- United States

- /

- Specialty Stores

- /

- NYSE:BBWI

Is There Opportunity in Bath & Body Works After 37% Drop in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Bath & Body Works could actually be a hidden value play in today's retail market? If you are curious whether it's time to dive in or steer clear, you are definitely not alone.

- Recently, the stock has had a rough patch, dropping 5.1% in the last week and 10.5% over the past month, with a year-to-date decline of 37.6% and trailing 12-month return of -23.6%.

- Headlines about changing consumer behaviors and evolving retail trends have been swirling, adding some uncertainty to the outlook for retailers like Bath & Body Works. In particular, renewed focus on product innovation and store experience has caught analysts' attention and may signal possible inflection points for the brand's future.

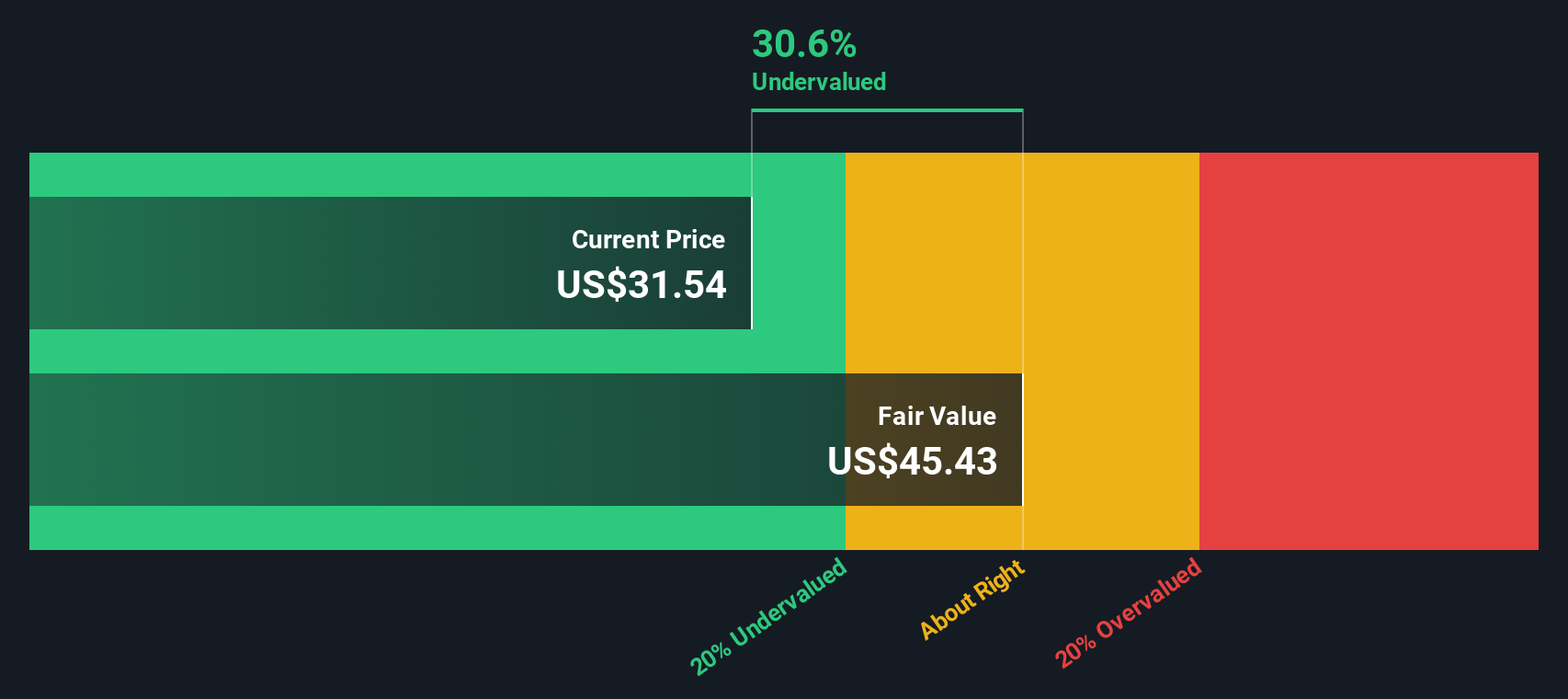

- On our valuation checks, Bath & Body Works scores a 5 out of 6 for being undervalued. This puts it among the stronger value candidates in its sector, at least on paper. We'll dive into how traditional valuation approaches stack up. Stay tuned, because there is an even better way to get the full picture at the end of this article.

Find out why Bath & Body Works's -23.6% return over the last year is lagging behind its peers.

Approach 1: Bath & Body Works Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's value. Simply put, the model looks at how much cash Bath & Body Works is expected to generate and calculates what that future cash is worth in present terms.

Currently, Bath & Body Works generates Free Cash Flow (FCF) of $740.9 Million. Analysts forecast moderate growth, with FCF expected to reach $753.9 Million by 2027. Beyond that, projections are extended using historical data and trend assumptions. FCF is estimated to grow to $893.6 Million by 2035. These figures highlight a steady, though not explosive, outlook for future cash generation.

Applying the 2 Stage Free Cash Flow to Equity model, the DCF analysis calculates an intrinsic value of $44.46 per share. At today’s price, this signals Bath & Body Works is trading at a 46.8% discount to its calculated fair value. The stock is considered significantly undervalued based on its discounted cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bath & Body Works is undervalued by 46.8%. Track this in your watchlist or portfolio, or discover 849 more undervalued stocks based on cash flows.

Approach 2: Bath & Body Works Price vs Earnings

For profitable companies like Bath & Body Works, the Price-to-Earnings (PE) ratio is a widely used valuation tool because it directly links a company’s share price to its actual earnings performance. This makes it a useful shorthand for how much investors are willing to pay for each dollar of profit.

However, what constitutes a “normal” or “fair” PE ratio depends on several factors. Companies with higher growth potential or lower risk are usually granted higher multiples, while slower-growing or riskier companies tend to trade at lower multiples. Comparing Bath & Body Works’ current PE ratio against sector peers and industry averages helps put its valuation into perspective.

Bath & Body Works currently trades at a PE of 6.7x. For context, the average PE ratio for the Specialty Retail industry is 16.4x, and the average among its closest peers is 19.7x. This puts the company’s valuation well below both benchmarks.

To get a more personalized gauge, Simply Wall St calculates a proprietary “Fair Ratio” that factors in a company’s specific earnings growth, profit margins, market cap, industry, and risks. Unlike generic industry or peer comparisons, this approach aims to filter out noise and focus on what is truly warranted for the business in question. Bath & Body Works’ Fair Ratio stands at 16.2x, notably higher than its actual PE.

Because the company’s current PE is meaningfully below its Fair Ratio, this indicates that Bath & Body Works is undervalued on this metric as well.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bath & Body Works Narrative

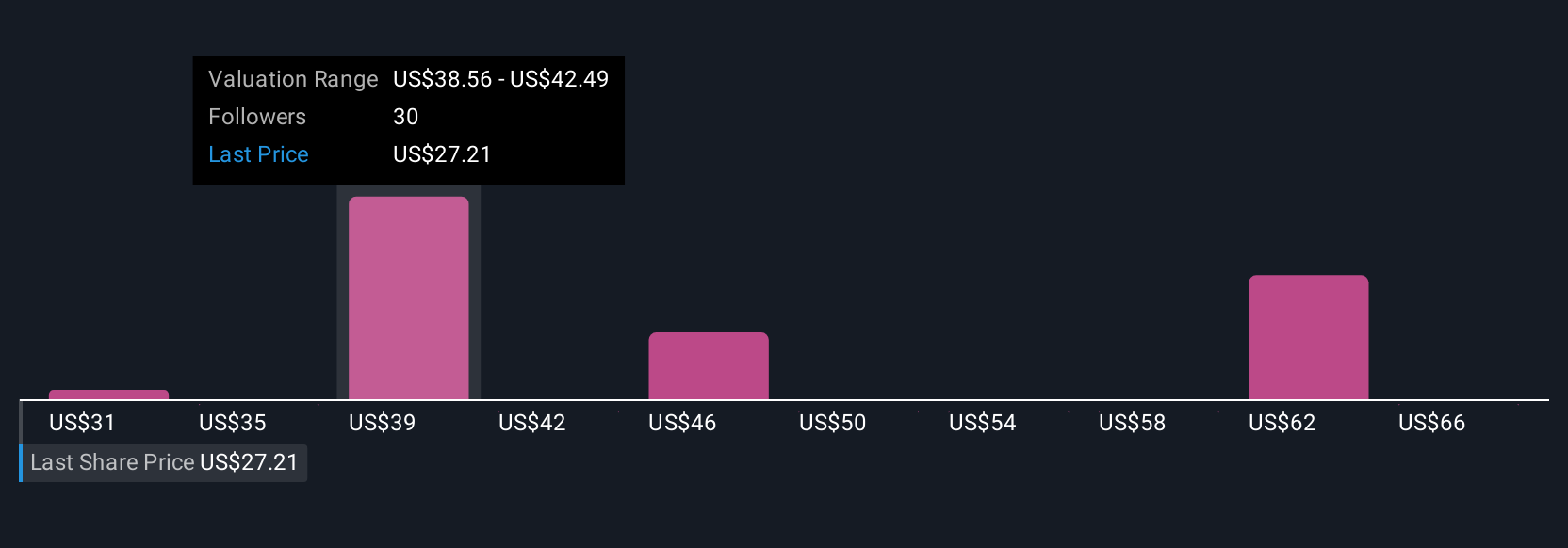

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your opportunity to look beyond the numbers and create your own story about Bath & Body Works. This means connecting what you believe about its business, industry, or management with your assumptions for future revenue, profit margins, and fair value. Narratives link a company’s unique story with a simple financial forecast, helping you see how your view translates directly into a fair value estimate.

On Simply Wall St, Narratives are an accessible and dynamic tool used by millions of investors. Within the Community page, you can easily select or build your own Narrative and compare it with those of other investors, each with their own assumptions and fair value. This approach helps you clarify when it may be time to buy or sell, as you can measure your Narrative’s Fair Value estimate directly against the latest share price.

Narratives update automatically as new news or earnings reports emerge, so your fair value keeps pace with the latest developments. For example, while some investors see Bath & Body Works as a high-potential turnaround with a fair value as high as $64.56 if lease renegotiations and new categories succeed, others are more cautious, projecting a fair value as low as $37.77 if debt pressures and slowing growth persist. Narratives make it simple to see where you stand and why.

Do you think there's more to the story for Bath & Body Works? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bath & Body Works might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBWI

Bath & Body Works

Operates as a specialty retailer of home fragrance, personal and body care, soaps, and sanitizer products.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives