- United States

- /

- Specialty Stores

- /

- NYSE:ANF

Have Tariffs And Raised Sales Targets Rewritten The Abercrombie & Fitch Investment Story?

- Abercrombie & Fitch reported better-than-expected first-quarter results, driven by robust demand and record sales across its brands, especially Hollister, and increased its annual sales guidance, even as tariff impacts prompted the company to lower its yearly profit outlook.

- While the company is experiencing higher costs due to tariffs, it continues to invest in store expansion and share repurchases, reflecting management’s confidence in ongoing brand strength and sales momentum.

- We'll examine how Abercrombie & Fitch’s record sales and raised guidance potentially reshape its long-term investment case.

Abercrombie & Fitch Investment Narrative Recap

To consider Abercrombie & Fitch as a potential long-term investment, you need to believe in the resilience of its brand appeal and the company's ability to drive sustained sales growth through compelling products, operational execution, and expansion. The recent uptick in sales, particularly at Hollister, bolsters confidence in short-term sales momentum, but pressure from tariff-related costs is currently the biggest risk and could weigh on profitability. For now, these developments are having a material impact on both the catalyst and risk profiles.

Among recent announcements, Abercrombie & Fitch's decision to raise its annual net sales growth target (now 3 to 6 percent) directly connects to strong consumer demand and leadership’s confidence hinted at in the latest earnings. This raised guidance shifts the focus to top-line progress as a primary catalyst for near-term investor sentiment, even as profit headwinds remain an issue.

However, investors should keep in mind the potential downside of compressed margins from tariff-driven costs, especially if…

Read the full narrative on Abercrombie & Fitch (it's free!)

Exploring Other Perspectives

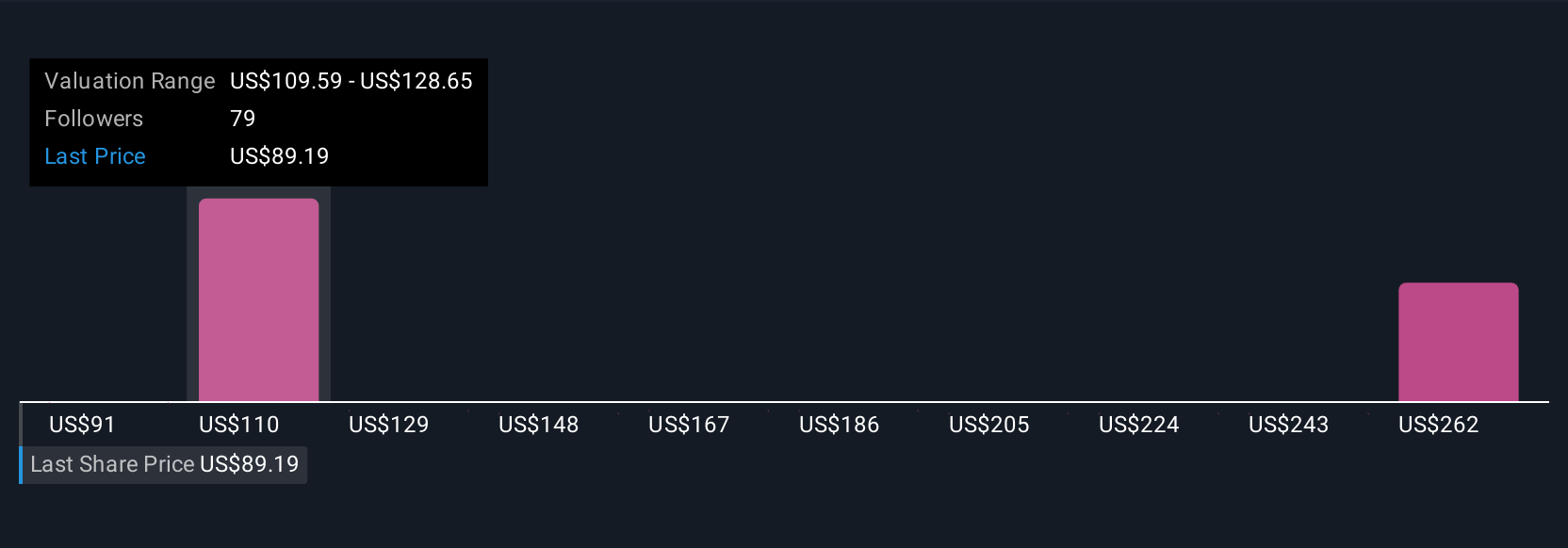

Simply Wall St Community members provided 11 different fair value estimates for Abercrombie & Fitch, spanning from about $32 to $237 per share. With higher costs from tariffs impacting profit guidance, these diverse opinions show how your view of risk could reshape your expectations for the company.

Build Your Own Abercrombie & Fitch Narrative

Disagree with existing narratives? Create your own in under 3 minutes , extraordinary investment returns rarely come from following the herd.

- A great starting point for your Abercrombie & Fitch research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Abercrombie & Fitch research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Abercrombie & Fitch's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar, for now. Get in early:

- AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANF

Abercrombie & Fitch

Through its subsidiaries, operates as an omnichannel retailer in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success