stores

- /

- NYSE:GME

What Does GameStop’s Volatile 2025 Ride Mean for Shareholders After the Latest Earnings Report?

Reviewed by Bailey Pemberton

Are you wondering what to do with your GameStop shares after the latest rollercoaster moves? You are not alone. Whether you are holding tight, thinking of buying more, or just weighing your options, it pays to look past the hype and examine the numbers. GameStop's stock closed at $25.38 most recently, but that simple figure masks a year that's been anything but quiet. In just the past month, shares jumped 12.3%, only to dip 6.7% over the last week. For long-term holders, the ride has been even wilder, with a stunning 760.3% jump over the past five years. However, there was a more muted 1.5% gain across three years and even a 17.2% drop year-to-date.

So, what is driving all these moves? While headlines frequently swirl around GameStop's place in retail investing lore and shifting market moods, real value questions remain. For example, on a numerical “value score” based on six standard valuation checks, GameStop earns a 2 out of 6. That means it is only considered undervalued by two criteria, leaving plenty of debate about whether the price makes sense right now or if risk levels have truly changed.

To really make sense of where GameStop stands, it is important to dig into the numbers that matter and see how valuation methods stack up. But as useful as these scores and tools can be, there is an even sharper lens for understanding what the market might be missing, a subject we will cover at the end of the article.

GameStop scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: GameStop Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company's future cash flows and discounts them back to their present value. This aims to estimate what the business is truly worth today. For GameStop, this approach starts with the company's current free cash flow of $474.48 million and then looks ahead at anticipated growth each year.

Analysts generally provide up to five years of free cash flow forecasts, with later years extrapolated for a full decade. According to these projections, GameStop's free cash flow is estimated to climb to over $1.35 billion by 2035, with the following milestones along the way:

- 2026: $610.36 million

- 2028: $853.56 million

- 2030: $1.04 billion

- 2035: $1.36 billion

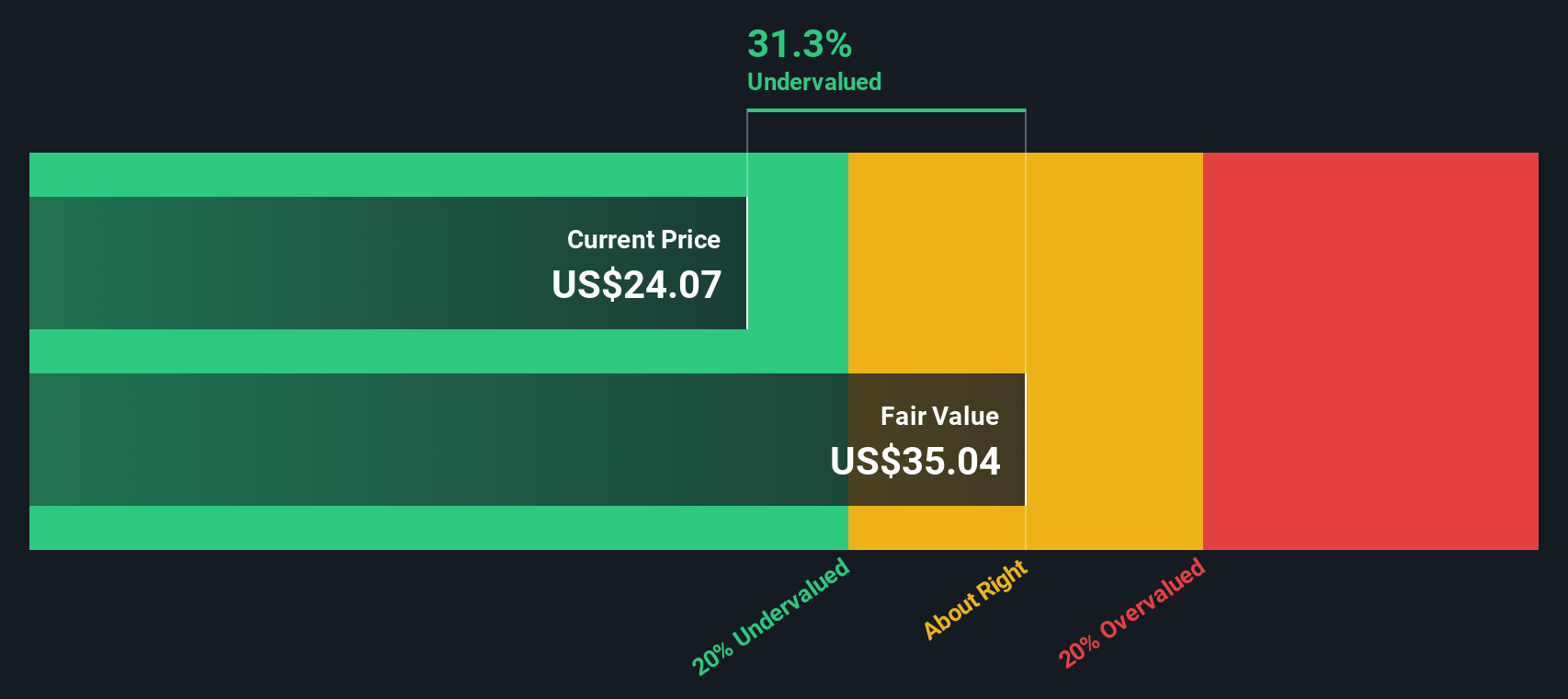

After these figures are discounted back to present terms, the DCF analysis estimates GameStop's intrinsic value per share at $35.18. With the current share price at $25.38, this valuation implies the stock is 27.8% undervalued at this time.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests GameStop is undervalued by 27.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: GameStop Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular valuation tool for profitable companies, as it measures how much investors are willing to pay for each dollar of a company’s earnings. When a company is generating consistent profits, the PE ratio can give a quick sense of whether its stock is reasonably valued compared to how much it actually earns.

Not all PE ratios are created equal. A “normal” or “fair” PE will depend on expectations for future growth and perceived risk. Companies with faster earnings growth or less risk often justify higher PE multiples. More uncertain, slow-growing firms trade at lower ratios.

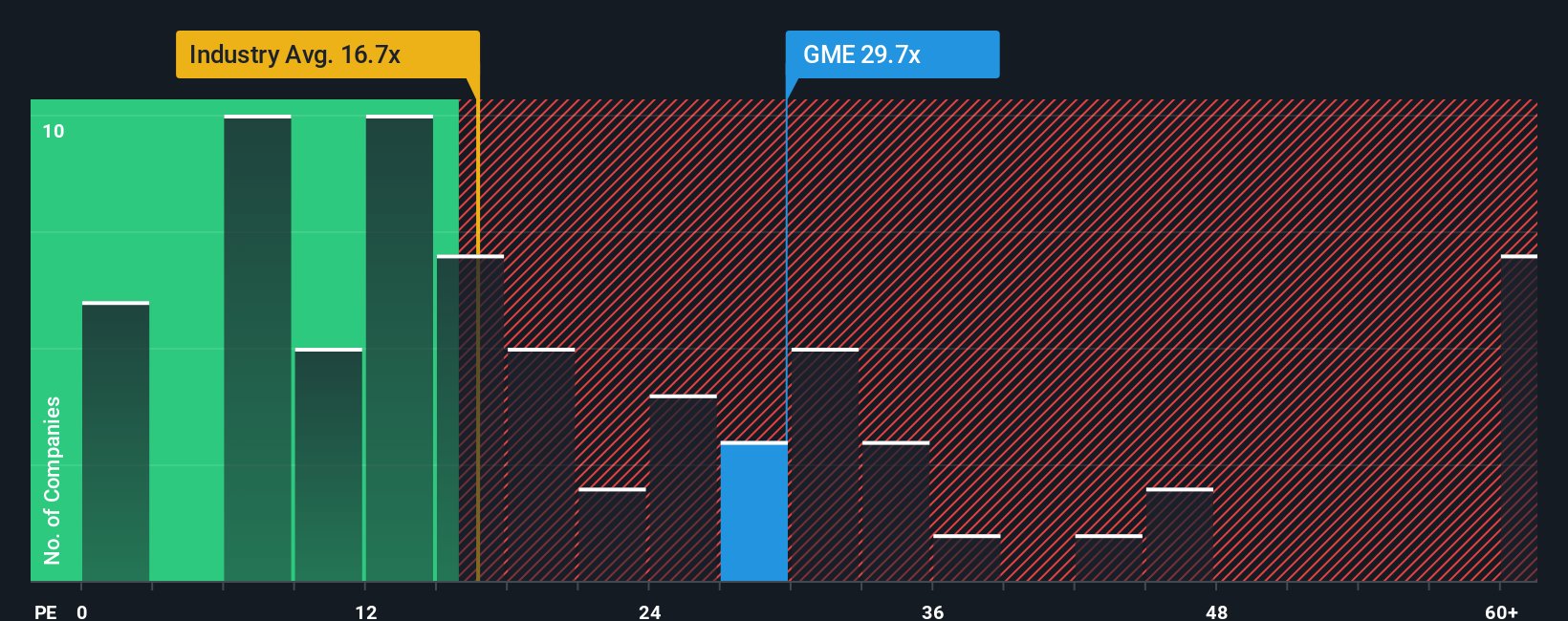

Today, GameStop trades at a PE of 31.4x. For comparison, the average specialty retail company in the industry trades at 17.3x, while the peer group average stands at 20.3x. On the surface, this makes GameStop look a bit expensive by traditional standards.

Simply Wall St’s proprietary “Fair Ratio” approach goes a step further than peer or industry averages. It adjusts for GameStop’s own earnings growth outlook, profit margins, risk profile, size, and industry. This provides a more dynamic benchmark that can indicate whether the current price accurately reflects the company’s specific strengths and challenges.

In this case, the difference between GameStop’s actual PE ratio and its calculated Fair Ratio is more than 0.10, pointing to the stock being valued above what the fundamentals and broader context would suggest is reasonable.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your GameStop Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are Simply Wall St’s unique tool that lets investors connect their own story or viewpoint about a company to the numbers they believe matter most, like future revenue, profit margins, and fair value estimates. This helps bring together personal insights and financial forecasts in one place.

Instead of just relying on ratios or historical data, a Narrative transforms your perspective on a company into concrete forecasts and an up-to-date fair value. This makes investment decisions more human and dynamic. Narratives are accessible through Simply Wall St’s Community page, used by millions of investors, and are designed to be easy to create and update, even as new information, such as earnings or breaking news, is released.

This approach empowers you to decide whether to buy or sell by comparing your Fair Value to the current share price and adapting your decisions as conditions change. For example, some investors see GameStop’s Bitcoin holdings and strong cash position as reasons to set Fair Value above $120. Others believe the best estimate is closer to $12, reflecting a range of perspectives you can weigh against your own.

For GameStop, however, we'll make it really easy for you with previews of two leading GameStop Narratives:

Fair Value: $120.00

Percentage Undervalued: 78.8%

Revenue Growth Rate: 0%

- Highlights GameStop’s robust financials, including a strong cash position of $6.4 billion, no long-term debt, and a strategic Bitcoin holding worth over $500 million. This positions the company for market shocks and digital transformation.

- Emphasizes significant insider and retail ownership, with 75 million shares directly registered and high retail engagement helping to reduce short-selling and drive potential price surges.

- Credits successful leadership, community resilience, aggressive cost controls, and a shift from legacy retail to a crypto-invested model as drivers of long-term growth opportunity.

Fair Value: $11.91

Percentage Overvalued: 113.2%

Revenue Growth Rate: 0%

- Points to ongoing challenges from the digital transition and online competition, with recent revenue declines and only brief profitability following major cost cuts.

- Notes GameStop’s moves into crypto and digital payment strategies such as Buy Now, Pay Later, while recognizing these as bold but risky adaptations that add to the business’s uncertainty.

- Warns that the meme stock phenomenon and speculative community backing create extreme volatility, making the stock’s current price difficult to justify on fundamentals alone for long-term investors.

Do you think there's more to the story for GameStop? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GME

GameStop

A specialty retailer, provides games and entertainment products through its stores and e-commerce platforms in the United States, Canada, Australia, and Europe.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success