- United States

- /

- Specialty Stores

- /

- NYSE:GME

Analyzing GameStop’s Value After a 12% Drop and Bitcoin Strategy News

Reviewed by Bailey Pemberton

- Curious if GameStop is still a hidden gem or just holding onto meme stock fame? Let’s break down what’s really driving interest in the stock right now.

- GameStop’s shares have been on a roller coaster, dropping 12.2% in the past month with a year-to-date move of -27.3%. The five-year return still stands at a jaw-dropping 660.6%.

- Major headlines have been swirling around renewed trading activity and retail investor energy, especially after high-profile social media posts and a surge of trading volumes spurred by online communities.

- The company currently scores 2 out of 6 on our valuation checks. This suggests there’s a lot more to uncover about what really drives GameStop’s value. Stay tuned as we dive into the main valuation approaches, plus a twist on how to really judge whether it’s worth your hard-earned cash.

GameStop scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: GameStop Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a business by projecting its future cash flows and discounting them back to today’s dollar value. This approach aims to capture the long-term earning power of the company based on realistic growth and profitability assumptions.

For GameStop, the model uses its most recent Free Cash Flow of $474.48 million as a starting point. Analysts have provided growth estimates for the next five years. After that, Simply Wall St extrapolates the numbers. For example, the company’s free cash flow is forecast to reach approximately $1.36 billion by 2035. Annual projected growth rates gradually slow from 28.6% in the near term to around 4.1% by the end of the projection period.

