Etsy (ETSY): Evaluating Valuation as Holiday Campaigns and Product Updates Target Growth in Shifting Market

Reviewed by Simply Wall St

Etsy is turning up the volume on its 2025 holiday season, unveiling a multi-channel marketing campaign focused on personalized gifting and emotional connections. At the same time, the company is piloting instant seller payouts and building new digital partnerships.

See our latest analysis for Etsy.

Etsy’s share price has been on a rollercoaster this year, rallying over 11% year-to-date but dropping 14% in the past month as investor sentiment adjusted to slowing buyer growth and a looming CEO transition. Recent earnings and marketing innovation point to efforts to reignite momentum, though the longer-term total shareholder return remains deep in the red since 2021.

If you’re interested in what else is drawing attention on Wall Street, now is an ideal time to expand your opportunities and discover fast growing stocks with high insider ownership

With shares down significantly from their highs and new strategies rolling out, investors must ask whether Etsy is undervalued at current levels or if the market has already accounted for all the growth that lies ahead.

Most Popular Narrative: 13.3% Undervalued

The narrative’s fair value pegs Etsy’s shares at $68.19, which is about 13% above the last close. This sets the expectation of upside if performance matches analysts’ forecasts.

Etsy's increasing investment in AI-driven personalization and recommendations, leveraging large language models to understand buyer interests at a deeper level, is designed to materially boost conversion rates, buyer frequency, and lifetime value. This strategy supports future revenue growth and improved margins.

Etsy’s future, according to this narrative, pivots on ambitious upgrades in buyer engagement and a radical financial transformation. Wondering which precise metrics could swing the calculation? The secrets behind loftier earnings targets and higher margins are revealed only in the full story.

Result: Fair Value of $68.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, declining buyer engagement or persistent drops in gross merchandise sales could quickly challenge projections for Etsy’s sustained long-term growth and profitability.

Find out about the key risks to this Etsy narrative.

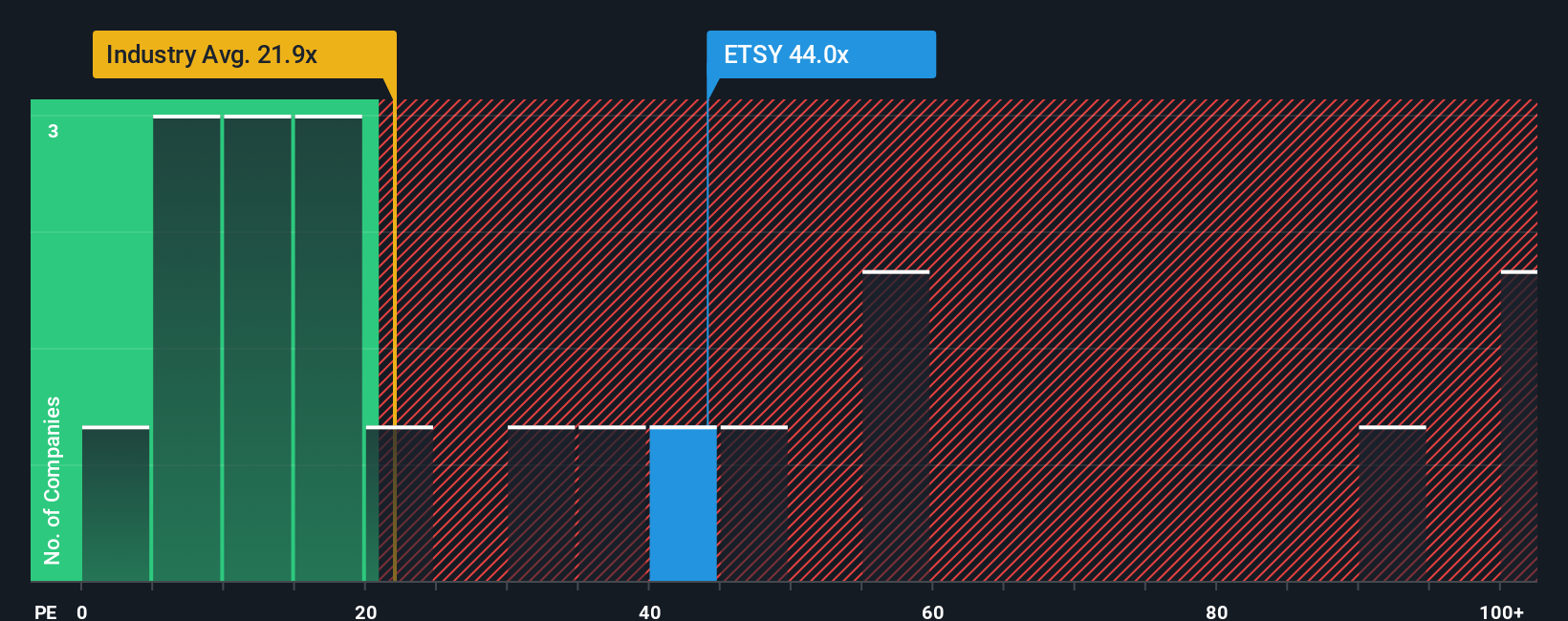

Another View: Market Ratios Tell a Different Story

Despite the broader optimism, Etsy’s current price-to-earnings ratio sits at 32x, which is much higher than both the peer average of 18.8x and the multiline retail industry average of 19.9x. Compared to a fair ratio of 22.6x, Etsy’s shares appear expensive by several yardsticks. Could this premium signal future potential, or does it point to increased valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Etsy Narrative

If you’re keen to explore the numbers firsthand or want to craft a story that fits your investing perspective, you can easily build your own narrative in just a few minutes, your way: Do it your way

A great starting point for your Etsy research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

You have plenty of potential winners waiting beyond Etsy. Now is your chance to jump ahead and let the Simply Wall Street Screener open fresh doors for you.

- Boost your search for consistent income and tap into opportunity with these 16 dividend stocks with yields > 3% offering strong yields beyond 3%.

- Uncover tomorrow’s tech leaders by seizing your spot among these 25 AI penny stocks, powering progress in artificial intelligence advancements.

- Capitalize on attractive entry points while they last by targeting these 874 undervalued stocks based on cash flows driven by compelling cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Etsy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETSY

Etsy

Operates two-sided online marketplaces that connect buyers and sellers worldwide.

Moderate risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives