- United States

- /

- Specialty Stores

- /

- NYSE:BOOT

Boot Barn (BOOT) Margin Gains Reinforce Bullish Narrative Despite High Valuation

Reviewed by Simply Wall St

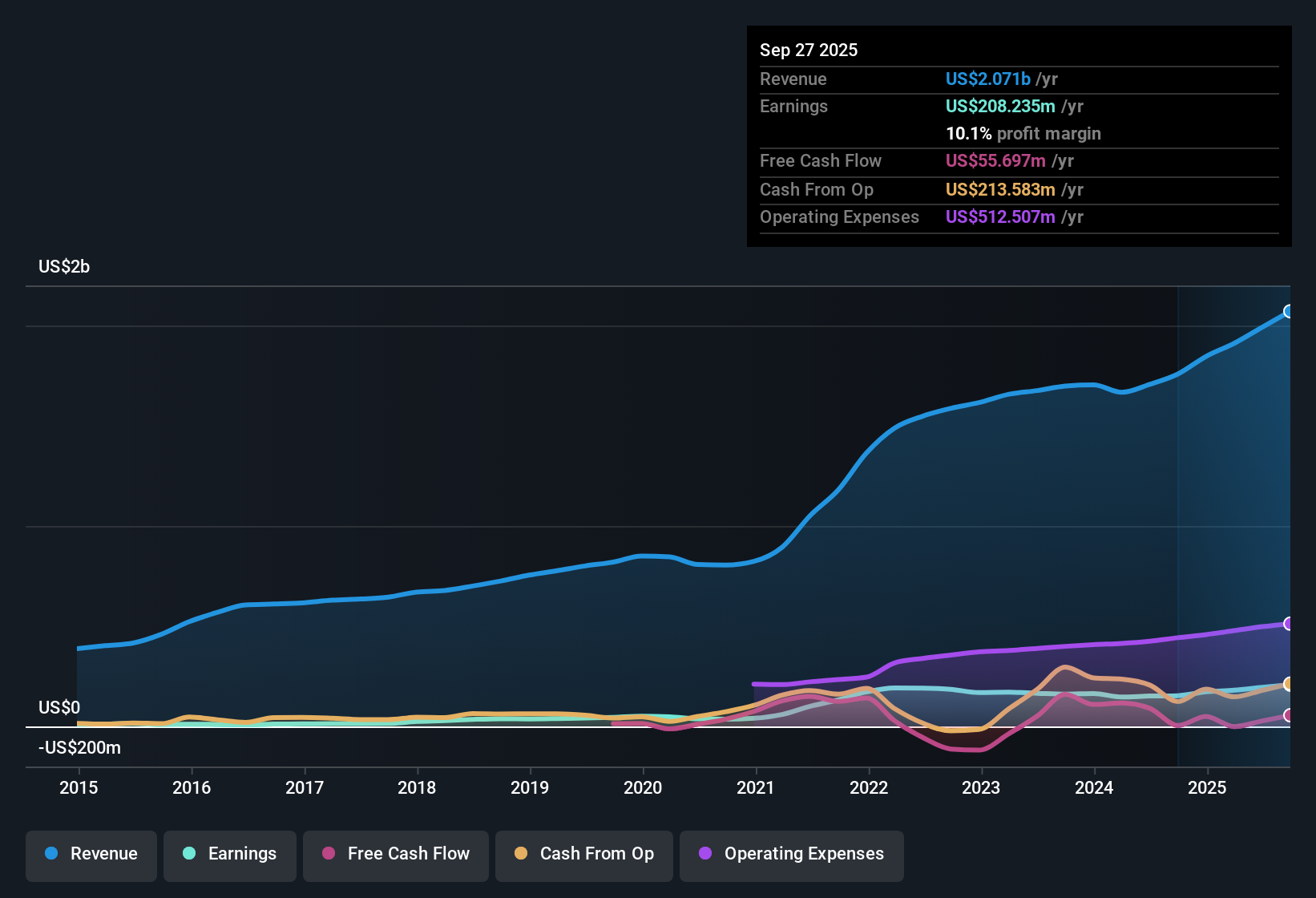

Boot Barn Holdings (BOOT) reported net profit margins of 10.1%, up from last year’s 8.7%, with earnings growth reaching 35.8% over the past year. This figure is well ahead of its five-year average of 14.9% per year. Revenue is now forecast to grow 12.6% annually, exceeding the broader US market projection of 10.3%, while future EPS growth of 11.8% per year falls behind the market average of 15.7%. With consistently expanding profit and revenue numbers, investors are likely to focus both on margin improvements and the recent acceleration in earnings. These factors must be balanced against a premium valuation and more moderate growth forecasts going forward.

See our full analysis for Boot Barn Holdings.Next, we will put these numbers side by side with the most widely discussed narratives on Simply Wall St to see which viewpoints hold up and which may get re-examined.

See what the community is saying about Boot Barn Holdings

Exclusive Brands Drive Margin Expansion

- Higher-margin exclusive brands now make up over 40% of Boot Barn's sales, supporting merchandise margin improvements. This is noted alongside the rise in net profit margin to 10.1%.

- Analysts' consensus view highlights merchandise margin expansion as a pillar of long-term profitability, with

- ongoing investments in exclusive brands expected to raise their sales share to 50% in coming years,

- and this mix helping offset risks from cost inflation and third-party brand price hikes.

- Consensus narrative notes cultural demand trends such as the growth of rural lifestyles and country music continue driving traffic to stores. This lends resilience even as core product lines dominate revenue.

Consensus narrative suggests Boot Barn's brand strategy and shopper trends could maintain growth even if fashion preferences shift. 📊 Read the full Boot Barn Holdings Consensus Narrative.

Valuation Outstrips Industry Norms

- Boot Barn trades at a price-to-earnings ratio of 27.2x, which stands well above both the US specialty retail average at 16.6x and its peer group average at 10.7x, signaling a significant valuation premium.

- Analysts' consensus view flags that investors are now expecting even stronger future growth, with

- the current share price of $185.51 exceeding the DCF fair value of $26.06 by a wide margin,

- and consensus targets calling for ongoing top-line gains to ultimately justify the premium multiples.

Store Expansion Fuels Top-Line Outlook

- Revenue is forecast to grow by 12.6% yearly, boosted by continued aggressive store rollouts into underpenetrated regions. This outpaces the broader US market projection of 10.3%.

- Analysts' consensus view sees this persistent expansion, along with growing omni-channel investments, as critical to sustaining above-market growth. This also introduces risks tied to changing consumer shopping habits and possible store performance volatility.

- Greater exposure to digital retail, with ongoing double-digit online sales growth, is expected to expand Boot Barn's reach,

- but heavy reliance on traditional categories and physical store growth means the company must continue adapting to evolving customer behaviors.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Boot Barn Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? You can craft and share your perspective in just a few minutes and shape the discussion: Do it your way

A great starting point for your Boot Barn Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite Boot Barn’s robust revenue growth and margin improvements, the stock’s high valuation multiples and premium pricing are above its underlying earnings and peer benchmarks.

If overpaying is a concern, now is the time to focus on better-priced opportunities by screening for companies trading below intrinsic value with these 850 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boot Barn Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BOOT

Boot Barn Holdings

Operates specialty retail stores in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives