- United States

- /

- Specialty Stores

- /

- NYSE:GAP

Gap (GPS) Valuation in Focus Following Earnings and Renewed Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Gap.

Gap’s share price recently jumped 7.5% in a single day and is now up over 11% this week, marking some of its strongest momentum this year. While headlines around the latest earnings and operational improvements have sparked renewed interest, the stock has delivered a steady 1-year total shareholder return of nearly 14% and more than doubled investors’ money over three years. In short, momentum is clearly building, as recent gains suggest a shift in market sentiment around Gap’s growth and risk profile.

If you’re watching this resurgence and want to broaden your search, it is a great moment to discover fast growing stocks with high insider ownership.

With shares gaining ground and recent results signaling improvement, investors now face a familiar question: is Gap currently trading at an attractive price, or is the market already factoring in stronger growth ahead?

Most Popular Narrative: 2.2% Overvalued

Gap’s widely followed narrative pegs fair value slightly below its latest close, suggesting the market is now pricing the brand's forward-looking improvements aggressively. With a newly raised analyst price target and confidence in management, the attention now turns to detailed drivers of value.

Operational discipline, portfolio optimization, and sustainable sourcing initiatives position Gap for future growth and enhanced competitive advantage. Persistent operational and strategic challenges, including trade risks, brand underperformance, inventory missteps, and rising competition, threaten profitability, revenue growth, and market positioning.

Curious what powers that razor-thin margin above fair value? Hidden in this outlook are key forward assumptions about leadership’s ability to expand profits, investor-required returns, and the big bet on future market share gains. The narrative’s case hinges on a detailed forecast for margins and revenue. Want to see what numbers could tip the scales?

Result: Fair Value of $26.03 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tariff pressures and continued brand underperformance at Athleta could challenge Gap’s steady margin gains and weigh on future earnings certainty.

Find out about the key risks to this Gap narrative.

Another View: What Do Earnings Multiples Say?

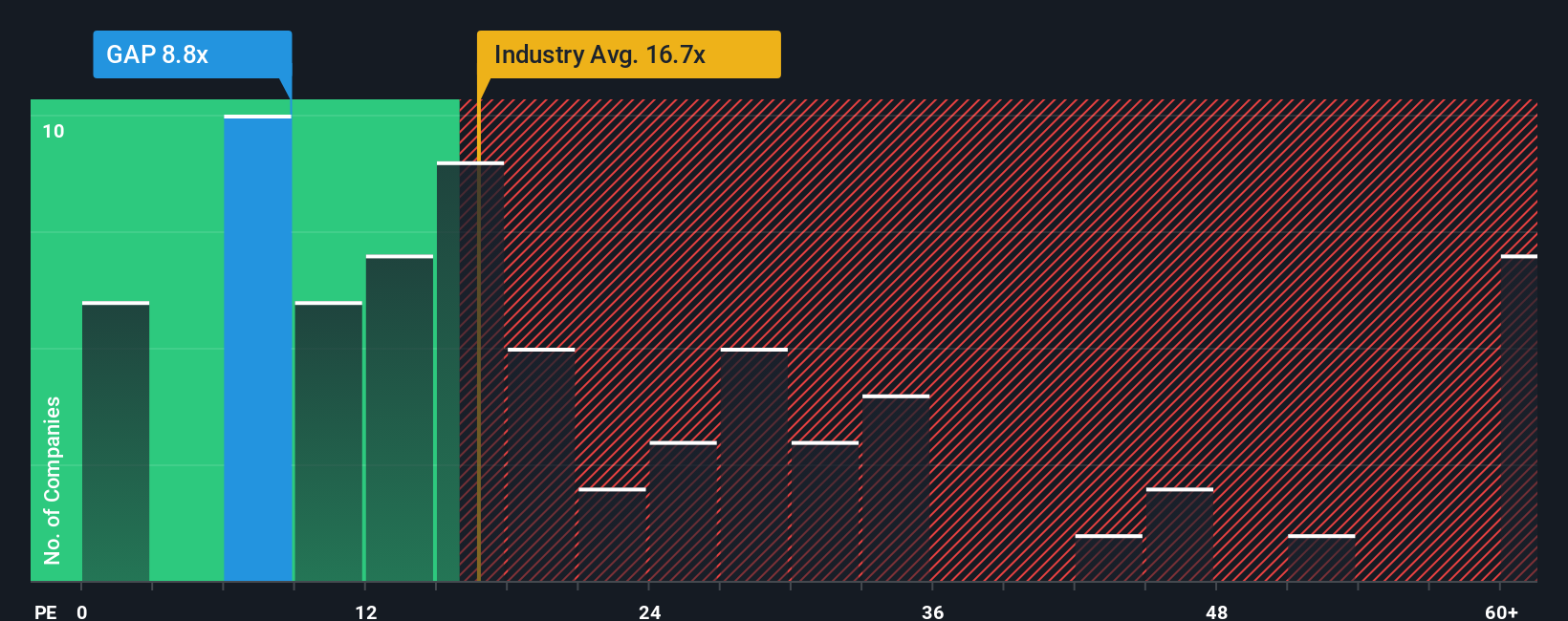

Taking a closer look at Gap’s valuation using earnings ratios, the stock looks appealing beside industry averages. At 11.6 times earnings, Gap trades much lower than both its peer average of 21.7 and the industry’s 18 times. The fair ratio, calculated at 17.5 times, suggests the market could eventually close this gap. This could potentially signal opportunity or highlight risk if sentiment shifts. Could the discount be pointing to untapped value, or is the market signaling caution for a reason?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Gap Narrative

If you want to dig deeper or piece together your own view from the facts and figures, building a personalized narrative takes just a few minutes, so why not Do it your way?

A great starting point for your Gap research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Opportunities are everywhere, and the next big winner could be outside your radar. Use the Simply Wall Street Screener to spot trends, strong returns, or big breakthroughs before everyone else.

- Spot high-yield opportunities and secure steady income streams with these 14 dividend stocks with yields > 3%, which boasts yields over 3%.

- Tap into future tech front-runners by targeting these 26 AI penny stocks, making strides in artificial intelligence innovation and adoption.

- Hunt for hidden value where the market has yet to catch up by reviewing these 924 undervalued stocks based on cash flows, based on robust cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GAP

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success