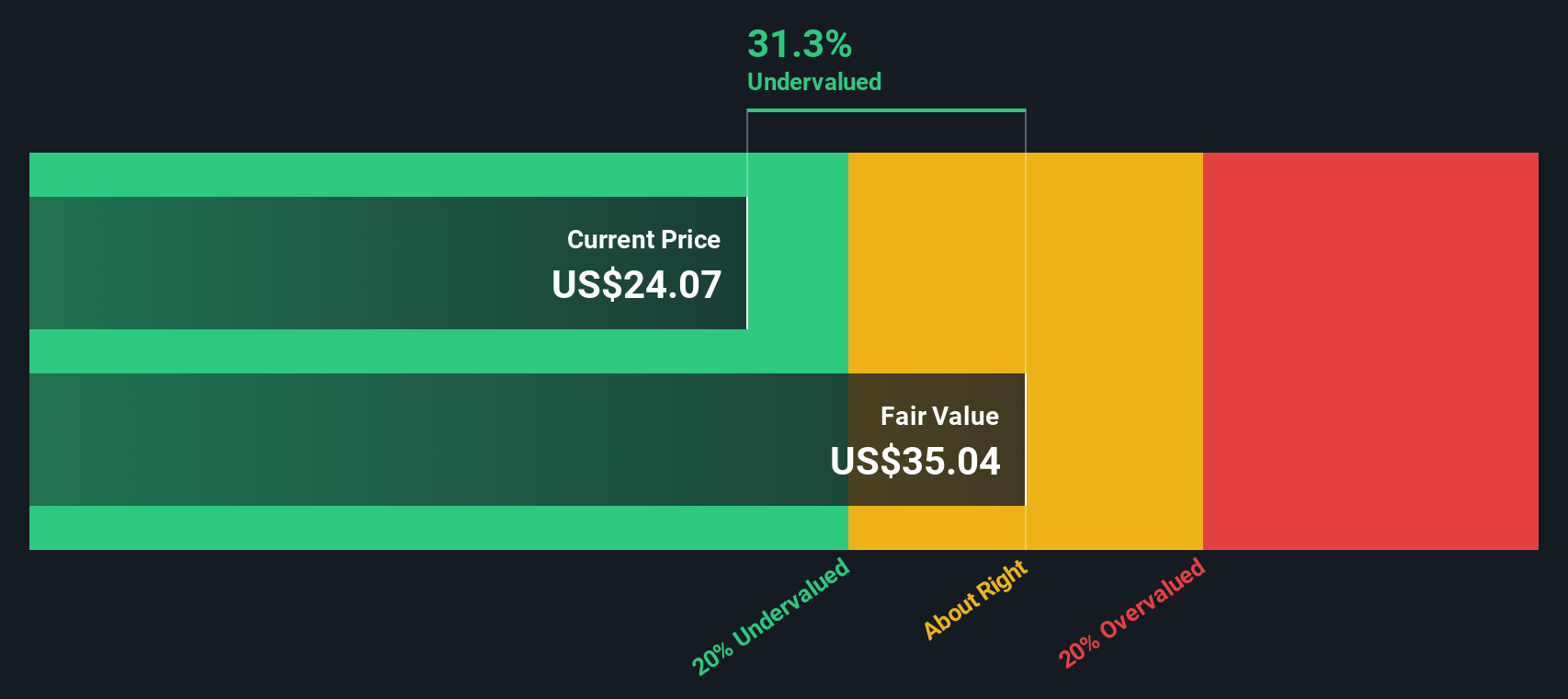

Based on these inputs, the DCF model calculates an intrinsic value of $35.13 per share. With GameStop currently trading at a 36.5% discount to this estimate, the stock appears to be undervalued by this measure.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests GameStop is undervalued by 36.5%. Track this in your watchlist or portfolio, or discover 838 more undervalued stocks based on cash flows.

Approach 2: GameStop Price vs Earnings

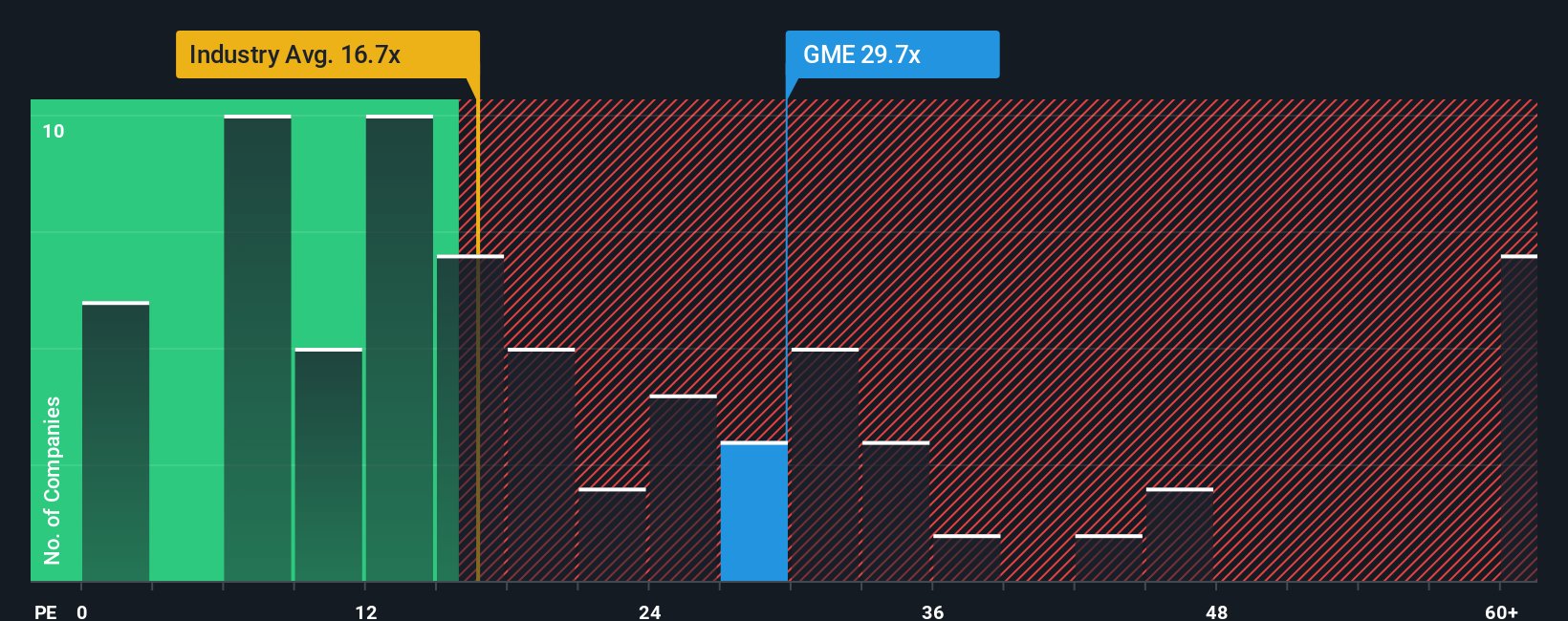

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies because it tells investors how much they are paying for each dollar of earnings. Generally, the PE ratio helps gauge whether the stock is overpriced or underpriced relative to how much profit the company makes.

What counts as a "normal" or "fair" PE ratio depends on growth prospects and risk. Companies expected to grow quickly or those considered less risky often trade at higher PEs, while slower growth or more uncertainty typically means a lower ratio is warranted.

Right now, GameStop is trading at a PE ratio of 27.6x. That is noticeably higher than both the specialty retail industry average of 16.7x and the peer group average of 18.0x. On the surface, this suggests that GameStop's stock might be more expensive than its competitors based on current earnings.

But rather than just comparing to those averages, Simply Wall St calculates a "Fair Ratio." This proprietary metric factors in GameStop's growth rates, risk profile, profit margins, industry trends, and company size. It is a more tailored benchmark that looks beyond basic comparisons. By using the Fair Ratio, investors get a more accurate sense of whether the current price reflects the company's true prospects and risks.

Since Simply Wall St’s Fair Ratio for GameStop is nearly identical to its actual PE ratio, the stock appears to be priced just about right relative to its core fundamentals and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1412 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your GameStop Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives give you the power to move beyond static numbers, letting you frame an investment as a story, based on your perspective of how the company’s future could unfold and what that means for its revenue, profits, and margins.

Instead of only relying on traditional formulas, Narratives help you connect the company’s journey to your financial outlook, translating your beliefs about GameStop’s direction into an estimated fair value. They are easy to access on Simply Wall St’s Community page, where investors from all backgrounds share and refine their stories, making this a powerful crowdsourced tool used by millions.

With Narratives, you can see how fair value compares to the current share price and decide if now is the right moment to buy or sell. Because these viewpoints update as soon as new facts or earnings are released, you always have a dynamic pulse on the market.

For example, some investors believe GameStop could be worth as much as $120 per share if its bold Bitcoin strategy pays off, while others, focused on traditional earnings, see a fair value closer to $12.

For GameStop, here are previews of two leading GameStop Narratives:

- 🐂 GameStop Bull Case

Fair value: $120.00

Undervalued by: 81.4%

Revenue growth rate: 0%

- GameStop’s solid Q1 2025 results, strong cash reserves, and strategic Bitcoin investment may support enhanced long-term value.

- Major cost-cutting, leadership commitment, and 25% of shares held by retail investors signal substantial resilience against volatility and short-selling pressure.

- The company’s pivot from legacy retail to a cash-rich, crypto-focused business model could create growth opportunities as its loyal shareholder community continues to support bold strategies.

- 🐻 GameStop Bear Case

Fair value: $11.91

Overvalued by: 87.2%

Revenue growth rate: 0%

- GameStop’s efforts to pivot digitally, cost cutting, and new payment offerings have not prevented sizeable declines in revenue or fully shifted its challenging business model.

- Investments in cryptocurrency add unpredictability and may not provide tangible, long-term value; meanwhile, the company faces mounting competition and a slow market recovery.

- The stock’s movement is heavily influenced by retail speculation and meme-driven momentum, resulting in high volatility and a disconnect from underlying fundamentals.

Do you think there's more to the story for GameStop? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GME

GameStop

A specialty retailer, provides games and entertainment products through its stores and e-commerce platforms in the United States, Canada, Australia, and Europe.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives