- United States

- /

- Specialty Stores

- /

- NYSE:BBY

Could IKEA’s In-Store Debut at Best Buy (BBY) Reveal a New Path for Service-Led Growth?

Reviewed by Sasha Jovanovic

- IKEA U.S. announced in early November 2025 that customers in select Texas and Florida markets can now access new IKEA shop-in-shop planning centers inside Best Buy stores, where they can design rooms and purchase appliances in one location.

- This collaboration brings together IKEA's home furnishing expertise with Best Buy's appliance offerings, highlighting an innovative approach to create an integrated, convenient retail experience for customers.

- We'll examine how the rollout of in-store IKEA planning centers could impact Best Buy's long-term growth narrative and service-driven strategy.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Best Buy Investment Narrative Recap

To believe in Best Buy as a shareholder, one needs confidence in the company’s ability to innovate and drive store traffic through differentiated customer experiences, such as its partnership with IKEA. The launch of IKEA planning centers may reinforce Best Buy’s omni-channel strengths, but the material impact on the most immediate catalyst, technology upgrade cycles, appears limited, while ongoing pressure from lower-margin categories and e-commerce competition remains a significant near-term risk.

Among recent announcements, the rollout of VITURE XR Glasses in 200 Best Buy stores is especially relevant, demonstrating continued investment in immersive in-store experiences and vendors that drive customer engagement. These product launches tie directly to catalysts like vendor partnerships and enhanced in-store assortments, but the ability to convert experiential traffic into profitable sales growth will be a key test.

Yet, investors should also be aware that in contrast to these new growth experiments, the risk of gross margin pressure from a growing mix of lower-margin categories remains a concern...

Read the full narrative on Best Buy (it's free!)

Best Buy's outlook points to $44.5 billion in revenue and $1.5 billion in earnings by 2028. This assumes a 2.3% annual revenue growth rate and an earnings increase of about $722 million from the current $778 million.

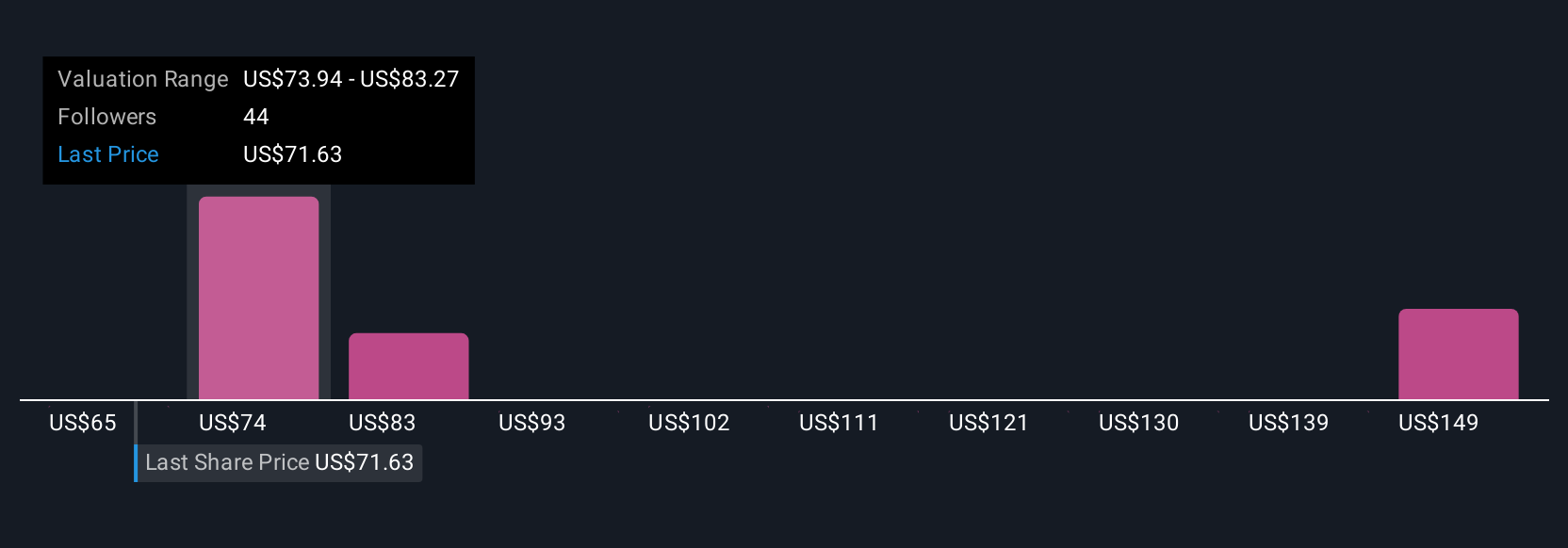

Uncover how Best Buy's forecasts yield a $80.71 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community value Best Buy anywhere from US$64.62 to US$179.46 per share. While some see upside potential, ongoing margin pressure and competitive risks remind us that the market’s future direction is still up for debate.

Explore 6 other fair value estimates on Best Buy - why the stock might be worth over 2x more than the current price!

Build Your Own Best Buy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Best Buy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Best Buy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Best Buy's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Best Buy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBY

Best Buy

Offers technology products and solutions in the United States, Canada, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives