- United States

- /

- Specialty Stores

- /

- NYSE:GAP

Is Gap Stock Still a Bargain After Brand Reinvention and Leadership Changes?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Gap stock is a bargain right now, you are not alone. Let us break down what is going on beneath the surface.

- The share price has seen some turbulence lately, slipping 1.1% over the last week but climbing 8.9% in the past month. It has also shown a solid 12.3% return over the last year and an impressive 148.1% jump in the last three years.

- Recent headlines have focused on Gap's brand reinvention efforts and leadership changes, which have sparked fresh investor interest. This new direction, along with strategic partnerships and evolving consumer trends, is shifting how the market values the stock.

- Currently, Gap clocks a 5 out of 6 valuation score, highlighting significant value across most of our key checks. Next, we will break down what goes into this score, explore different ways to gauge value, and reveal an even more insightful approach to valuation before we wrap up.

Approach 1: Gap Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a method for estimating a company’s intrinsic value by projecting future cash flows and discounting them back to present value. This helps investors understand what a stock might really be worth based on how much cash it can generate over time.

For Gap, the current Free Cash Flow stands at $773 million. Analyst estimates provide projected cash flows for the next five years, starting with $824 million in 2026 and gradually increasing to $837 million by 2030. Beyond year five, Simply Wall St extrapolates these figures and expects steady growth in annual cash flows through 2035. All values are in US dollars.

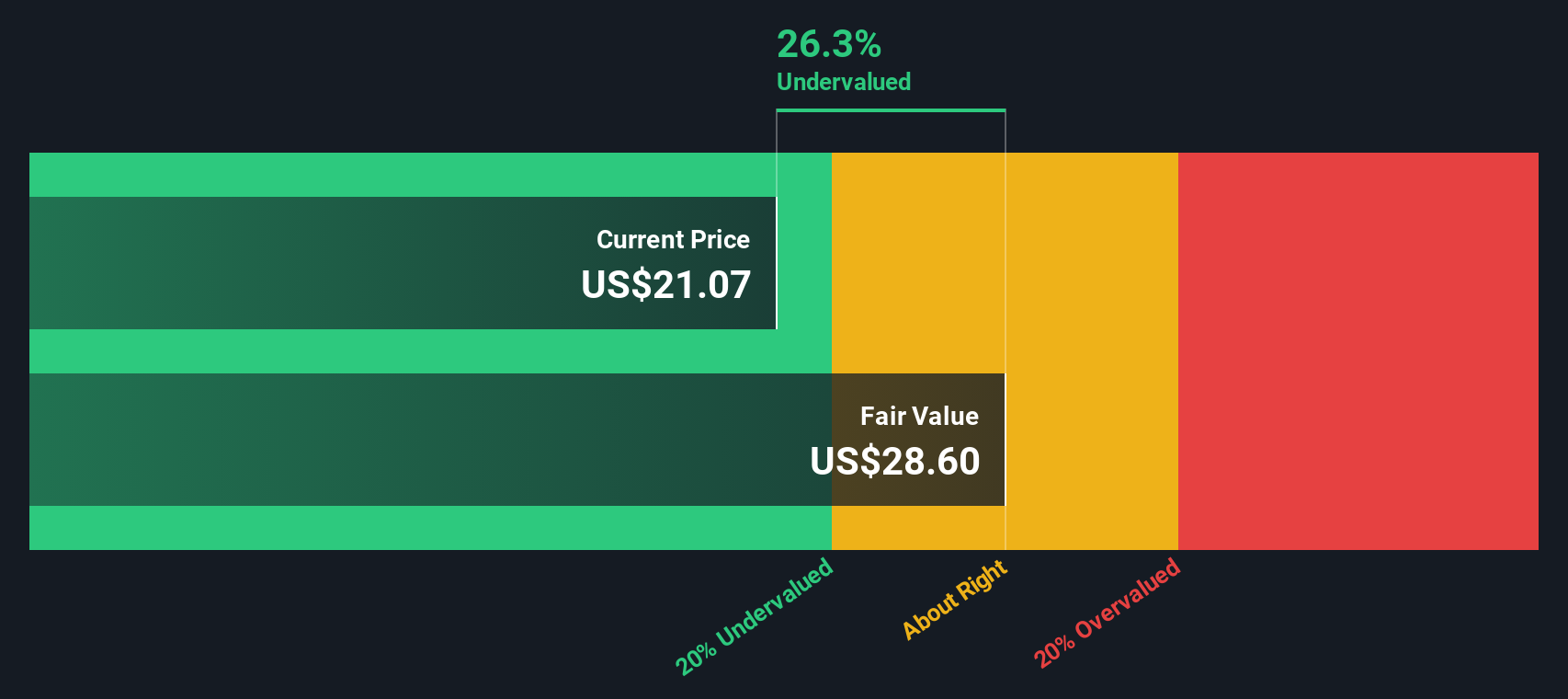

Based on these cash flow estimates and the 2 Stage Free Cash Flow to Equity approach, Gap’s DCF analysis suggests an intrinsic fair value of $29.88 per share. Currently, the DCF model indicates the stock is trading at a 21.6% discount compared to its calculated value, suggesting that Gap shares are undervalued relative to what its future cash flows suggest it is worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Gap is undervalued by 21.6%. Track this in your watchlist or portfolio, or discover 838 more undervalued stocks based on cash flows.

Approach 2: Gap Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a popular way to value profitable companies like Gap, as it compares the current share price to how much the business is earning. For companies generating steady profits, the PE ratio gives investors a quick sense of how much they are paying for each dollar of earnings.

What qualifies as a “normal” or “fair” PE ratio depends on several factors. Companies with above-average growth prospects or lower risk usually trade at a higher PE ratio, while slower-growing or riskier businesses tend to have lower PEs. Market sentiment, underlying profitability, and the broader economic environment also play a role in determining what investors are willing to pay.

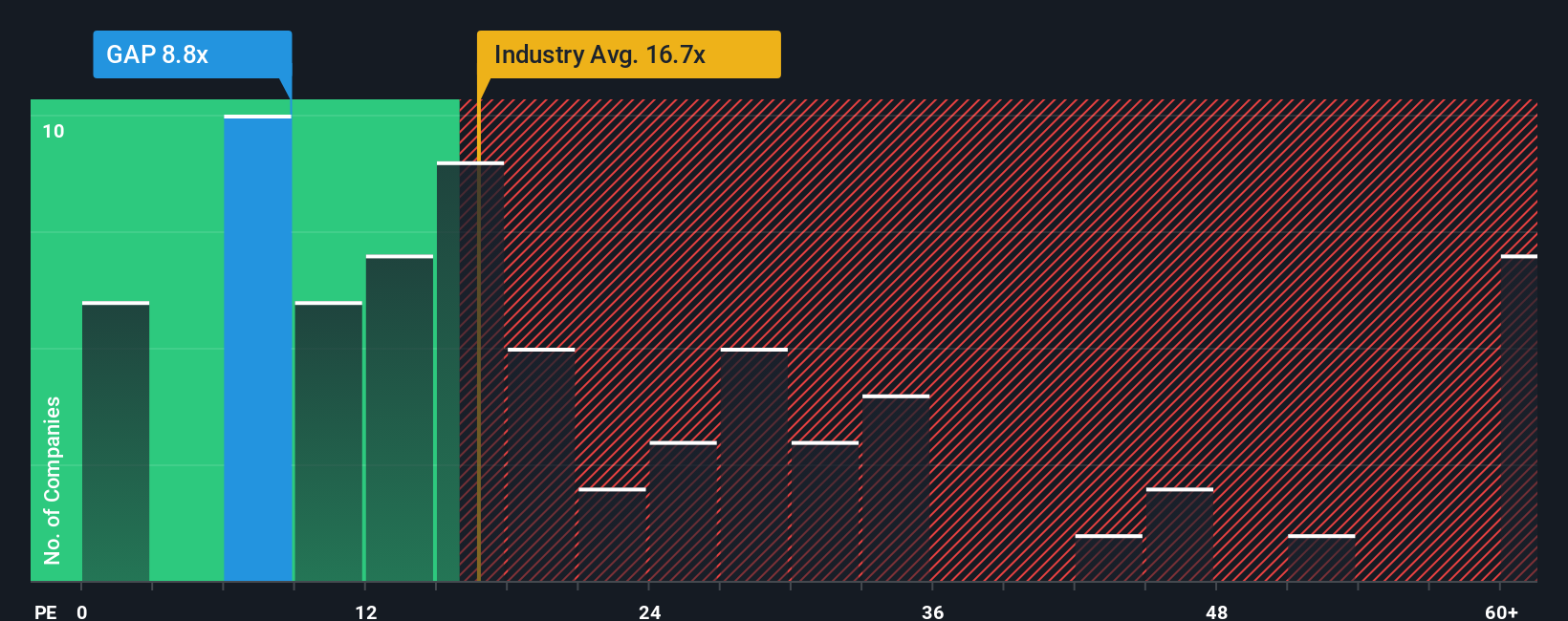

As of now, Gap’s PE ratio stands at 9.8x. This is noticeably below the Specialty Retail industry average of 16.4x and also well under the peer group average of 22.6x. At first glance, this might suggest Gap is undervalued relative to its peers and sector. However, looking solely at the industry average or peers can be misleading because each business has its own unique mix of growth rates, profit margins, size, and risks.

This is where the Simply Wall St Fair Ratio comes in. The Fair Ratio is designed to take a holistic view by factoring in Gap's earnings growth, profit margins, market cap, risks, and its place within the industry. Because it captures variables that simple peer or industry comparisons miss, it offers a more nuanced estimate of what multiple Gap should reasonably attract right now. For Gap, the Fair Ratio is 16.7x. Since this is significantly higher than Gap’s current PE ratio of 9.8x, it suggests the stock could be undervalued on this measure as well.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Gap Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, story-driven approach to investing that lets you frame your own perspective about a company’s future by linking its story, your expectations for revenue and earnings, and your resulting fair value estimate, all in one place.

Narratives bridge the gap between surface-level stock numbers and the business reality behind them. On Simply Wall St, millions of investors use Narratives in the Community page to quickly translate their personal outlook for Gap into a projected valuation, automatically connecting assumptions (like sales growth, expanding margins, or risk concerns) with a real-world fair value.

This tool makes it easy to see when your view signals a “buy,” “hold,” or “sell,” just by comparing your Narrative-driven fair value with the current share price. Even better, Narratives update dynamically as news and earnings data arrives, so your perspective stays relevant and actionable.

For example, some investors expect Gap’s steady margin improvement and digital expansion to drive a fair value near $32, while others, wary of persistent competition and margin risks, see just $19. This highlights how different facts and assumptions create very different stories and investment decisions.

Do you think there's more to the story for Gap? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GAP

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives