- United States

- /

- Specialty Stores

- /

- NYSE:GME

GameStop (GME): Assessing Valuation After Revenue Beat and Pokémon-Driven Earnings Momentum

Reviewed by Kshitija Bhandaru

GameStop (GME) surprised the market with stronger-than-expected revenue growth in its latest quarter. This was driven by a well-timed Pokémon distribution event that brought more customers into stores and energized its core fan base.

See our latest analysis for GameStop.

GameStop’s upbeat quarter has invigorated investor sentiment, supported by the buzz of its latest Pokémon event and increased focus on collectibles. While the stock delivered a solid 21.8% year-over-year surge in revenue, the latest share price of $27.22 reflects only modest short-term momentum, and the total shareholder return remains just 0.28% over the past year. Momentum is building, yet investors continue to weigh the company’s evolving business model against a mixed long-term track record.

If you’re watching GameStop’s moves and want to broaden your search, take a moment to discover fast growing stocks with high insider ownership

With all this energy and a 21.8% surge in revenue, is GameStop stock still trading at a discount to its true value, or is the recent buzz already reflected in the current price? Is there a buying opportunity, or has the market already priced in future growth?

Most Popular Narrative: 77.3% Undervalued

GameStop’s narrative fair value sits at $120, nearly quadruple its last close of $27.22, pointing to a huge valuation gap. This sets the stage for a closer look at the story that is powering such a bold outlook from the retail investor community.

GameStop’s Q1 2025 financials, combined with an impressive shareholder community, just showed its takes-money-to-buy-whiskey strategy at work. This demonstrates its status as a compelling investment, as the retail investors have been saying for years while facing a challenging environment with legacy media, bots, social media manipulation, and hedge funds. GameStop delivered an adjusted EPS of $0.17, beating estimates by 325%, and achieved a $44.8 million net profit, reversing last year’s $32 million loss.

Curious which financial moves justify this aggressive fair value? The narrative centers on dramatic profit swings, significant cost cuts, and an unconventional asset bet that almost no other retailer could attempt. Interested in how those bold choices are changing the valuation story? Click for the full breakdown behind GameStop’s high-stakes transition and the number that captured retail investors' attention.

Result: Fair Value of $120 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant risks remain, including ongoing volatility in the crypto market and uncertainty around whether cost cuts can drive sustainable growth.

Find out about the key risks to this GameStop narrative.

Another View: Are the High Hopes Justified by the Numbers?

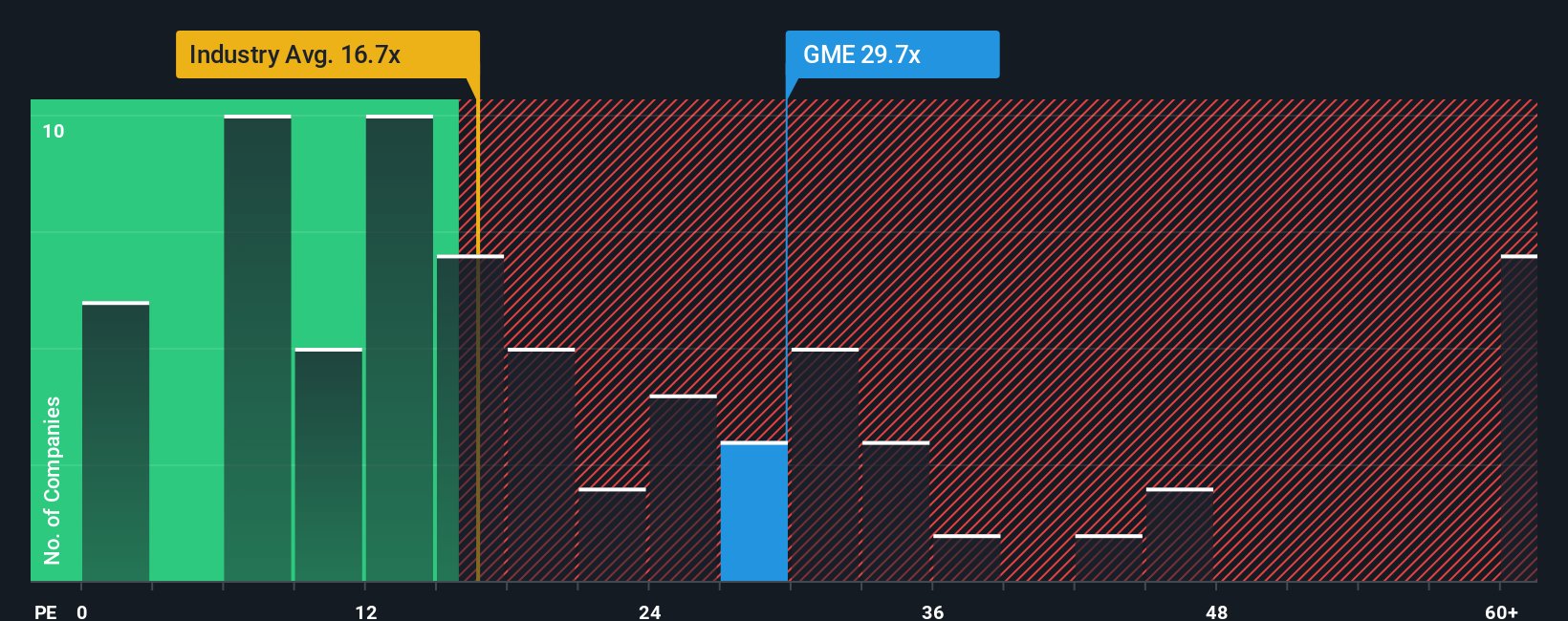

While the retail community sees big upside, a closer look at GameStop’s valuation compared to its peers suggests potential hurdles. Its price-to-earnings ratio stands at 33.6x, which is significantly higher than the US Specialty Retail industry average of 17.2x and the peer average of 20.7x. This elevated valuation means the market expects impressive growth or transformation; otherwise, investors risk overpaying for future performance. Can GameStop’s execution keep up with such lofty expectations, or will its multiples be forced to come down?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GameStop Narrative

Not convinced by the crowd’s take or looking to run your own numbers? You can analyze GameStop’s story for yourself in just a few minutes and Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding GameStop.

Looking for More Investment Ideas?

Smart investors know that the biggest winners are often hiding just beyond the headlines. Don’t limit yourself. Take action now so you never miss out on game-changing opportunities in dynamic markets.

- Capture potential with these 914 undervalued stocks based on cash flows that the market may be overlooking while others focus on yesterday’s favorites.

- Target reliable income by checking out these 19 dividend stocks with yields > 3% offering attractive yields and solid financials for a steadier portfolio.

- Spot emerging trends early. Pursue the future of healthcare by reviewing these 31 healthcare AI stocks powering tomorrow’s medical breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GME

GameStop

A specialty retailer, provides games and entertainment products through its stores and e-commerce platforms in the United States, Canada, Australia, and Europe.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success