- United States

- /

- Specialty Stores

- /

- NYSE:BOOT

Boot Barn Holdings: Valuation Insights Following 500th Store Milestone and Strong Quarterly Earnings

Reviewed by Simply Wall St

Boot Barn Holdings reached a major milestone this month by opening its 500th store, while also reporting quarterly earnings that beat expectations. Investors are taking note as the company continues to expand nationwide.

See our latest analysis for Boot Barn Holdings.

After celebrating its 500th store opening, Boot Barn Holdings saw momentum build in its share price, notching a 6.26% gain in the past day and a 7.33% jump over the last week. The stock has rewarded patient investors with a 26.44% total return over the past year and an impressive 345.71% total return across five years. This highlights both short-term excitement and long-term growth strength.

If recent milestones have you interested in other standout performers, it might be the perfect moment to broaden your view and discover fast growing stocks with high insider ownership

With solid growth, rising analyst targets and excitement over major milestones, is Boot Barn Holdings’ stock still trading at an attractive value, or has the market already priced in the next stage of its expansion?

Most Popular Narrative: 19.1% Undervalued

While Boot Barn Holdings recently closed at $183.90, the most widely followed narrative sets fair value considerably higher, hinting that market momentum may still be underestimated. This sharp difference points to bullish expectations that transcend recent share price gains.

Robust store expansion into underpenetrated markets, particularly in population-growing regions, is driving higher-than-expected new store performance, strong customer acquisition, and increased sales productivity. This expansion provides an ongoing tailwind for revenue and positions Boot Barn to benefit from broader demographic shifts, supporting long-term top-line growth.

Want to know what’s fueling this aggressive price target? The narrative is built on ambitious revenue growth, margin trends, and faith in outpacing the market’s average retailer. Bold predictions and strategic store bets are just the start. Discover how these elements combine to justify such a strong fair value calculation.

Result: Fair Value of $227.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on aggressive store growth and potential shifts in consumer shopping habits could quickly challenge Boot Barn’s positive trajectory.

Find out about the key risks to this Boot Barn Holdings narrative.

Another View: Is the Market Already Pricey?

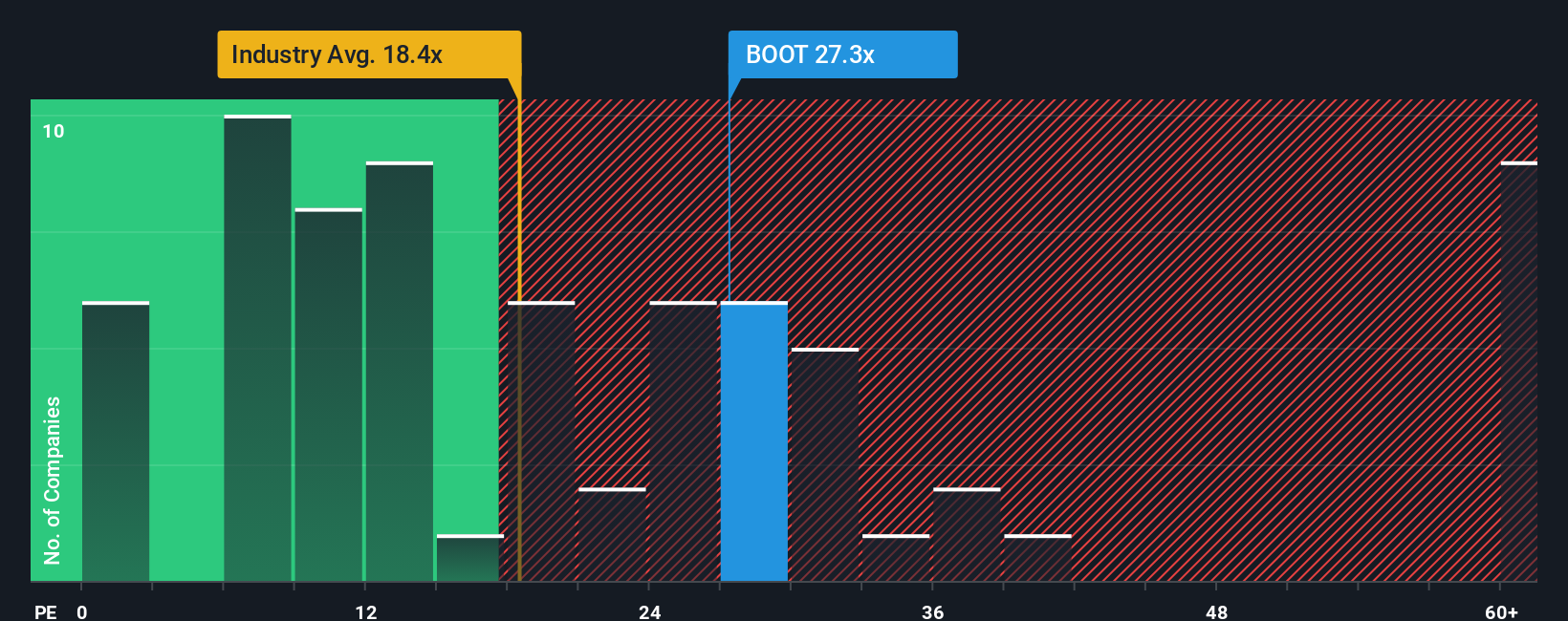

While the fair value narrative suggests Boot Barn Holdings remains undervalued, a look at the current price-to-earnings ratio tells a different story. The company’s ratio of 26.9x is significantly higher than its peer average of 11.2x, the US Specialty Retail industry average of 18.2x, and even the estimated fair ratio of 18.5x.

This wide gap implies that investors may be paying a premium for future growth, introducing valuation risk if expectations are not met. Could the enthusiasm for Boot Barn’s momentum be causing the market to overshoot its true worth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Boot Barn Holdings Narrative

If this perspective doesn’t quite fit your view or you value independent research, you can develop your own take on Boot Barn Holdings quickly by using Do it your way.

A great starting point for your Boot Barn Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Opportunities in the market are always shifting. Expanding your search now can help you spot the next breakout winner before everyone else catches on. Don’t miss your chance to act.

- Capture recurring income with these 15 dividend stocks with yields > 3%, featuring equities with reliable yields above 3% to strengthen your portfolio’s cash flow.

- Position yourself at the forefront of artificial intelligence advancements by reviewing these 26 AI penny stocks. Innovation shapes tomorrow’s leading companies.

- Secure strong value potential by choosing from these 927 undervalued stocks based on cash flows, a selection based on robust cash flow analysis and attractive prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boot Barn Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BOOT

Boot Barn Holdings

Operates specialty retail stores in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives